The current Cityscape is a much less effervescent affair than last year's when the buildings were taller, the plans grander and the visions bolder. Property developers in Dubai have often said the economic downturn took them by surprise. Even though the tremors of the Lehman Brothers collapse were starting to be felt by the time some 20,000 people walked through the doors on the first day of last October's Cityscape, developers still used the exhibition to show off their latest skyscraper, safe in the belief the emirate would be unscathed.

Some of the project announcements were at complete odds with the turbulent economic times: Nakheel said it would outdo Emaar Properties by building a tower that would be even taller than the Burj Dubai. At more than 1km high, the Tall Tower was going to be the centrepiece of the Nakheel Harbour and Tower Development. The project is now on hold. Meraas Holding, a Dubai Government-backed firm only formed in the middle of last year, also pushed the boat out with its Dh350 billion (US$95.28bn) Jumeirah Gardens project, a sprawling development planned for Dubai's humble Satwa district that was going to add several more skyscrapers to the emirate's skyline.

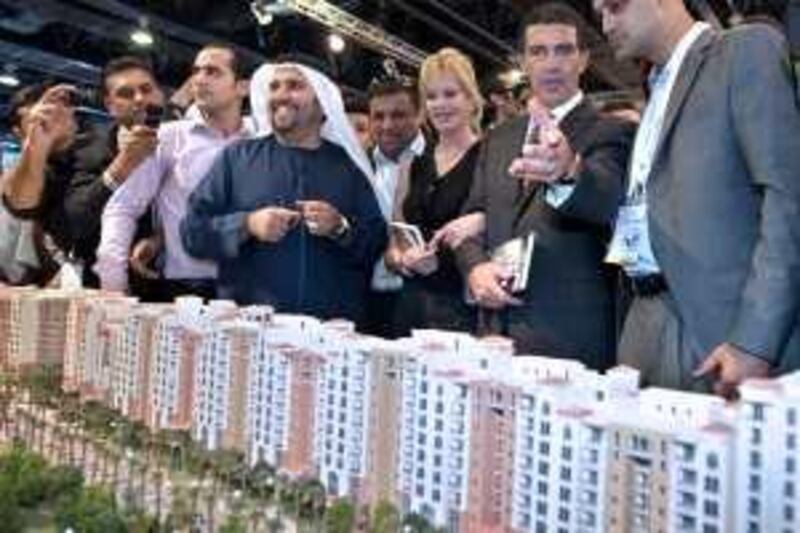

A touch of glamour also spiced up the proceedings, with tennis celebrity Boris Becker endorsing yet another ACI development and actor Antonio Banderas roaming the exhibition halls with the former chief executive of Hydra Properties, Sulaiman al Fahim. Before the downturn gripped the property sector, planning for tomorrow didn't really get much of a look-in. Developers were unleashed, giving them the freedom to carve out their own territory, regardless of how much money or experience they had.

So the events of the past year have been a stark reality to all involved in the game: developers have no cash left to build because buyers won't pay; and buyers won't pay because they either don't have the money or simply don't want to; and construction companies have been left high and dry because buyers won't pay developers and developers won't pay them. With that in mind this year's Cityscape, with 30 per cent fewer exhibitors and a sharp decline in visitors anticipated, will be a much more sombre, and possibly acrimonious, affair.

But it might also be a good time for developers, buyers and contractors to gauge the market and wise up for the next cycle. Peter Walichnowski, the chief executive of Majid Al Futtaim Properties, says some preparations have already started to be rolled out through market-constraining regulations announced by the Dubai Real Estate Regulatory Authority (RERA) at the start of the year. Developers now have to fully own their land before they can start property sales, as well as prove they have the finances in place.

They also have to build 20 per cent of a project before sales can begin. Restrictions on how much money can be withdrawn from an escrow account and how it is spent have also come into play. Such moves will create a "far better class of developer", says Mr Walichnowski. "The future developer in Dubai will have to be much better capitalised than in the past, so that in itself means the barrier to entry is going to get higher, removing the fly-by-nighters and speculators."

With the dangers of the off-plan sales model now exposed, developers will also have to seek out new ways to finance construction. "In more mature markets you have project finance, whereby a developer has enough money to buy the land and will typically borrow the cost of construction," says Mr Walichnowski. "They then don't have to sell off-plan in the early days, with the theory being the closer the project is to completion, the more people will pay. And if you have a bank on board funding construction, then you don't have to sell early."

Ali Khan, the managing director of Arqaam Capital, says developers will need to "ensure that projects committed are delivered in an orderly and timely manner, and to ensure their target markets are more diversified next time". Most of the disputes that have arisen in the past year between buyers and developers revolve around delayed construction and discrepancies between what was promised when the property was sold and what the buyer will actually get.

And while developers have tried to appease buyers in cancelled projects by shifting their investment to projects that are more likely to be built, the offer hasn't been welcomed by all. Many buyers, particularly those who sunk money into projects that have been completely shelved, simply made a bad investment. Going forward, investors will need to do thorough due diligence on the firms they are buying from, according to Saud Masud, the head of research and senior analyst of real estate at UBS bank.

"It was about speculation. Investors didn't really question the fundamentals of the company, the portfolio, time lines or finances. We all knew this was a pay as you go model." Construction companies have borne a large brunt of the crisis, with many still struggling to get paid for work completed as far back as early last year. Regardless of whether a developer has government backing or is privately owned, they have been slow to pay their suppliers, mainly because of the reliance on off-plan sales.

The situation has left contractors wary of the developers they will deal with in future, although it has also made them tougher. "We just have to be strong about getting paid," says Grahame McCaig, the general manager of Dutco Balfour Beatty. Imad Jamal, the vice president of the UAE Contractors Association, says contractors need to assess the reputation and financial capability of the developer.

agiuffrida@thenational.ae