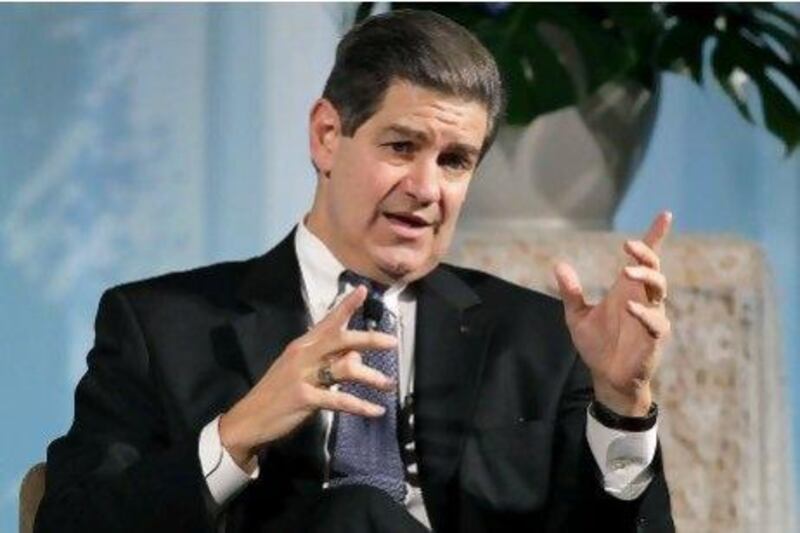

Investment banks are cutting staff amid mounting uncertainty in the euro zone and faltering growth in Asia. James Turley, the chief executive of Ernst & Young talks exclusively to The National about economic prospects for the year ahead.

What keeps you up at night?

When I look at the global economy I'm much less worried than I was at the depths of the financial crisis and the immediate recession that followed. We still have a multi-stage, multi-speed economy. I am concerned about the euro zone. The issues are quite complicated and beyond the simple characterisations. Everyone talks about the sovereign debt and the fiscal situation, which are obviously severe in many countries. But beneath that risk is a concern about growth across the whole region. If you are talking about the short-term dangers, a sustained period of low or no growth is very problematic.

Beneath that is the social change that is going to be necessary to be competitive. We are operating in places where people work 35 to 45 hours a week and retire in their early 50s in some countries.

In other regions of the world, people are working 45 to 50 hours a week until they are 65 and in still other regions they are working 65 to 75 hours and they never retire. This impacts competition and so I do worry about that. Are there reasons to be cheerful? North America is on the slow rebound, the spirit of entrepreneurship is strong and we are beginning to see traction of a sustained recovery. In the emerging markets, I am positive on those despite the short-term challenges.

If you look at China as an example, you are seeing GDP growth slow in large part because they can no longer count on 10 per cent growth every year by export-driven external demand. They need to rebalance that with consumer-driven growth, and they're doing that. But they need to do it faster than was planned because of the real weakness in Europe and North America. They'll work through that.

I see China, India, Eastern Europe, the Middle East, Latin America as all being long-term success stories, not in straight lines, there will be bumps along the road, but long term success.

What is your view on Dubai as a regional financial hub?

I still think Dubai has a positive future. Dubai was almost alone in the region in its global connectivity so there are more westernised hotel properties and other property being built and a lot more travel options into Dubai.

Now the region is seeing more cities and countries building to a new level of prominence. We are seeing this in different cities across the region, so I don't think Dubai will be alone in the destination space for the Middle East and North Africa.

Has it become easier to do business in Saudi Arabia?

We have seen significant changes in terms of the easing of starting up a business. It is encouraging to see the number of procedures needed to open a business decline. In the kingdom it went from about 13 procedures to about four over the last five years. The average time it takes to complete those procedures may have gone from a 60-day horizon to about five days. So it is much easier to have the capital to form a business and go out and start hiring.

How did the Arab Spring impact your business?

We are blessed with the largest market share in the profession in the Middle East and North Africa, which means when there are disruptions to economies we are impacted. A lot of new relationships are being made not just on the corporate side but also on the government side in many of these markets.

Overall, we are staying on the front foot on all these changes and we're positive about them. By operating Ernst & Young as a single business in the region, even though we are in 15 different countries here, we are able to give the right resources at the right time in the right places.

Growth in the region has been a little bit retarded by the Arab Spring-summer-fall and winter, so I think we are growing slightly less than India or China, but we are very positive.

twitter: Follow our breaking business news and retweet to your followers. Follow us