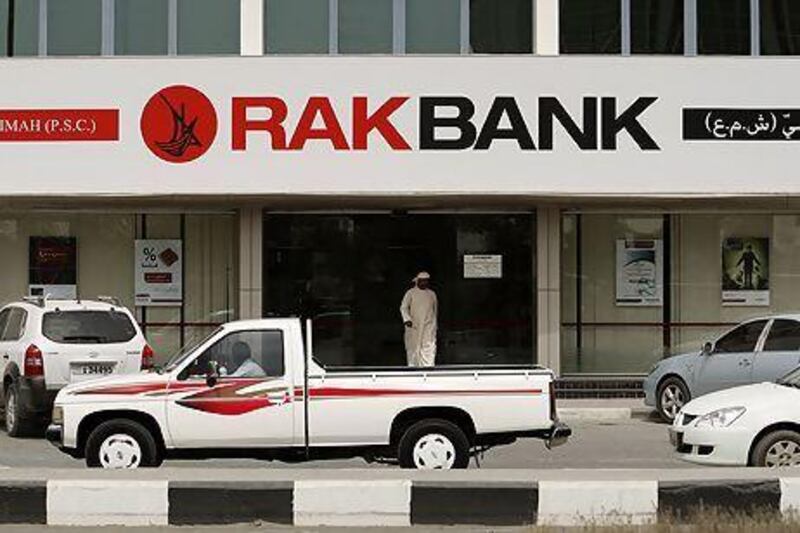

RAKBank has become the latest lender to launch an Islamic banking unit, amid a flood of investment into the Sharia-compliant financial sector.

The Ras Al Khaimah-based lender said in a statement yesterday that it had gained approval from the Central Bank to launch an Islamic offering, through which it will offer customers debit and credit cards with discounts at Sharia-compliant outlets, as well as car loans and takaful policies.

The subsidiary, RAKBank Amal, joins a growing number of lenders seeking to capitalise upon a development drive into Islamic finance.

"As the fastest-growing bank in the region, introducing Islamic banking is the natural direction for RAKBank as it strives to better serve existing and potential customers in the country through added choice," said Graham Honeybill, RAKBank's chief executive.

RAKBank established the Islamic unit with an issued capital of Dh100 million (US$27.2m) last year, according to the bank's financial statements. Although the lender has sought to stand out from the rest of the banking sector, launching Chinese-language ATMs and flooding radio airwaves with its company jingle, it has lagged other banks in tapping into Sharia-compliant banking.

This month, Sheikh Mohammed bin Rashid, Vice President of the UAE and Ruler of Dubai, outlined plans to make "Islamic economy" a key pillar of the emirate's industrial development.

Dubai intends to launch initiatives to deregulate industries including Sharia finance, halal food, cosmetics and pharmaceuticals, alongside charitable endowments and dispute resolution, to enable local businesses to succeed, said Hussain Al Qemzi, the chief executive of Noor Islamic bank. He sits on the board of the higher committee tasked with steering the development drive.

Shuaa Capital, the Dubai investment bank, said last week that it would open an Islamic window through its Gulf Finance Corporation subsidiary.

The company plans to submit the necessary applications in the first quarter of this year, adding that it aims to be "market-ready" by spring, subject to regulatory approvals.

The Islamic banking sector has been on a growth spurt in the Arabian Gulf during the past year, attracting record levels of funding from overseas as investors in Asia scour the world for high-yielding assets.

Companies and governments in the Arabian Gulf sold $21.3bn of sukuk last year, the highest level on record, according to data compiled by Bloomberg.

The ratings agency S&P anticipates rapid growth for the industry as a whole, from about $1 trillion today to $2.6tn by the end of 2015, equivalent to the current size of the money market fund industry.