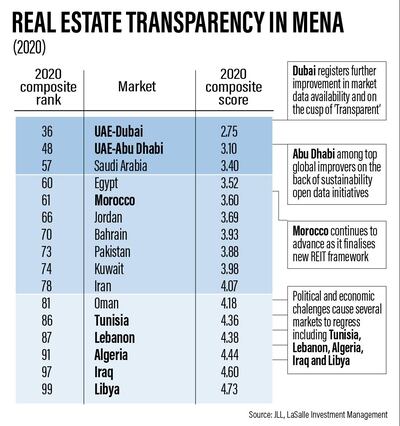

Dubai and Abu Dhabi rose in a global ranking of the most transparent real estate markets in the Middle East and North Africa (Mena) on the back of new government initiatives, according to the consultancy JLL.

Dubai, the commercial and trading hub of the Middle East, jumped three spots to 36 to maintain its position as the most transparent market in the Middle East, while Abu Dhabi moved up to 48, becoming one of the top performers globally due to sustainability initiatives rolled out by the government. Abu Dhabi was ranked 55 in the previous survey in 2018.

“Our GRETI (Global Real Estate Transparency Index) report this year is being launched at a time of massive economic and societal disruption. As governments and businesses recover from the impact of Covid-19, questions around transparency and trust have been bought into even sharper focus,” Thierry Delvaux, chief executive of JLL Middle East and Africa, said.

“During times of such uncertainty, the need for transparent processes and accurate, timely data becomes more important than ever. The findings of our report provide reasons for optimism with the current disruption forcing the pace of change.”

The most significant initiative launched in 2019, and a key contributor to Dubai’s ranking, was the creation of an official residential transaction-based index, Mo’asher, by the Dubai Land Department in partnership with a private sector entity, according to the report.

“Mo’asher constitutes a potentially important step forward for Dubai, as it means the establishment of a single index that is widely used by all market participants,” said Dana Salbak, head of research at JLL MENA.

Driven by the introduction of further initiatives to promote corporate and real estate sustainability, Abu Dhabi emerged as a top performer globally, reflecting positively on the overall transparency ranking and future investment outlook.

“Among the many initiatives introduced, the UAE Ministry of Climate Change and Environment signed a pledge with the Abu Dhabi Global Market (ADGM), a financial free zone, to embed sustainable finance policies in the UAE, contributing to the emirate’s ranking," Ms Salbak said. "The policies cover all forms of corporate and investment financial services which yield environmental, social, and economic benefits.”

Other factors that contributed to Abu Dhabi’s ranking include the establishment of the first Green REIT by Masdar at the ADGM in early 2020 and the unveiling of a new data-centric platform and sharing eco-system by the Abu Dhabi Digital Authority.

Saudi Arabia continues to demonstrate a strong commitment to the implementation of positive reforms to expand the economy and the real estate market, according to JLL’s report.

The government rebranded its publicly available central database – The General Authority for Statistics – and has continued to collate more data from government agencies, it said.

The Ministry of Finance and the Saudi Arabian Monetary Authority have also begun to publish more micro-level indicators on a monthly and quarterly basis. Data from the Ministry of Justice has also become a valuable indicator for commercial and residential real estate transactions and performance.