The hosting of the football World Cup in Qatar this year is set to boost the Dubai property market, providing a ‘mini-Expo like effect’, industry experts say.

The market has been booming during the past year on the back of the wider economic recovery in the UAE following the coronavirus-induced slowdown. This momentum is expected to continue amid record transaction levels in recent months, experts say.

The start of the football tournament in Qatar in November is set to provide a further impetus, they say, with many fans choosing to stay in the UAE between matches.

"I’m incredibly optimistic that the World Cup is going to be a mini-Expo opportunity," Scott Bond, UAE country manager for Property Finder, told The National.

"The World Cup is shorter [than Expo] but there is a large population who want to come to Dubai and then go and experience the World Cup, so they can come here and can feel the attributes of the UAE, such as the weather and beaches, safety and spread their wings a bit. That is going to shine a light here.

"In terms of the long-term effect of the World Cup, that is a bit of an unknown, but anything that shines a light on how great this area is can be positive for the market."

Dubai property prices, which declined slightly on a monthly basis in summer, bounced back in August and rose by 1.24 per cent on average, Property Monitor said.

In terms of transactions, it was a record August and the highest monthly figure seen since 2009, with residential sales transaction numbers reaching 8,882, it said.

Overall, in the first eight months, there were just under 60,000 transactions registered in Dubai, 88.4 per cent of which were residential, marking an annual increase of 59 per cent and equal to 97.8 per cent of the entire annual transaction volume of 2021, the report found.

The prime market, in particular, has had significant price rises in the past 12 months amid an influx of high-net-worth individuals and the success of the UAE's golden visa programme.

Rising rents in the city are also leading tenants to purchase property despite interest rates continuing to increase, online portal Mortgage Finder reported.

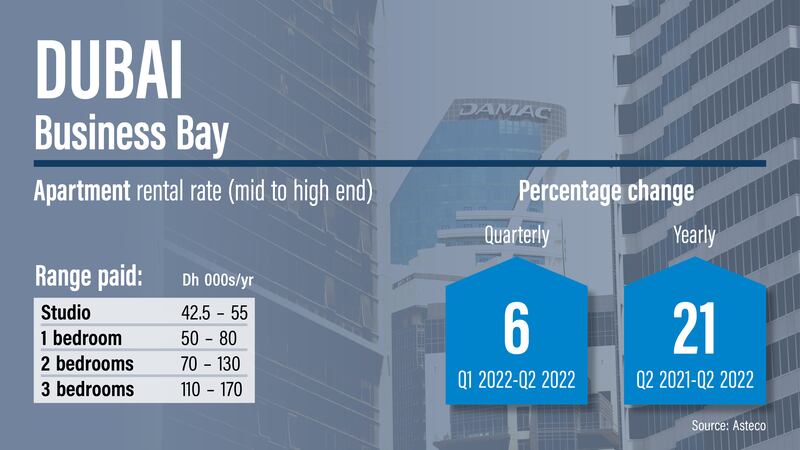

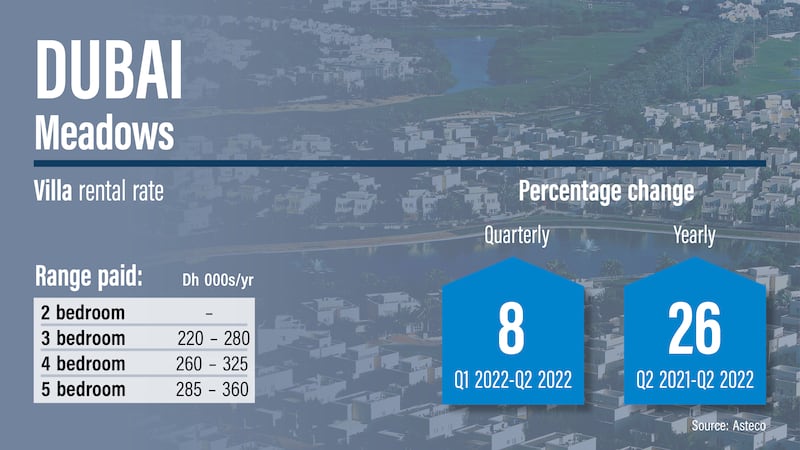

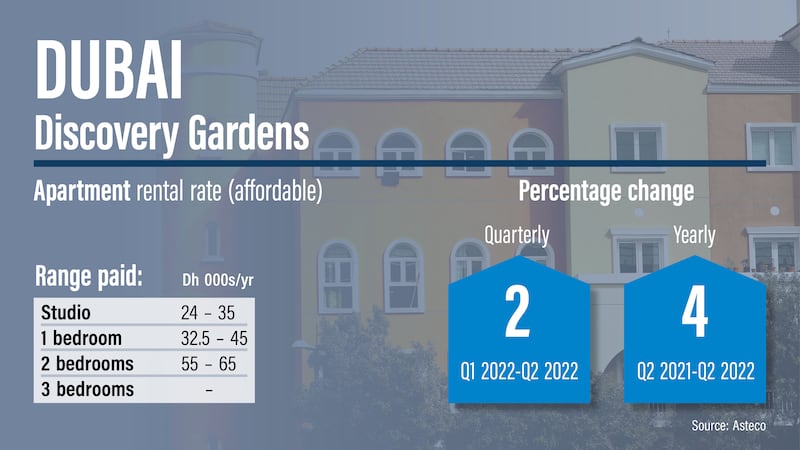

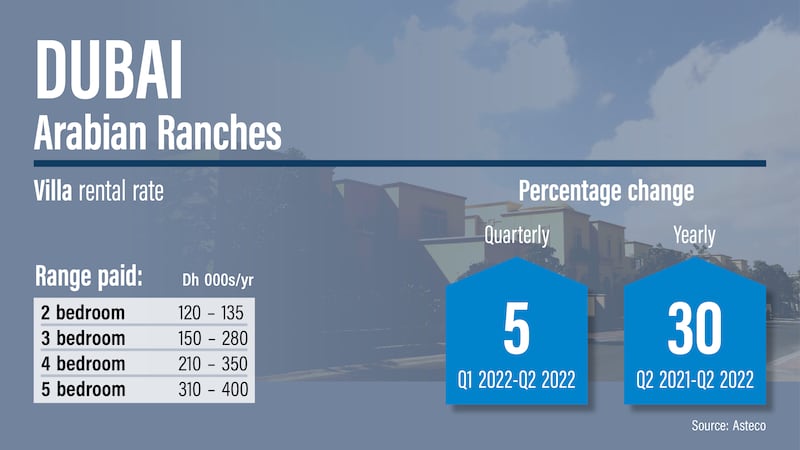

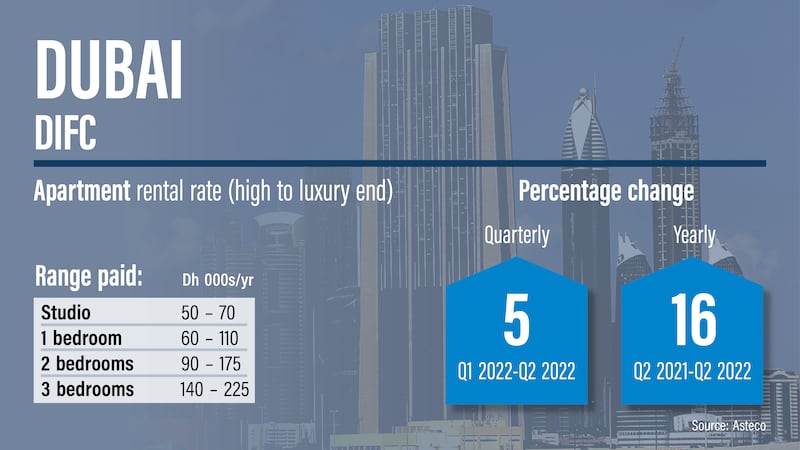

Average apartment rents were up by 24.9 per cent year on year in August, while average villa rents increased by 24.2 per cent, CBRE said.

The strength of the Dubai market comes against a backdrop of global instability, which is working in the emirate's favour, Mr Bond said.

"It’s a time of uncertainty in some areas of the world and people will be coming in from experiencing 10 or 12 per cent inflation in their homeland, their energy bills have increased by three or four times," he said.

"This is still a part of the world where you can get more for your dollar compared to other major cities.

"The government continues to make great decisions on friendly policies on why you should invest here against a backdrop of record inflation elsewhere in the world and supply chain issues."

A shortage of accommodation in Qatar has led to football fans seeking either hotels in the UAE or short-term rentals. There is also interest from potential buyers looking to invest and then rent out their property during the tournament.

"We are seeing an uptick in interested investors who are looking to buy property in prime areas so they can put them up for rent — short-term rentals have been huge across the city, and that segment of the market is expected to perform extremely well over the World Cup period," said Mark Castley, chief operating officer at LuxuryProperty.com.

"In terms of end users looking to move into a new home, that hasn't seen any additional traction as a result of the World Cup — it's definitely something that's more for investors and tenants."

The effects of the World Cup being hosted in the region are already being felt in the short-term market, with many tenants unable to find any availability, Mr Castley said.

"Anything that is available on the market now is commanding a huge premium.

"We will see a knock-on effect from short-term to long-term rentals, as there is going to be a sizeable drop in stock over the next few months, which will push prices up further over the medium term. This, in turn, will push tenants at the top end of the market towards buying a property instead."

How people attending Qatar World Cup can apply for UAE's multiple-entry tourist visa

Rentals costing upwards of Dh1 million ($272,294) are being witnessed on Palm Jumeirah, Mr Castley said.

"At that point, it just makes sense to put in a down payment and jump into the sales market."

The accommodation in Qatar ranges from designated fan camps in temporary housing units 40 minutes outside of the city, to cruise ships docked in the glittering West Bay, city hotels and Airbnb-style options. Many are expensive or already booked up.

As such, the UAE has become an attractive option for fans, with Air Arabia and flydubai operating a combined total of 45 daily shuttle flights from Dubai and Sharjah into Doha.

Tourism will already be at its peak in Dubai amid the cooler weather and hotels expect to be close to full capacity in the final months of the year.

"Investors are seeing this as a key opportunity to purchase investment properties," Tommy Burden, luxury client manager at Prime by Betterhomes, told The National.

"I've had a big increase in inquiries from clients asking about villas and apartments to purchase for long and short-term rent — the World Cup has expedited this demand."

Prime areas such as Palm Jumeirah and Dubai Marina, given their proximity to the beach, social amenities and access to the airports, are likely to benefit the most, he said.