It’s been a busy six months with massive stories breaking across many sectors in the UAE.

Sultan Al Jaber takes the reins at Adnoc

The UAE Minister of State, Sultan Al Jaber, was appointed to the role of chief executive of Abu Dhabi National Oil Company (Adnoc) by Ruler’s decree in February. Dr Al Jaber is also the chairman of the renewable energy firm Masdar and chief executive of energy at Mubadala. In May, he announced a new corporate regime at Adnoc as he moved to transform the culture, with changes at the top including Abdulaziz Abdulla Alhajri being named director of Adnoc’s refining and petrochemicals division, and Omar Suwaina Al Suwaidi moving to lead the gas division, having been deputy director of planning and strategy.

Emaar to build tower eclipsing Burj Khalifa

In April, the Dubai developer Emaar Properties unveiled plans for a mega-retail district at Dubai Creek which would also include a tower taller than the Burj Khalifa. Mohamed Alabbar, the Emaar chairman, later revealed that the tower would be 100 metres taller than Burj Khalifa, which stands at 828 metres, and work is now underway on the project. The development will have 2 kilometres of creekside waterfront and will house 679 million square metres of residential space, 851,000 sq metres of commercial property, 22 hotels with 4,400 rooms and 11.16 million sq metres of retail. By comparison, The Dubai Mall has an overall footprint of 1.1 million sq metres. The tower is set to be beaten in the height stakes by Saudi Arabia's 1km Jeddah Tower, however, that has hit delays and is now due to complete at the end of 2019.

• Take a closer look at The Tower at Dubai Creek Harbour here

Abu Dhabi expats to pay 3% municipal fee on home rentals

A new fee on expats in the capital was published in February's Official Gazette. The new fee will be collected with monthly electricity and water bills, and will add about Dh5,000 to the cost of renting an average two-bedroom apartment. UAE nationals are exempt. This is similar to the levy in Dubai, only that is 5 per cent. Details emerged on the opening day of Cityscape Abu Dhabi in April, and NBAD later calculated that it could boost government revenue by as much as Dh612 million a year.

Dubai breaks solar records

Last month, Dubai announced that the third phase of its Mohammed bin Rashid Al Maktoum solar park had set a new benchmark for the industry at 2.99 US cents a kilowatt-hour. A Masdar-led consortium won the contract for the 800 megawatt phase at what will be the largest single-site solar project in the world with a planned capacity of 5,000MW by 2030. This is enough to power 800,000 homes with a total investment of Dh50 billion. The second phase, which totalled 200MW - and also saw a then world record broken at 5.84 cents per kWh from Saudi Arabia's Acwa Power and its Spanish partner TSK. Dubai is looking to have 7 per cent of its total power output from clean energy sources in the next four years, followed by 25 per cent by 2030 and 75 per cent by 2050.

• Abu Dhabi solar project could match Dubai record-low prices - read here

Ipic and Mubadala to merge

We learnt just last week that the Abu Dhabi Government is to merge the two investment titans International Petroleum Investment Company (Ipic) and Mubadala Development Company. A joint committee headed by the Deputy Prime Minister Sheikh Mansour bin Zayed will be created and given the responsibility of merging the pair, state news agency Wam said. The combined entity will have assets of about US$135 billion, based on the latest financial reports from Mubadala and Ipic. Expect further details to emerge in the coming weeks and months.

• Read our analysis of the merger here

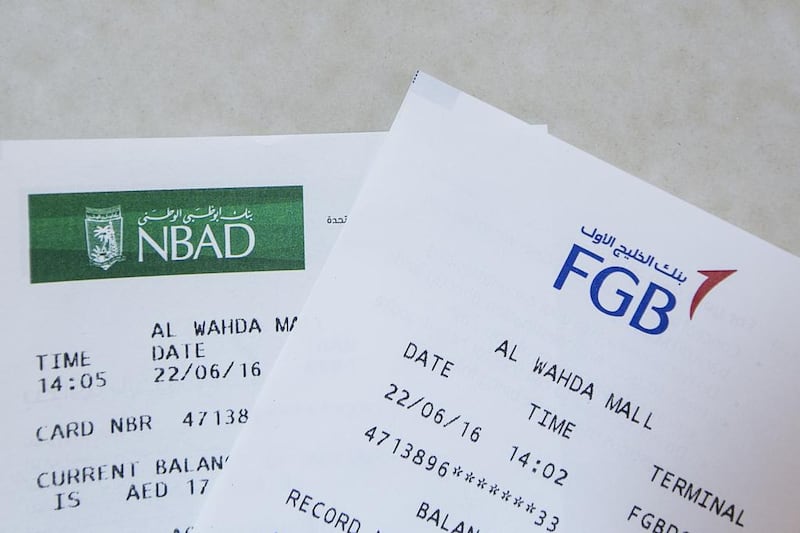

NBAD and FGB to create mega bank

The first big merger of the year was on the cards when NBAD and FGB said in June they were in discussions to join forces to create the biggest banking entity by assets in the Middle East. The past year has been tough for banks with many laying off employees because of a decline in business. More than 50 banks and financial institutions serve 9 million customers in the UAE, making it one of the most crowded banking markets in the region. A combination of NBAD and FGB will be the biggest banking merger in the UAE since Emirates Bank International and the National Bank of Dubai joined in 2007 to create Emirates NBD. The two banks’ boards unanimously voted to recommend to their shareholders the merger, it was announced on Monday.

• Listen to our podcast on the merger here

business@thenational.ae