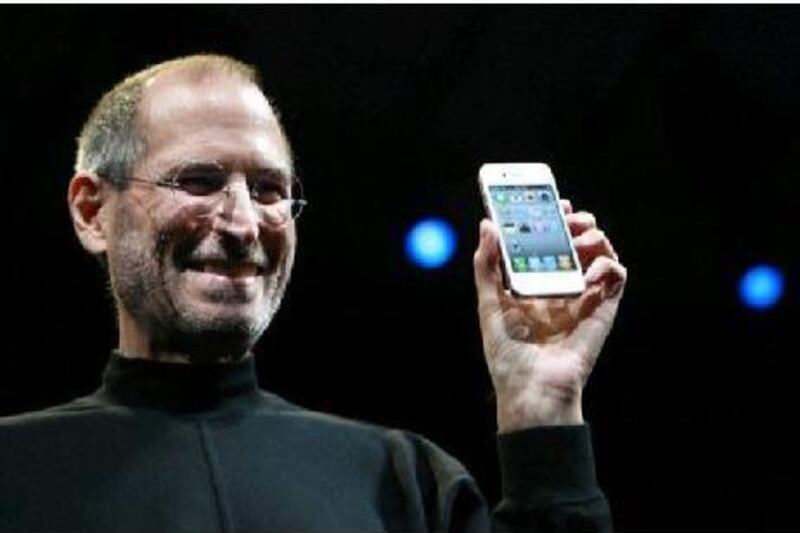

With his black polo-necks, round glasses and cropped grey hair, Steve Jobs has created a style all of his own. And with the iPhone and the iPad he has invented a couple of products that have left the competition trailing. But that could be about to change.

Google has Apple in its sights and, like William Tell, it rarely misses its target. This is why, despite exceeding its previous quarterly earnings record by US$930 million (Dh3.41 billion) to achieve net income of $4.31bn, Apple's shares slipped by 6 per cent in after-hours trading following its third-quarter results this month.

Disappointing iPad sales after news of supply constraints rang alarm bells in investors' minds, triggering further questions about the challenges now faced by Apple.

There is growing uncertainty about the future of the iPhone, which has become Apple's cash cow. The company sold 14.1 million iPhones in the third quarter compared with just under 7.4 million for the same period last year. But analysts report that rival smartphones powered by Google's Android operating system may soon start taking a bigger slice of the market. And with phones powered by Microsoft's new Windows Phone 7 mobile operating system due for release before the end of this year, Apple is about to feel the hot breath of competition on its neck.

"Is Android eating the iPhone's lunch? The answer is 'yes'," says Ramon Llamas, an analyst at the international research company IDC.

"iPhones had record sales in Q3 but Apple's mobile operating system only ships with Apple iPhones, whereas Android ships with Samsung, Motorola and a number of other manufacturers."

But Mr Jobs, Apple's co-founder and chief executive, believes the sheer number of versions of Android software in use by various phone makers will work in Apple's favour. "In addition to Google's own [applications] marketplace, Amazon, Verizon and Vodafone have all announced that they are creating their own app stores for Android … This is going to be a mess for both users and developers," Mr Jobs says.

But many customers may opt for a lower-priced Android-powered phone with similar functionality to an iPhone. Mr Llamas says: "In China, for example, an Apple iPhone sells for around $1,000, whereas a similar-level Android phones sells for 40 to 50 per cent less. That is quite a price differential."

In the long run, Mr Llamas says, new applications and services on phones running on Android software could work out cheaper than iPhone applications simply because of scalability across such a wide number of phones.

Apple is already starting to face competition from smartphones running Android that provide a similar user experience to the iPhone. Some of these phones offer improvements to the iPhone, such as faster internet connections.

Mr Llamas says: "Real competitors to the iPhone are already here. HTC's Evo and the DROID2 from Motorola are two examples. These devices offer very compelling experiences. When you put them next to the iPhone they really stack up."

Adam Leach, an analyst at the researcher Ovum, agrees that iPhone is on the receiving end of some stiff competition from Android phones.

"There are some good Android smartphones out there already. HTC make some good ones but a particularly good example is the Samsung Galaxy S," he says.

The iPhone is also about to face new rivals with the launch of phones running another rival operating system, Microsoft's Windows Phone 7. It is reported to be a dramatic improvement on anything Microsoft has so far achieved in the mobile space and will have a high appeal to consumers.

"I am really positive about Microsoft's soon-to-be-launched Windows Phone 7 mobile operating system … Windows Phone 7 is aimed at a mass market. Don't think Microsoft Mobile, think Xbox," Mr Leach says.

Microsoft's new mobile operating system is reported to be far simpler to use than its rivals and is designed to appeal to a broad range of consumers.

Mr Llamas says: "Windows Phone 7 will offer improved ease of use even for more mundane tasks such as texts, e-mails and surfing the web. This OS [operating system] is expected to launch in November in the US and selected countries."

Increased competition is also likely to offer consumers in non-English speaking markets such as the Middle East better value and improved services. Mr Leach says: "This war between the various operating systems and phone makers is good news for consumers in markets such as the Middle East as it offers more choice."

The big question is: how long can Apple continue to dominate the top end of the market while providing only a one-size-fits-all product when competing with phone makers who cater for every strata of the market? One option could be for Apple to adopt a more segmented approach, such as the one it has used to great effect with its iPod range of music players.

Mr Llamas says: "What can Apple do? Take a look at how Apple is set up in terms of the iPod. Different models include the Classic, the Touch and the Nano range. I do not have any special insight into Apple's plans but one strategy would be for similar segmentation of the iPhone with something like an iPhone Light."

But with iPhone sales doubling year on year, there is little pressure on Apple to revise its iPhone strategy.

Mr Leach says: "While this is happening there is no need [for Mr Jobs] to segment his iPhone offering and offer a range of phones. With doubled sales growth there is no pressing need for Apple to develop segmented handsets."

But Google is prepared for a long campaign to establish the dominance of its mobile phone software. It has yet to make a profit from Android, in contrast to Microsoft's highly lucrative Windows licensing strategy.

Mr Leach says: "I doubt that we are seeing a replay of the PC versus Apple battle. That is too simplistic. In contrast to Microsoft's PC licensing strategy, Google earns zero revenues from licensing Android to phone makers and instead hopes to generate ad revenues from mobile devices some time in the future.

"There is no question that phones running Android will outsell the Apple iPhone in the mid-to-long term as consumers do not necessarily buy software, they buy phones from Samsung or HTC. These companies are serious competitors to Apple."