What was the general market movement in Abu Dhabi in the second quarter?

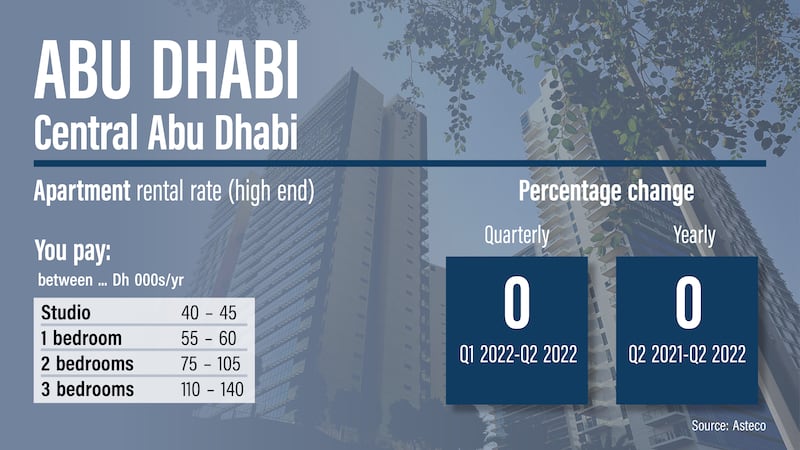

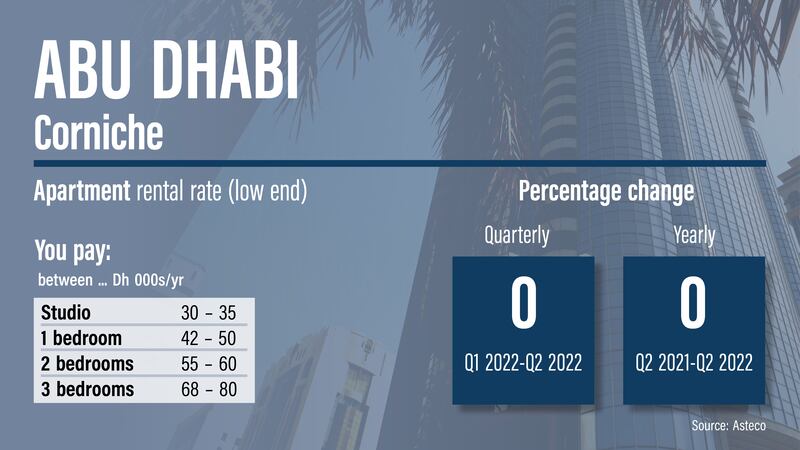

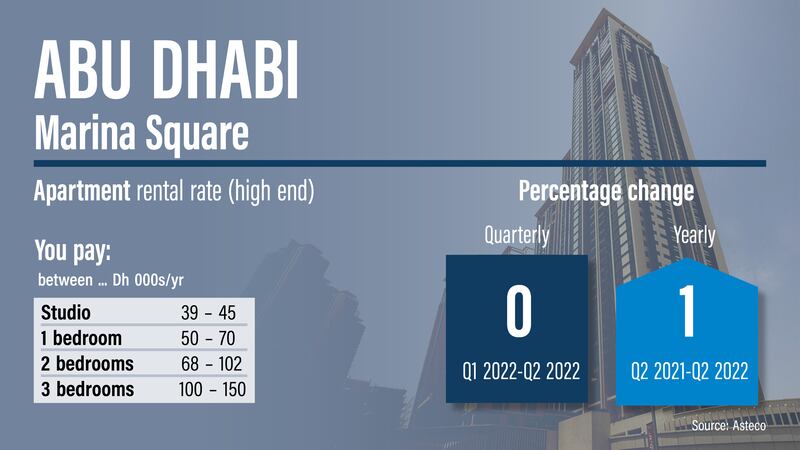

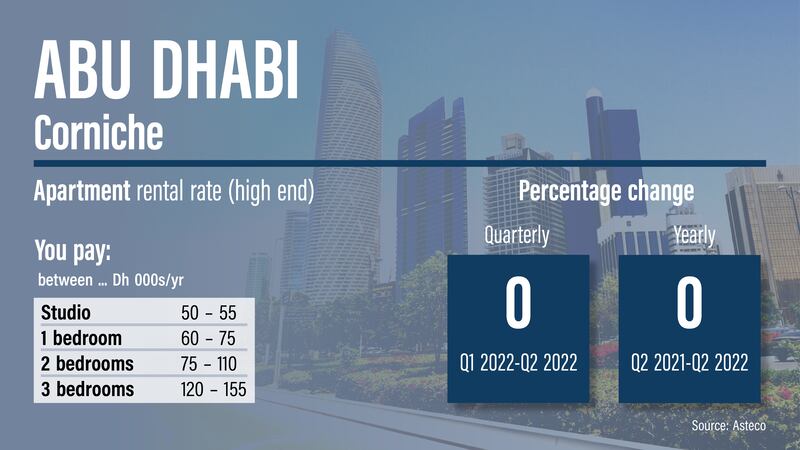

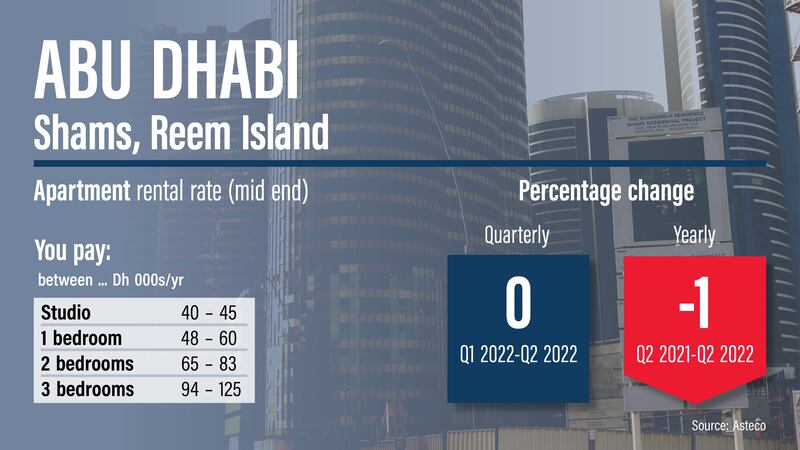

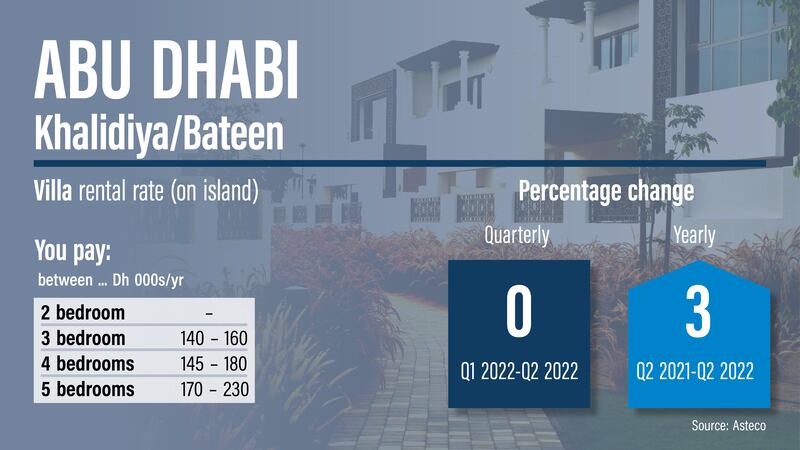

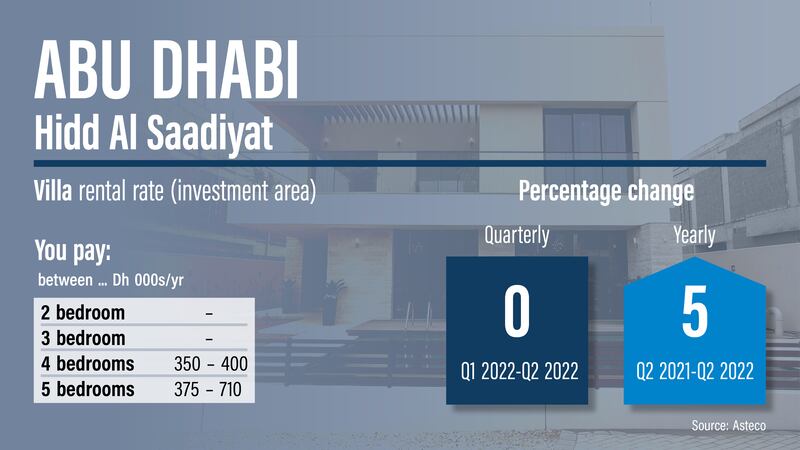

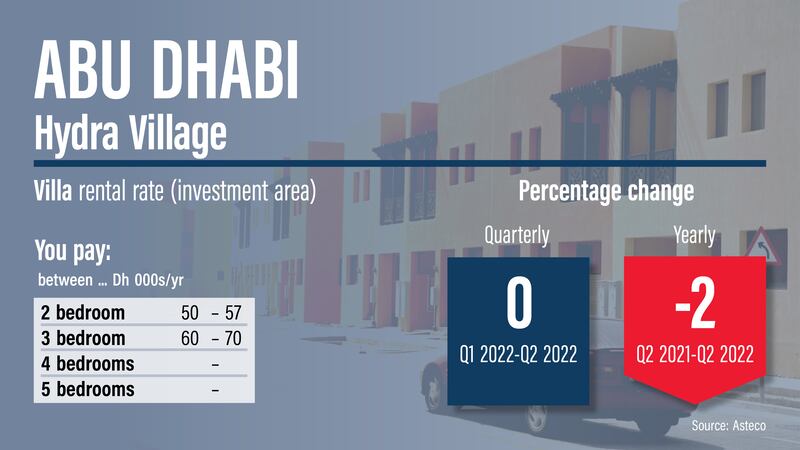

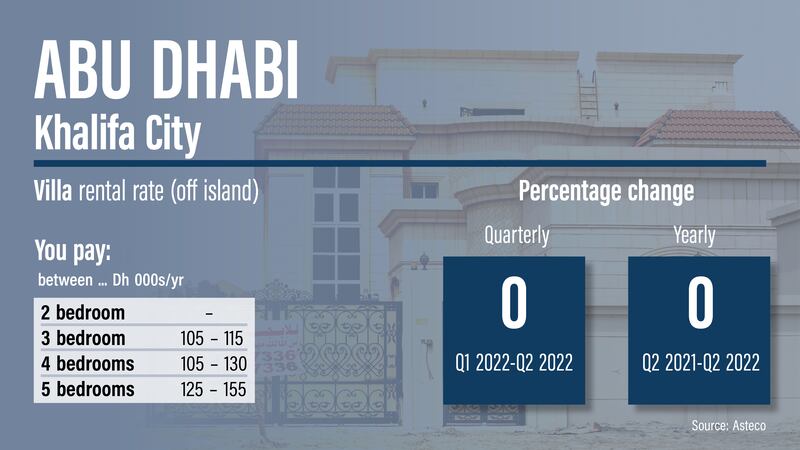

The Abu Dhabi rental market remained stable in the second quarter, with very little change in the rates being paid from the previous three months, brokers have said.

Property consultancy Asteco said new leases in good quality developments were being offered above market rates while some owners were still offering reduced rents and incentives to ensure a swift take-up of units.

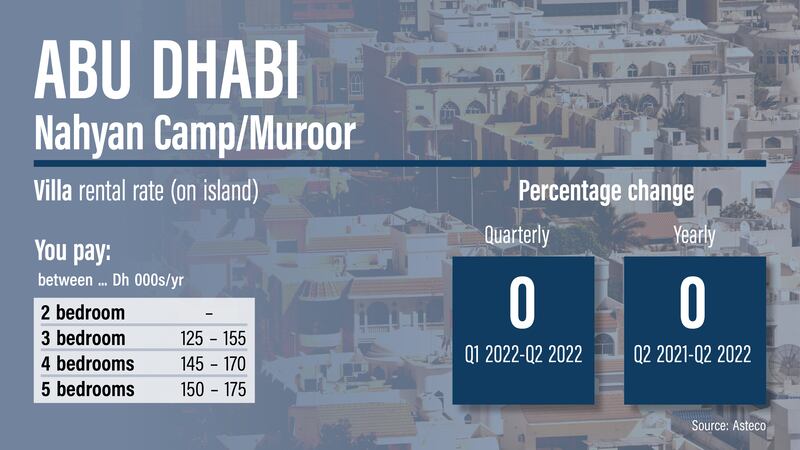

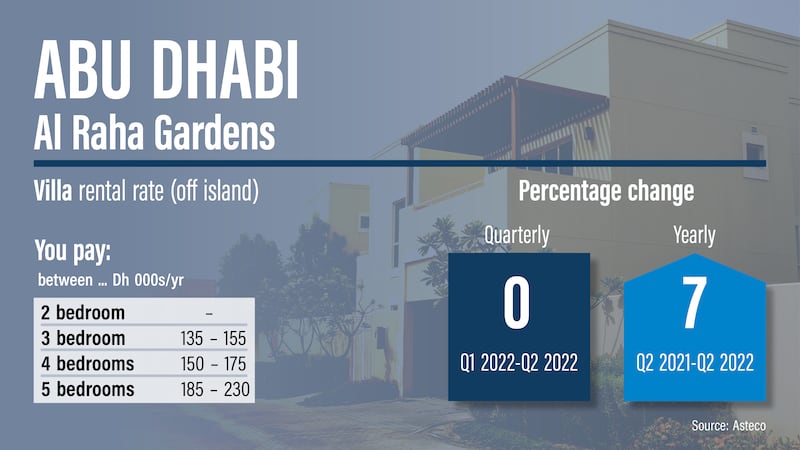

It said demand for villas in popular areas such as Saadiyat Island and Yas Island remained strong, although rental rates overall were stagnant over the quarter and rose by an annual 5 per cent. The biggest rise over the past 12 months was at West Yas, where rents were up 9 per cent during the period.

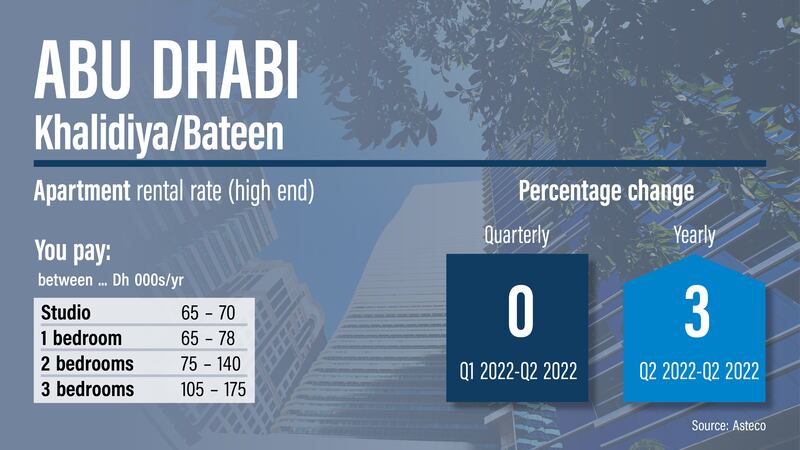

JLL, meanwhile, recorded a 3 per cent annual increase in average rental rates across the capital during the period and described demand for new villa and townhouse developments as “robust”.

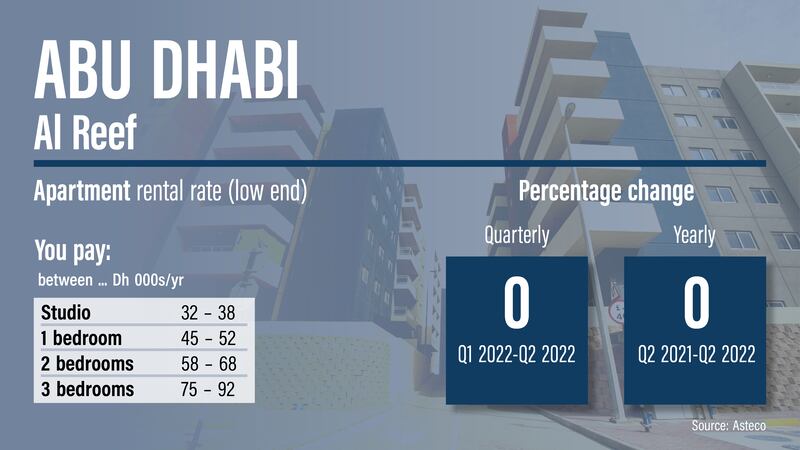

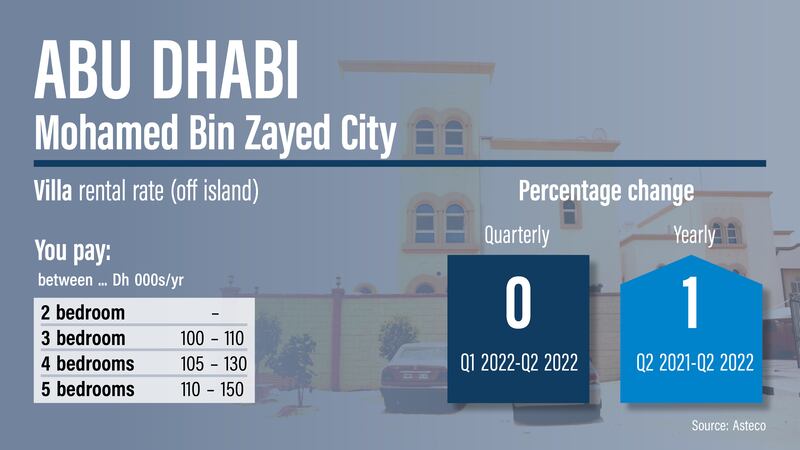

The most sought-after areas, according to trends observed by property portals Bayut and dubizzle, include Mohamed bin Zayed City, Khalifa City A, Al Reef, Shakhbout City (Khalifa City B) and Al Shamkha South.

The portals said these areas had recorded increases of up to 7 per cent in average annual rents during the first six months of this year.

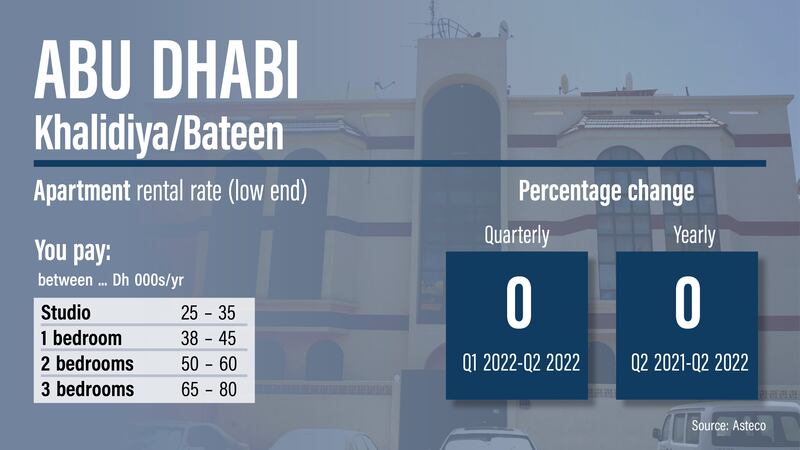

Al Mushrif was the most sought-after luxury area while Khalifa City A had the highest number of searches for cheaper flats in the city.

The UAE's property market has grown sharply during the past year amid the broader economic recovery from the coronavirus-induced slowdown.

The country’s economy remains on a strong growth trajectory. It grew by 8.2 per cent in the first three months of this year on higher oil prices and measures to mitigate the impact of the Covid-19 pandemic, according to the UAE Central Bank.

What about supply of new units?

About 1,300 apartments were delivered from April to June, according to Asteco.

These were spread across different areas of Abu Dhabi, with the focus on Al Raha Beach and Reem Island.

“While there has been a marked rise in new project launches in the first half of 2022, several others have already progressed to the planning stage and are expected to start construction within the next six to 12 months,” the property consultancy wrote in its second-quarter report.

“The majority of these developments are located in Al Raha Beach, Yas Island and Reem Island.”

Asteco expects a total of 3,400 units to be completed this year, while JLL said it expects 5,000.

New projects announced this year include Louvre Abu Dhabi Residences and Grove District on Saadiyat Island, Reem Hills on Reem Island and Bloom Living, close to the Abu Dhabi International Airport.

How did Abu Dhabi's sales prices perform in the second quarter?

Villa sales prices were largely the same as in the first quarter, but up 10 per cent year on year, Asteco said.

Apartment prices were also flat during the three-month period, but up 4 per cent year on year.

“Completed villas continued to be well received, with emphasis on popular high-quality villa developments,” it said.

“As such, some of these communities recorded double-digit growth, compared with the same period last year. Still, the lack of units available for sale in the secondary market has resulted in particularly high asking prices in several prime [communities].”

JLL reported a year-on-year sales price rise for apartments and villas of 5 per cent on average.