Sales of baked goods and poultry boosted earnings at Saudi Arabia's Almarai, the Arabian Gulf region's largest dairy producer, as it reported stronger than expected quarterly results.

Net profit surged 29 per cent in the fourth quarter to 369 million Saudi riyals (Dh361.3m). Its shares traded up .75 per cent at 66.75 riyals a share yesterday.

The result exceeded most analyst forecasts. Cairo-based EFG Hermes predicted a 333 million riyals effort, while NCB Capital had pencilled in 329m riyals.

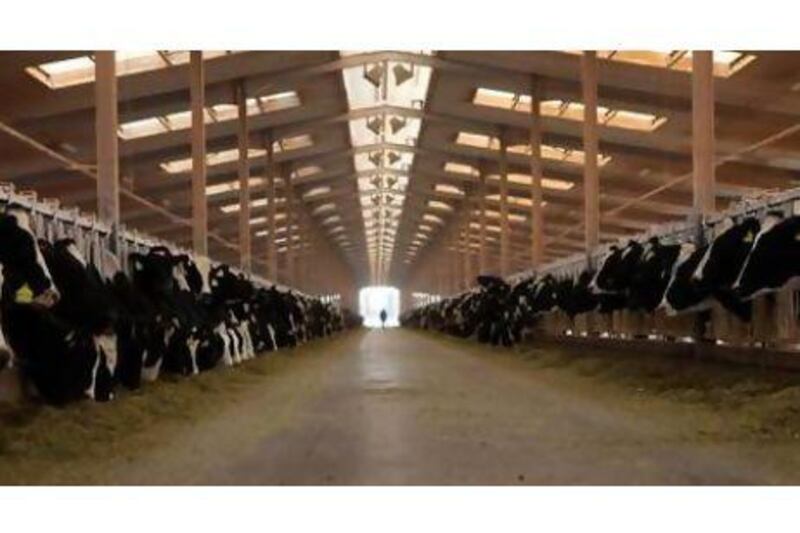

Almarai, which has a 44 per cent share of the Gulf's dairy market, has invested US$3 billion (Dh11.01bn) since 2007 to diversify its product lines to include chicken, juice, baby food and other goods.

Almarai operates a joint venture with PepsiCo, International Dairy & Juice.

The company said full-year net profit increased 26 per cent to 1.44bn riyals. Earnings per share climbed to 3.60 riyals last year from 2.85 riyals the year before.

"The profit growth in the quarter was negatively affected by continued level of higher material costs and overhead growth due to expansion in new projects, but it was positively affected by capital gains realised on sale of assets," the company said in a statement.

Almarai's board of directors said it would propose paying 500 million riyals in dividends.

Analysts have a positive outlook for the dairy producer.

"We believe Almarai has a solid long-term growth outlook, with poultry and bakery expected to play an increasingly important role," Bloomberg reported NCB Capital as saying. "We believe margins have bottomed out, and thus continued evidence of this will act as a key catalyst for the stock price."

The revenue of the company, based in Riyadh and founded in 1977, has almost tripled in the past five years to 7.95bn riyals as demand for its products - milk, cheese, processed chicken, baked goods and juices - has surged with the nation's population.

As of January 16, its shares were up 125 per cent since its 2005 initial public offering. Prince Sultan bin Mohammed bin Saud Al Kabeer is Almarai's founder and largest individual shareholder. He has a 28.6 per cent stake in the operation.

"Almarai offers an appealing risk-reward balance to play the region's demographic and income growth," JPMorgan analysts said this month.

The company's shares trade at a 14 per cent discount to global peers, based on this year's earnings, they said. The company trades at 16 times estimated 2013 earnings, compared with 22 times for BRF-Brasil Foods, the world's largest poultry exporter, data compiled by Bloomberg show. Four analysts have a buy recommend on Almarai, while 12 say hold and two advise to sell, according to Bloomberg last week.

Last week, its Saudi food peer Savola Group posted a 17 per cent drop in fourth-quarter net profit year on year mainly on a capital gain of 153m riyals it incurred from the sale of two land plots during the fourth quarter of 2011.

* With agencies