The French car maker Renault's move into low-cost cars, which has kept it afloat as mass-market peers drown in European losses, may soon help it to sink competitors beyond the old continent.

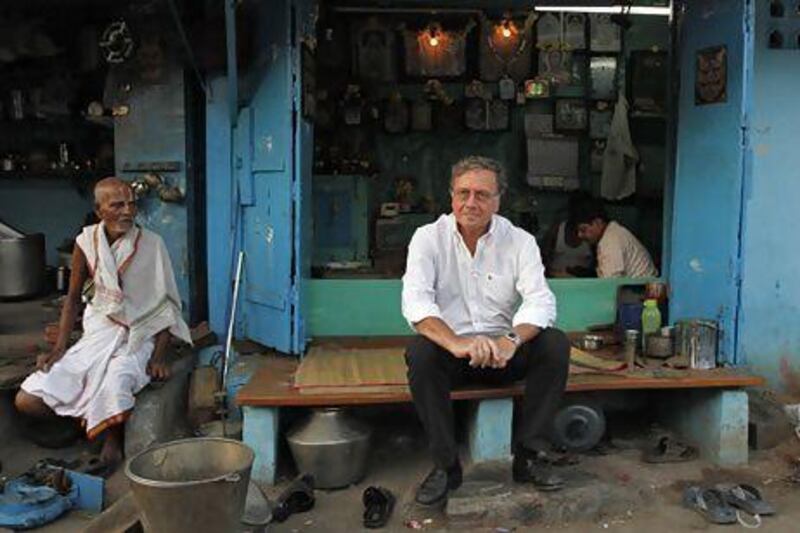

That is the long game for Gerard Detourbet, the man behind the no-frills Logan and other "entry" models, who has a new mission: to devise an even cheaper vehicle programme for India that can compete with such champions of frugality as Maruti Suzuki and Hyundai.

Mr Detourbet moved to Chennai early this year and has been quietly building an Indian supplier network and crack team of local executives.

If he pulls off the challenge that was set by Carlos Ghosn, the Renault-Nissan chief executive, it could then give his car making alliance a new weapon with which to undercut rivals in emerging markets around the globe.

Set firmly in Mr Ghosn's sights is a major car market combining the promise of breakneck growth with implausibly low prices.

Suzuki Motor holds sway in India with models from its Maruti subsidiary starting below €3,550 (Dh17,162) and accounting for 1 million registrations a year in a market of 2.6 million.

Hyundai has also made dramatic inroads of late with its Eon mini, priced closer to €4,300.

Renault's new "sub-entry" architecture will offer roomier cars for a similar price tag and spawn at least one additional model for Nissan, Mr Detourbet said.

Renault and its 43.4 per cent-owned Japanese affiliate already make costlier vehicles such as the Pulse and Micra subcompacts at their Chennai factory, claiming a combined 3 per cent Indian market share for the April to last month period.

Producing a car in the Eon's €4,300 bracket would then provide the blueprint for an assault on the lower ends of markets such as Brazil and Russia.

"India is the only country where you begin to see modern cars at this kind of price," Mr Detourbet said.

"Once you've done battle with the world's best cheap car manufacturer, you can go into another country where there isn't a Maruti Suzuki and be relatively comfortable."

Logan-derived models such as the Duster 4x4 and Lodgy minivan have become an earnings mainstay, helping Renault to avoid the job cuts and plant closures suffered by PSA Peugeot Citroën and Ford.

Thanks largely to the €12,000 Duster, Renault recorded a modest auto division profit in the January to June period, with almost half its global deliveries outside Europe.

Renault-Nissan's scramble to field cut-price Indian vehicles follows several false starts in the country.

While the original Logan caught on unexpectedly in Europe, Indian consumers were not seduced. Renault scrapped a production venture with Mahindra & Mahindra in 2008, then discussed plans with Bajaj to build an ultra-cheap car to counter Tata Motors' $3,000 Nano.

That project was abandoned last year, as the Nano itself fell far short of Tata's sales objectives.

Now, the new programme could launch its first car in late 2014, Mr Detourbet says.

* Reuters