The UAE’s biggest listed real estate companies improved their sales in the second quarter of 2018 as market sentiment buoyed on higher oil prices. However, a challenging market environment and rising costs squeezed margins and impeded profit growth.

The latest financial statements from Abu Dhabi’s Aldar Properties, Dubai-based Emaar Properties and Damac Properties painted a picture of generally improving performance in terms of sales , but earnings were weighed down by related rising cost of sales, unfavourable revaluation of assets and, in Damac’s case, the cost of debt financing during a tough few years.

“Direct costs have been rising for the last year or two as developers have been forced to align their prices to the [downward] market trend to keep operations going,” said Selima Mrabet, financial analyst at equity research firm Alphamena.

“Maintaining the progress of ongoing projects has put pressure on margins, particularly for Damac operating in the luxury space.”

UAE property markets have slowed in recent years in the wake of a three-year oil slump, and sales and rental prices have declined as a result of new supply coming to the market, muted demand and a reduction in consumer purchasing power.

In Dubai, residential sales prices declined by an average of 2.9 per cent year-on-year in the second quarter, according to consultancy Cavendish Maxwell. An estimated 3,700 residential units were handed over in Dubai during the quarter.

In Abu Dhabi, sales price declines were more marked, at between 1-10 per cent for apartments and around 9-10 per cent for villas. An estimated 2,300 residential units were handed over in Abu Dhabi during the quarter, the consultancy said.

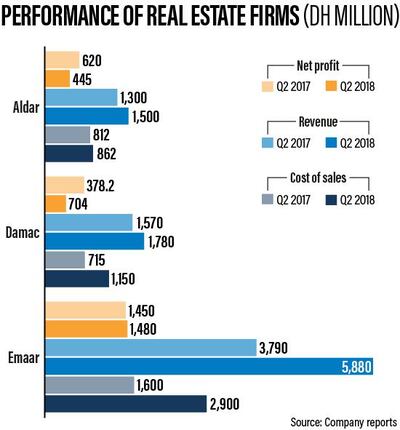

State-backed Aldar Properties posted a 10 per cent year-on-year increase in sales revenue in the second quarter to Dh1.5 billion. However, its net profit dropped 28 per cent - “pressured by a significant one-off loss” on revaluation of investment properties of Dh190 million, noted Sara Boutros, senior analyst, real estate and research, at CI Capital. Aldar's income missed the lowest estimate of Dh538m of analysts polled by Bloomberg.

Direct costs rose 6 per cent to Dh862m during the period and there was a Dh16.8m loss on selling and marketing expenses, Aldar said. Chief financial officer Greg Fewer said the added costs were in line with growth in revenues and profit margins remained consistent. But he added: “We’ve seen some headwinds in the retail portfolio. We’ve renewed some leases and our values reflect some revaluation.”

_____________

Read more:

[ Abu Dhabi's Aldar Q2 net profit slips 28 per cent as costs rise ]

[ Emaar's Q2 net profit climbs 2% after accounting for unit minority interest ]

[ Damac looks to reduce its debt by $500m over 3 years amid tough market conditions ]

_____________

Dubai-listed Damac Properties also reported an increase in sales during the quarter – revenues were up 11 per cent year-on-year to Dh1.78bn. Despite this, net profit plummeted 46 per cent to Dh378.2m, below the average Dh450.7m estimate of analysts polled by Bloomberg. There was a 37 per cent rise in cost of sales to Dh1.15bn.

Damac paid out higher costs on finance, too. It has roughly Dh5.32bn ($1.45bn) of debt on its balance sheet, and group chief financial officer Adil Taqi told The National the company plans to lower the debt below $1bn over the next 2-3 years.

Egyptian investment bank EFG Hermes predicted in February Damac would experience “cash flow pressures” in 2018 after the developer reported a 25 per cent drop in full-year net profit for 2017.

Meanwhile, Emaar Properties reported a solid performance for the quarter, with a 2 per cent annual rise in net profit after accounting for minority interest following Emaar Development's initial public offering last year. The profit increase was driven by growth in the malls business. Revenue was up 35 per cent year-on-year to Dh5.8bn, and the company made a Dh48.8m gain on disposal of assets during the second quarter.

“The developer has a highly resilient business model with an enhanced profitability and a sustained growth over the last six years amid a weaker property market,” said Ms Mrabet.

Like the other two developers, Emaar’s profit growth was accompanied by rising cost of sales – up 80 per cent to Dh2.9bn from the second quarter of 2017. Payroll costs went up during the quarter and marketing costs almost doubled, as Emaar invested in promoting schemes amid a resurgence in construction activity.

Real estate market sentiment, though, is rebounding as the national economy improves on higher oil prices. Developers have responded by targeting investors with attractive sales incentives and mid-priced schemes to pique their interest.

Overall market activity in Q2 was “quite healthy”, according to EFG Hermes’ latest market review in July. Excluding land transactions, aggregate sales value rose 28 per cent year-on-year and the value of residential transactions stood at Dh17bn in the quarter – the highest since the first quarter of 2017, “helped by a pick-up across all transaction types”, it said.