Breaking News - Egypt has this morning delayed the reopening of the stock market - for more on this click here.

Egypt's stock market is expected to suffer a sharp reversal today as trading is due to resume for the first time in more than a month.

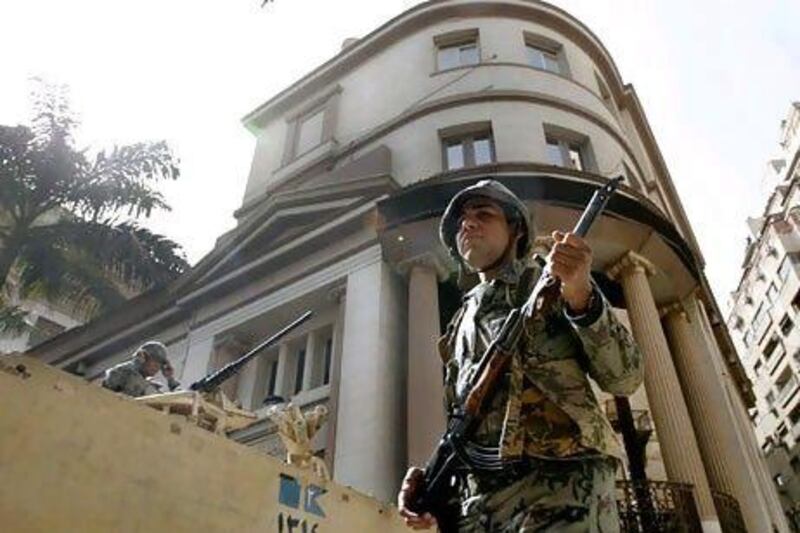

The closure was sparked by unrest that led to the ousting of the president Hosni Mubarak after 30 years in power.

The reopening of the exchange could be cut short as the regulator has brought in rules designed to prevent panic selling.

Egypt's Financial Supervisory Authority, which regulates financial markets, has said it will limit the daily share price movement on the Cairo EGX 100, the benchmark index, to 10 per cent and reduce the trading sessions to three hours from four.

Sharp falls are expected at the outset, partly for investors to escape positions they have been trapped in since the index closed on January 27, analysts and fund managers said. The value of shares traded on the market at that point was 91.32 billion Egyptian pounds (Dh56.85bn).

"In the current turmoil in the current market environment, we should reach the limit down very quickly in Egypt," said Sebastien Henin, a Mena region portfolio manager at The National Investor. "The market will close in a few seconds."

Although Egypt and Morocco are the only Mena region countries classified as emerging markets, their weighting on the MSCI's emerging market index is slightly less than 1 per cent, compared with Brazil's 16.4 per cent and China's 17.4 per cent weighting.

This means most emerging market fund managers regard positions in the region as marginal and are likely to drive selling in early trading.

Much of the Egyptian economy has been under pressure from reduced foreign investment, weaker tourism revenue, declining workers' remittances and the return of migrant workers from Libya.

Khaled Seyam, the chairman of the Egyptian Exchange, said the new Egyptian prime minister Ahmed Shafik had declined his resignation request in a recent discussion, and Mr Seyam "will continue to work hard to bring stability to the market", Bloomberg News reported.

"Everywhere you turn you can see potential impact on the market," said Ann Wyman, the head of emerging markets research at Nomura.

"If investors see that window is open there is a risk that they are encouraged to get out as quickly as they can for fear the gates will close again."

Egypt's index fell 16 per cent in the two days before its closure and some analysts said the most aggressive selling would be targeted at banking and property stocks linked to a string of alleged corruption cases that have arisen among high-ranking business tycoons and former members of government.

"You will definitely see more sellers because, for real estate, they have significant risk over their land bank; it's all about how they acquired it," said Mostafa Abdel Aziz, of Beltone Financial in Cairo.

In the past month, unrest the Mena region has spread to other countries including Algeria, Morocco, Jordan, Iraq and Yemen.

Stock markets in the GCC area have lost US$77bn (Dh282.84bn), or 10 per cent, in market capitalisation since January 25 when anti-government protests in Egypt intensified, according to Dow Jones data.

The Dubai Financial Market went down 13.5 per cent over the past month. It slumped to a seven-year low yesterday as it closed 3.8 per cent down at 1,410.70.

In Oman the Muscat measure retreated to a two-year low after reports of unrest on Sunday. The index ended 4.9 per cent lower at 6,142.42 points. It has fallen 12 per cent during Egypt's stock exchange closure.

Tunisia's market regulator also suspended trading on its stock exchange, for a second time, on Sunday after escalating civil upheaval forced the resignation of Mohammed Ghannouchi, the country's prime minister.

The suspension will remain in place until further notice, according to a statement on the Bourse de Tunis website. It was recommended by the local association of stock brokerages who feared a sell-off, said Bloomberg News.

Trading on Tunisia's benchmark Tunindex was first suspended on January 14 for two weeks following the ousting of Zine el Abidine Ben Ali, the country's president. Before Sunday's suspension, it had declined 11 per cent since it resumed trading.

"In the case of Tunisia foreign investment was always quite small, so local investors holding on to their positions helped to stabilise the market for a little while," said Ms Wyman, although she added Egypt's stock exchange performance risked following Tunisia's path.

Saudi Arabia's Tadawul, the Arab world's largest stock market, narrowed the biggest fall in eight months on Sunday as it closed 0.15 per cent down at 5,941.63 points yesterday.