After six decades spent buying up assets spanning retail, media and real estate, one of Britain’s most discreet billionaire clans is weighing a retreat.

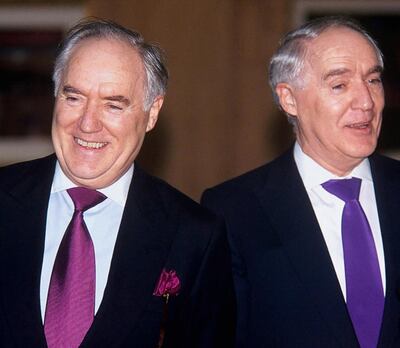

The investments by the families of David and Frederick Barclay have put them among the top ranks of the country’s rich and powerful. The twins have forged reputations as stealthy buyers who rarely turn to public markets or investment bankers to finance deals for their closely guarded business empire.

In a surprise twist, the Barclays are now considering offloading some of their most prominent holdings. Those include the Telegraph newspaper titles and Mayfair's five-star Ritz hotel, where guests dine below chandeliers and can see the sights of the English capital in a custom Rolls-Royce.

The Barclays have hired lawyer Marco Compagnoni of Weil Gotshal & Manges, whom they’ve worked with before, to advise on the review, according to people with knowledge of the decision, who asked not to be identified because the matter is private. Compagnoni declined to comment, as did a representative for the Barclays.

The Times of London was first to report the plans, which come as some of their holdings are under pressure.

Over the past two years, the brothers have injected more than £300 million (Dh1.4 billion) into businesses such as online retailer Shop Direct and delivery service Yodel. Last week, Shop Direct said it was exploring financing options after disclosing it’s seeking £150m in extra funding to cover a spike in claims tied to Britain’s insurance mis-selling scandal. The shortfall creates a “material uncertainty", the company’s auditor, Deloitte, said on Monday.

The Telegraph group could attract a number of bidders. Although no formal process has started, Daily Mail & General Trust could be interested, according to a source, as declining newspapers merge to maximise their audience while minimising operational costs. A representative for DMGT declined to comment.

The Barclays may struggle to recoup the £665m they spent to buy the paper in 2004. Circulation and earnings have plummeted, there have been repeated rounds of job cuts and operating profit was just £700,000 for the most recent financial year. Still, the paper remains influential in the UK. It’s been a leading voice for Brexit and employed Boris Johnson as a columnist until he became Prime Minister in July.

With Middle East money backing many of London’s luxury hotels these days, the brothers may look further afield to sell the Ritz. Four years ago, they sold their stake in three other London hotels — Claridges, the Berkeley and the Connaught — to GCC investors.

It’s already been a busy year for the Barclays, who turned 85 on Sunday. David lost a libel case he filed against a little-known French playwright who satirised the lives of him and his brother in July, and his lawyer said at the time that he would probably appeal. This month, it emerged that Frederick is embroiled in a divorce court row with his estranged wife. A judge who oversaw the preliminary hearing placed limits on what can be reported, but the case may eventually shed light on the Barclay family’s finances if it reaches a public decision.

“For someone concerned about their privacy and public profile, that is a pretty horrible thing to contemplate,” said James Ferguson, a partner at London law firm Boodle Hatfield who specialises in family matters including divorces. “It’s going to incentivise him to want to settle the case.”

David is the older sibling by 10 minutes. Born to Scottish parents, they spent their early days in a west London household so close to a railroad that trains rumbling by would rattle the windows. After leaving school at 16, David and Frederick started their careers in the accounts department of General Electric, according to The Twin Enigma, a 2010 book by Vivienne Lewin. They teamed up in the 1960s to turn old boarding houses into hotels and moved into breweries and casinos, marking the beginning of their business empire.

When a Middle East oil embargo sparked a collapse in UK stocks and real estate during the 1970s, the twins defaulted on loans owed to a British government agency that had expanded into corporate lending. The brothers almost lost everything, but were spared from absorbing the full losses.

The twins have since bought companies that others often reject or overlook, developing real estate and selling off pieces for quick profits. That strategy has allowed the Barclays to own more than 50 firms in the UK, Japan and Sweden and gain stakes in at least a dozen more.

These include Sears, which once had businesses ranging from women's wear to mail-order shopping. With financing from Bank of Scotland and Bank of Boston, the Barclays joined with fellow billionaire Philip Green two decades ago to buy the clothing retailer for £548m. Mr Green and the Barclays recouped the purchase price within 12 months by selling some of Sears’s real estate and its three retailing units.

The Barclays also paid £2.3m in 1993 for the English Channel island of Brecqhou off the UK’s southern coast for a family compound. They erected a mock-Gothic castle, complete with almost 100 rooms, gilded turrets and a helipad. A visitor from the neighbouring island of Sark said framed pictures of the brothers with Nelson Mandela, Margaret Thatcher and Charles de Gaulle adorned a palatial living room. The twins would finish each other’s sentences, the visitor said.

Even as their holdings grew, the business has remained a family affair, with David’s sons Aidan and Howard increasingly running matters.

“Our business is large, but is a family business,” Frederick Barclay said in a 2012 witness statement as part of a UK court case about their attempts to buy a number of luxury hotels in London. “My brother and I retain a strong interest in the affairs of the business and regularly discuss matters with Aidan and Howard and other advisers.”

But even as the family’s holdings evolve and the younger generation exerts more sway, one tenet remains constant: Discretion is paramount.