Hong Kong doubled the sales tax on property costing more than HK$2 million (Dh947,339) and targeted commercial property for the first time as bubble risks spread from apartments to parking spaces, shops and hotels.

The stamp duty will increase to 8.5 per cent of the purchase price for all properties, the Hong Kong financial secretary John Tsang said at a briefing yesterday. The Hong Kong Monetary Authority also tightened mortgage terms for commercial properties and parking spaces.

The government widened its property curbs to cover commercial transactions after earlier this week hundreds of people turned up to buy hotel rooms being sold by Li Ka-shing's Cheung Kong (Holdings) in the city, prompting a warning from the government. Home prices have doubled in the past four years on near-record low mortgage rates, an influx of mainland Chinese buyers and a lack of new supply.

"This again shows the government's determination to curb prices," said Thomas Lam, the head of research for Greater China at Knight Frank. "It will affect the luxury residential sector and also investors of buildings and commercial properties. This will add a lot to their purchasing cost."

The value of retail property transactions rose 78 per cent from a year earlier to HK$85bn last year, as curbs on home prices prompted investors to seek other properties, according to Centaline Property Agency, the city's biggest closely held estate agent. That's the highest since at least 1996, when the realtor began collecting data.

Under the new rules, Hong Kong property deals below HK$2m will incur stamp duty of 1.5 per cent of the purchase price, from HK$100. The tax for those over HK$2m will be raised to as much as 8.5 per cent from 4.25 per cent, Mr Tsang said.

The measures take effect today and local permanent residents who don't own homes will be exempted.

Buyers of non-residential properties will be required to pay stamp duties when they sign the purchase agreement, he said.

Prices of offices rose 23 per cent last year, while those of retail spaces advanced 39 per cent.

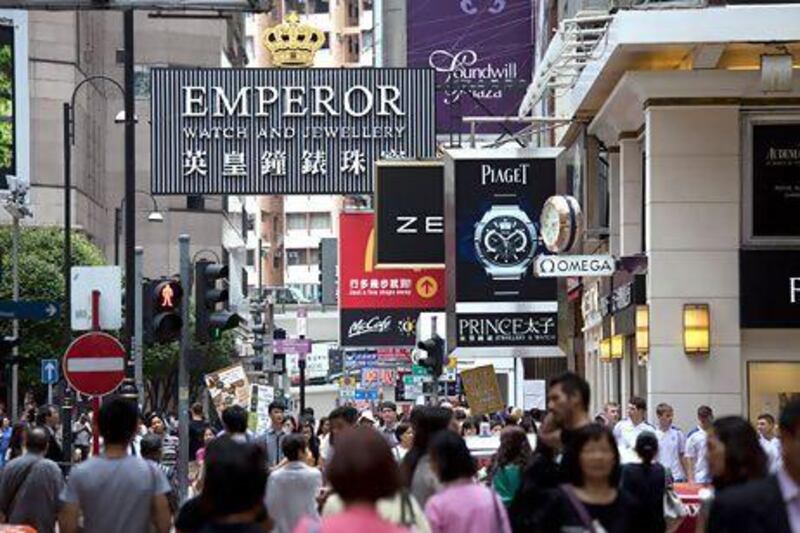

Hong Kong has the world's highest shop rents and is the world's second-most expensive place to rent office space, property brokers, including CBRE Group and Cushman & Wakefield, have said.

"The property market bubble risks have only increased and not decreased," Mr Tsang said. "If we allow the risk to continue to expand, ultimately it will affect the macroeconomic and financial system's stability. The destructive power on society will be considerably large."

The HKMA will require banks to lower the maximum mortgage loan-to-value ratio on commercial properties by 10 percentage points, Norman Chan, the chief executive of the authority, said in a separate briefing yesterday. The monetary authority is also limiting the maximum mortgage for car park space to 40 per cent of the value, with a 15 year-cap on the length of the loan.

Concerns that housing is becoming unaffordable has forced the chief executive Leung Chun-ying to introduce a raft of measures since taking over in July as the city's leader.

Mr Leung's government in October imposed an extra 15 per cent tax on all home purchases by companies and non-permanent residents, adding to earlier steps including accelerating new home sale approvals and tightening banks' mortgage lending.

* Bloomberg News