Property speculators usually flee housing markets when the going gets tough - but not in Singapore. It was the city-state's overnight millionaires who helped trigger a property-buying frenzy in the middle of last year, despite the fallout from the global financial crisis, driving prices up by 24 per cent over the full year and forcing the government to implement a plan to cool speculation.

Homeowners had amassed piles of cash in 2007 and 2008 by selling land on which their apartment buildings stood to property developers. "People had built up wealth prior to the crisis through collective sales," says Tay Huey Ying, the director of research and advisory at the Singapore office of the consultancy Colliers International. "Owners of apartments in condominiums would get together to sell the land to developers for redevelopment. This process was very hot in 2007 and 2008."

As global markets recovered and confidence in the local economy rebounded last year, it was this group of new cash buyers who helped property sales reach a "feverish pace", adds Ms Tay. The outlook was entirely different in the first few months of last year when Singapore property prices dropped 25 per cent compared with the same period in 2008. Falling prices started to attract predominantly Singaporean buyers who snapped up homes in prime districts. As the boom took off, an estimated 10,000 homes exchanged hands between June and September last year alone.

And the sector gathered pace through the first six months of this year as prices in the second quarter jumped 5.2 per cent. Resale prices of homes built by the Housing Development Board (HDB), an authority set up in 1964 to provide affordable accommodation for Singaporeans, climbed 3.8 per cent. But as developers responded to the soaring demand in the private sector with new projects, Singapore's government introduced a number of measures to cool speculation.

Among them was a stamp duty for property sellers, while buyers of off-plan housing had to pay up front instead of on completion. The moves have helped cool the market, says Ms Tay, with prices now stabilising. "Things got pretty out of hand and the government had to introduce cooling measures," she adds. "One of the main things was to abolish deferred payments so people now have to buy according to their means and commit to a financial package."

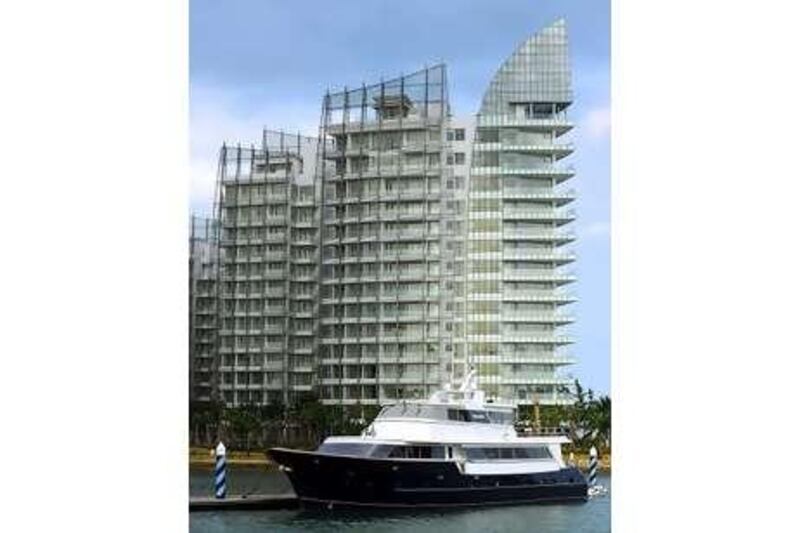

Singapore's economic model has often been compared to Dubai's. Both cities have huge ports and thriving tourist sectors, while their drive to become the business centres of their prospective regions helped spark property booms. Singapore is also building glitzy hotels similar to those in Dubai, such as the recently opened Marina Bay Sands. "Dubai has seen itself as the Singapore of the Middle East," says Nicholas Maclean, the Middle East head of the property consultancy CB Richard Ellis. "Both have the benefit of being adjacent to underdeveloped or emerging markets."

But one of the reasons Singapore's property market is easier to manage than Dubai's is that 80 per cent of the homes in the city are controlled by the HDB. To qualify for an HDB apartment the buyer must be Singaporean or have permanent residency, while personal income must be no more than S$8,000 (Dh21,325) a month. In addition, resale is not permitted within five years of purchase, which has kept price growth steadily moving upwards.

"Projects by private developers are subject to a lot of price fluctuation ? there is less control than those built by the HDB," says Tay Boon Sun, a spokesman for the HDB. "In the last two years demand for an HDB home has still been strong. We had 10,000 applications in 2009. But the homes are not meant for speculation." Another distinction is that 75 per cent of Singapore's private property buyers are local, while most of those who fuelled price rises in Dubai came from overseas.

Even so, while efforts are being made to avoid another bubble in the private property sector, Singapore's government is also planning to increase the supply of land to help meet demand. Three sites, designed to accommodate about 1,300 homes, were released for sale last month, while the HDB recently unveiled 2,696 "build-to-order" flats, which attracted almost 2,500 applications. All of this is part of a plan to boost the city's population from 5 million to 6 million in the coming years.

"Whether the quantum of land being released will contribute to an oversupply very much depends on the government's will for population growth," Ms Tay says. As land comes on stream, developers are also gearing up for new projects, albeit cautiously, says Daniel Leong, a broker at ERA Realty Network in Singapore. "Currently, most developers are in a good position," Mr Leong says. "But they make very careful calculations before they build."

@Email:agiuffrida@thenational.ae