Azizi Developments plans to spend $15 billion in the next three years on building projects, as well as launching the second-tallest tower in Dubai next year, as it looks to capitalise on booming demand in the UAE’s property market, the company’s chief executive said.

The construction cost of the tower at a “prime location” on Sheikh Zayed Road in Dubai may reach Dh5 billion ($1.36 billion), Farhad Azizi told The National on Monday on the sidelines of Cityscape in Dubai.

The construction of the skyscraper will begin in the first quarter of next year.

“Building that whole property is going to be expensive, obviously, as it's like a master community but in one tower,” he said.

“We're planning to launch [the sale of units] in 2023 and we're looking at it maybe after the summer, in September. That's one project that's keeping us super-excited because it's quite different.”

The mixed-used development with retail, hospitality and luxury penthouses, will be among the top–10 tallest skyscrapers in the world.

The developer had first announced the building of the 570-metre skyscraper with 122 storeys in March 2018, but Mr Azizi on Monday declined to give the final height of the project, saying it would be revealed next year.

Azizi plans to funded the project through its own equity and may seek finance at a later stage, he said.

“Right now, it's coming out of our equity, but I have the doors open for banks,” he said.

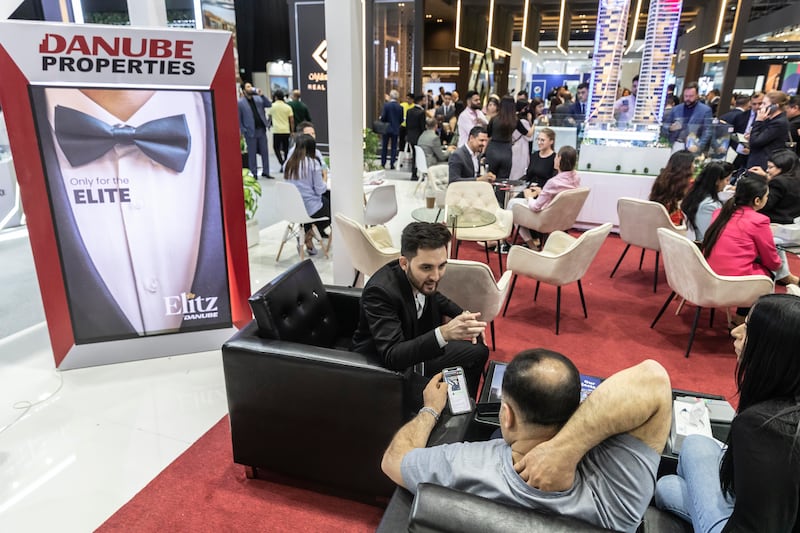

The property market in Dubai, which last year bounced back strongly from the pandemic-driven slowdown, has picked up more momentum this year. Developers are spending aggressively on new commercial, retail and residential developments to capitalise on growing demand for properties in the emirate.

As of this month, Azizi has already spent $3 billion to launch and construct new projects — the amount it spent during the whole of the last year — and could spend another $200 million by the end of the year as it boosts the pace of deliveries, Mr Azizi said.

“A lot depends on demand and right now the market is quite fantastic,” he said. "With so many things happening, we will be spending, we will be delivering, we're going to buy new land and we're going to be launching [new projects]."

The company is looking at “things very much through the lens of the market” in terms of growth prospects over the next three to five years.

“The way things are looking and the programmes and the infrastructure that is being put in place [in the UAE], we're thinking that the next three years are going to be good, so the expenditure we're planning is going be that much [$3 billion] or even more,” Mr Azizi said.

Azizi’s spending push and the launch of several projects in 2021 helped the company to triple the number of units delivered this year.

Azizi, which handed over 3,000 units in 2021, had already delivered about 7,000 units by last month and plans delivery of another 2,000 this month and next, largely in its Riviera development in Dubai.

Next year, it plans to deliver about 10,000 units to clients, Mr Azizi said.

Dubai’s property market has recorded the most robust performance in the first nine months of the year since 2011, with the volume of transactions increasing 60 per cent, compared with a year earlier, on the back of the UAE's broader economic recovery.

The Arab world’s second-biggest economy is set to expand this year at its fastest pace in more than a decade, with growth estimates forecast as high as 7 per cent.

A looming recession in Europe, weakening of the euro and the Russia-Ukraine conflict are also supporting the accelerated pace of property sales in the emirate, Mr Azizi said.

The company, which sold 10 to 15 units a week last year, has sold up to 25 units a week this year, amid rising interest from buyers from the European Union, Russia and Ukraine.

They [investors] are not happy the way things are back in their home countries," Mr Azizi said. "Inflation and interest rates, the devaluation of the euro … so they've been putting money more into currencies that are pegged to the US dollar."

An overwhelming majority of investors want to live and invest “where there is stability, where they get the rental income and the return on investments”, he added.

The company still has firm plans for an initial public offering, however, it may now seek to list in 2025 as numbers are “changing all the time” with rapid growth and they must be stable before the valuation process can be conducted, Mr Azizi said.