Aldar Properties, Abu Dhabi's largest listed developer, reported a 5 per cent rise in first quarter net profit thanks to higher offplan sales and a one-off gain from the disposal of an asset.

Net profit attributable to equity owners in the three months ending March reached Dh669.5 million from the year-earlier period, the company said in a statement on Tuesday to the Abu Dhabi Securities Exchange, where its shares are traded. The earnings came above the average Dh579m estimate of analysts polled by Bloomberg.

Revenue for the quarter stood at Dh1.5 billion, in line with Dh1.58bn in the first quarter of 2017, while development sales for the quarter plunged 32 per cent to Dh681m from about Dh1bn.

Key drivers for the profit rise included “an increase in underlying gross profit” and strong off-plan sales, Aldar’s chief financial officer Greg Fewer told reporters by telephone on Tuesday.

There was also Dh133m of ‘other’ income handed over by the government for infrastructure projects, and a one-off gain from the disposal of Aldar’s 50 per cent stake, via a joint venture with Tabreed, in cooling assets on Reem Island, he said.

Aldar expects to report increased earnings over the coming quarters once the planned acquisition of Dh3.7bn worth of real estate assets from Abu Dhabi’s Tourism Development & Investment Company completes in the summer. The company also has tied up with Emaar Properties, Dubai's biggest listed real estate company, to develop a potential of Dh30bn worth of projects in the UAE.

The operating assets being acquired from TDIC – including the Eastern Mangroves complex and Cranleigh School Abu Dhabi – will deliver Dh120m of annualised net income, while projects under development – including Saadiyat Grove, with Emaar – are expected to generate gross revenues of Dh2.5bn.

“We are very happy with our acquisition and we expect it to be immediately accretive,” Mr Fewer told reporters.

_______________

Read more:

[ Aldar acquires real estate assets from TDIC in Dh3.7bn deal ]

[ Abu Dhabi Hyperloop route announced following Aldar agreement ]

[ Aldar's Q3 net profit declines 20% year-on-year due to one-off land sales last year ]

_______________

Aldar’s asset management portfolio of residential, retail, office and hospitality properties delivered steady net operating income of Dh396m, “demonstrating portfolio resilience”, the company said.

Aldar's net profit beat Bahrain-based investment bank Sico's Dh593m forecast due to higher non-recurring income, said Ayub Ansari, a senior analyst. However, he highlighted the drop in value of projects sold to Dh681m, reflecting a more challenging real estate market, Mr Ansari said. Mr Fewer, though, told reporters he was seeing a “very healthy market”.

Meanwhile, occupancy levels at Yas Mall declined to 89 per cent in the quarter, from 95 per cent. “Aldar attributes this to a temporary re-allocation of tenants - including possible letting go of low-yielding tenants - and expects occupancy levels to go up in the coming quarters,” Mr Ansari said after an analysts' call with Aldar on Tuesday afternoon.

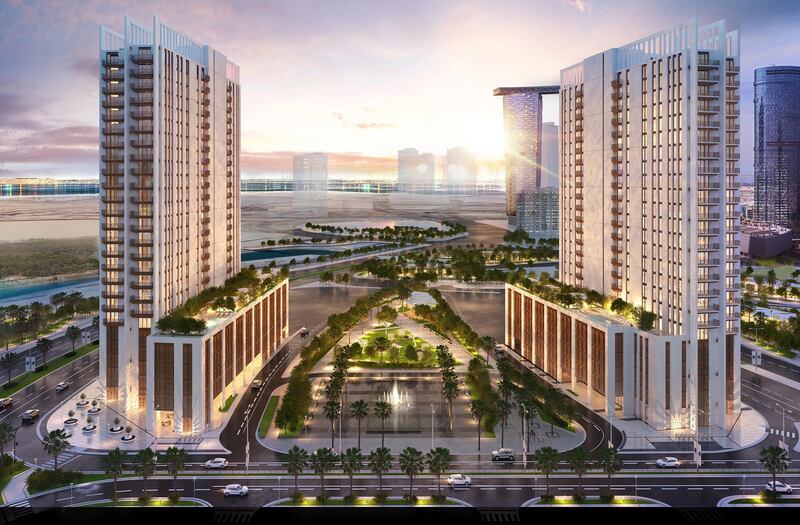

During the first quarter, Aldar completed handovers for its Ansam and Al Hadeel projects, started handover of Nareel Island and Al Merief, and launched Reflection, a new residential development on Abu Dhabi’s Reem Island. It also awarded a Dh1.3bn construction contract for the Water’s Edge scheme.

In April, Aldar unveiled the Dh10bn masterplan for Alghadeer community on the border of Dubai and Abu Dhabi. Sales from the first phase are expected to boost the balance sheet later this year.

“Aldar started 2018 strongly with the announcement of an historic partnership with [Dubai-based] Emaar Properties to develop the next era of iconic real estate destinations,” said Talal Al Dhiyebi, chief executive of Aldar Properties.

“The initial Dh30bn pipeline of projects, including Saadiyat Grove in Abu Dhabi and Emaar Beachfront in Dubai, is just the start of this partnership, which will enhance our country’s reputation as a destination of choice for residents and tourists alike.”