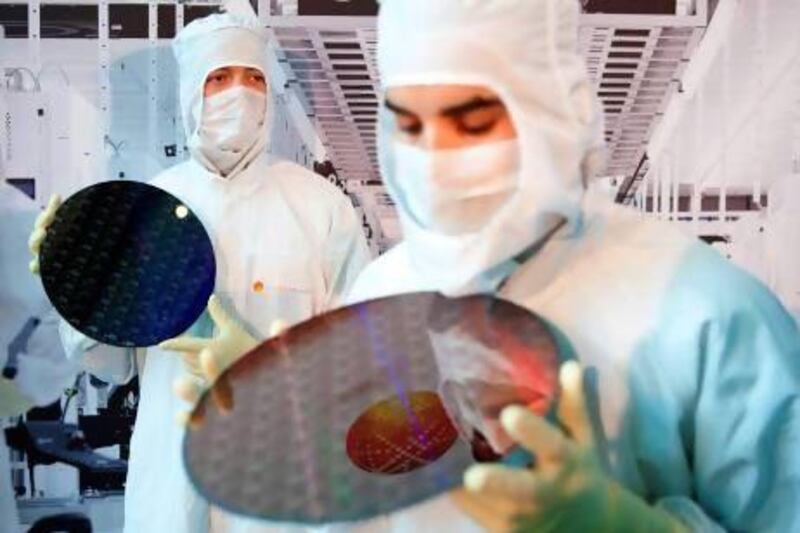

As thousands of silicon wafers zoom around in fabrication plants across the world, undergoing hundreds of processes to create the microprocessor chips used to power electronic devices, few can be certain of the effect that these chips will have on technology and our future.

The semiconductor industry is perhaps one of the most competitive and capital-intensive industries, and today it is all heading in one direction, creating smaller, faster silicon chips to power our electronic devices. The only certainty is in the speed of these microprocessors. How exactly they will be used by consumers and what new technologies they may spur remains unclear.

According to the Intel co-founder Gordon Moore, the number of transistors that can be placed on a chip at the same cost will double about every two years. This is known as Moore's Law and so far this has roughly been the case in the decades since the idea was proposed.

Today, silicon chip manufacturers such as TMSC and GlobalFoundries are producing 28 nanometre and 22 nanometre (nm) nodes, which refers to the size of the chip. To put this into context, a human hair is 75,000nm in width. The industry is heading towards 14nm, expected to be in production by next year, and eventually to 8nm nodes, which is a longer way off.

These smaller chips will be faster than anything currently on the market and will consume less power. While the logical assumption would be to plant these chips in mobile devices and tablets, the true implications of such technology is difficult to gauge as new devices and applications are developed and change the needs and preferences of businesses and society.

"It is video and pictures that is driving everything. No one predicted that this is how people would use their phones, and videos require powerful chips. We are building the technology and we will have to see how they will be used," says Michael Fancher, the vice president for business development and economic outreach and associate professor of nanoeconomics at the University at Albany in New York.

Despite the uncertainty, there are many parties that are banking on this technology for the future, shaping their economies around it to get a slice of the huge profits the industry generates.

Many countries are investing millions in their education systems, encouraging students to consider a career in the high-tech industry. The UAE has also invested heavily in the semiconductor industry through the Abu Dhabi Government's strategic investment vehicle, Mubadala Development. The Advanced Technology Investment Company (Atic), wholly owned by Mubadala, is the owner of the fastest-growing chip maker, GlobalFoundries.

According to the Semiconductor Industry Association (Sia) the sector is worth US$300 billion annually, spread over just a few key players. Sia announced this year that worldwide sales of semiconductors reached $24.05bn for the month of January, an increase of 3.8 per cent from the previous year, when sales were $23.16bn.

The traditional market for the semiconductor industry - the PC market - is waning, which presents a problem for the likes of Intel, IBM and GlobalFoundries. What is on the up is the sale of smartphones and tablet devices and now the so-called phablets, which straddle the line between the two. Just 10 years ago, these devices did not exist, nor did the applications that are now being used on them.

It was the gaming industry that essentially helped to shape the semiconductor drive for faster chips.

"The market has changed radically," says Bea Longworth, a senior public relations manager at Nvidia, the United States-based chip maker. "The core business heritage was in computer gaming - silicon chips were developed primarily for that market. The future trends are towards mobile and high-performance computing. Computer games now seem very niche."

From computers to cars and even pens, a silicon chip is now in almost any gadget with a digital screen.

"We have seen many people using graphics processes for non-graphics problems. Because computer games are so complicated, the processor they run on is well suited to other applications. These can range from weather prediction to fluid dynamics," says Ms Longworth.

The potential seems endless. Already, applications in the mobile-health space have started to emerge on smartphones with the ability to track essential biological data that can be monitored and stored on a cloud in real time.

To enable more efficient functionality, some scientists are now working on stacking silicon chips on top of one another, to reduce latency and speed up communication between the different chips.

"Space always results in latency," says Mr Fancher. "By figuring out how to align the wafers and combining the sensors so that they can be attached uses less power so that the information does not travel from one to another. It helps the chips to perform better."

It is this sort of speed that is still unfathomable and unlike anything we have seen before. Where it will lead remains a mystery.

"The future is about connected everything. We are talking about ultimate convergence. Your phone is not a phone, it is not even a smartphone, it's a smart device," says Ziad Matar, the head of Middle East and Central Asia at Qualcomm, another US-based semiconductor maker. "These devices become like a buddy, tracing your sleep patterns, blood pressure and other things. This is nothing we can stop, we just have to find solutions."