Dubai's property heavyweights were the biggest losers in the emirate as bearish investors sold their positions and extended a losing run on the index.

More Business news: Editor's pick of today's headlines

Last Updated: May 25, 2011

Industry Insights // Tablets not bitter pill for laptops Devices such as Apple's iPad are increasingly popular, but across the GCC Samsung has been experiencing enormous growth in sales of its laptop computers this year. Read article

Abu Dhabi's Gasco to offer 1,800 jobs in big expansion Abu Dhabi Gas Industries hopes to hire hundreds of engineers and technicians as part of a major expansion ahead of large projects. Read article

Spanish solar plant built by Masdar is well worth its salt A Spanish solar plant developed in part by Masdar, Abu Dhabi's clean energy company, is to deliver electricity 24 hours a day for more than half the year. Read article

[ More business ]

Emaar Properties, the developer of the world's tallest tower in Dubai, the Burj Khalifa, shed 1.6 per cent of its value to Dh3.02. It is at its lowest price for two months as almost 11 million shares changed hands.

Deyaar Development slipped 1.6 per cent to 30 fils and Arabtec retreated 1.5 per cent to Dh1.27.

Shares in Gulf General Investment Company were among the only two stocks that gained on the market, as it rose 2.6 per cent to 31.8 fils, reversing losses it made earlier in the week after it said it defaulted on almost Dh500 million of repayments on bank loans.

Elsewhere, Dubai Islamic Bank slumped 1.9 per cent to Dh2.04, on trading of almost 3 million shares.

The benchmark Dubai Financial Market General Index fell 1.2 per cent to 1,526.39 points, its lowest point since 23 March. Losses on international markets and a sliding oil price has dictated the movement of regional markets in recent weeks, prompting investors to sit on their positions.

The market has lost almost 10 per cent in a month.

Brokers and fund managers have also begun a sell-off in stocks as the summer hiatus approaches.

Technical analysts said that once the DFM falls below the 1,550-point level, the market is likely to keep selling off until the next target point of 1,500 points.

"There is not any sign of rebound right now, and even if it rebounds the market is still going in a downtrend channel," said Amjad Bakir, the trading manager at Menacorp Alternative Investment in Abu Dhabi.

"The bullish strength is really weak," he said.

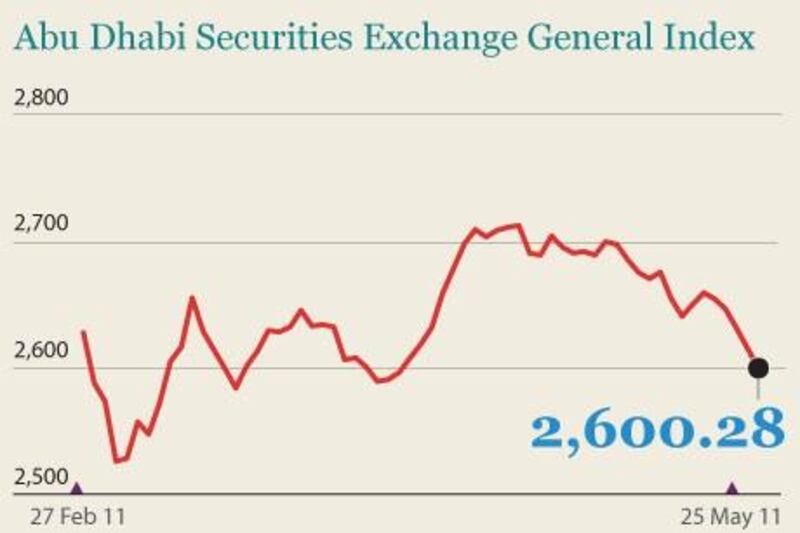

The Abu Dhabi Securities Exchange General Index fell slightly and was down 0.6 per cent to 2,600.28 points.