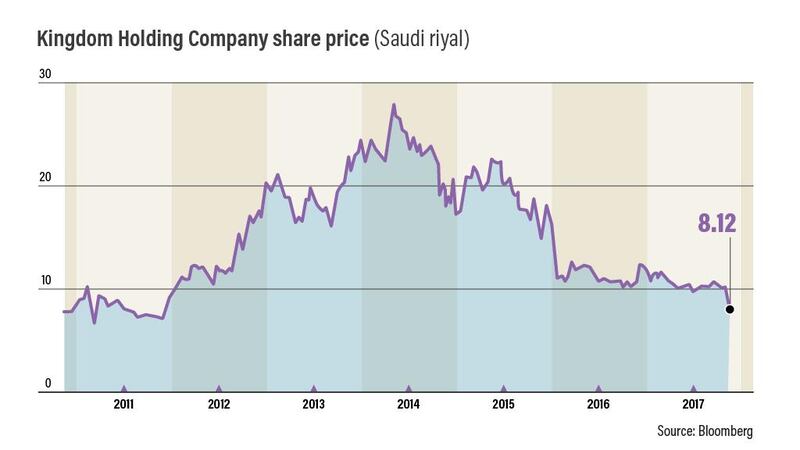

Shares of Kingdom Holding Company (KHC), the investment vehicle of billionaire businessman Prince Alwaleed bin Talal, dropped to the lowest level on Tuesday since December 2011, following reports of his detention and other prominent figures amid an anti-corruption crackdown in the country.

The company, which is 95 per cent controlled by Prince Alwaleed, saw its share price plunge 9.78 per cent by mid-day on Tadawul to 8.12 riyals, as investors continued to react to reports of his prolonged detention and other high profile individuals in the wake of an investigation launched by a newly established anti-corruption committee, chaired by Crown Prince Mohammed bin Salman. The company’s share price had dropped to 7.85 riyals on December 18, 2011.

“This a natural concern for investors to reduce exposure…due to the fact that there is an allegation under process against the biggest shareholder of the company,” said Tariq Qaqish, managing director of asset management at Menacorp. “This is their right to be concerned, I think the Saudi government will play it right in terms of protecting minority interests.”

Alwaleed, whose net worth, prior to his reported detention, was estimated at US$19 billion in Bloomberg Billionaires Index, holds stakes in various companies across a number of industries which include Twitter, Citigroup, Lyft, Careem, the Four Seasons hotel chain and Accor Hotels. The prince’s net worth declined by $1.3bn in 48 hours, according to Bloomberg.

On Sunday, the company reported third-quarter net profit of 247.5 million riyals (Dh242.2m) due to an increase in hotel revenues and operating income, compared with a loss of 355m riyals made in the same period a year ago, according to a regulatory filing to the Saudi stock exchange.

The firm had previously reported a 179.9m riyal net profit for the 2016 third quarter, but said in the latest regulatory filing “comparative figures of the same period last year were reclassified to be consistent with current figures”.

It gave no further direct explanation, but noted that KHC – like other companies in Saudi Arabia – switched to IFRS global accounting standards this year.

Net profit in the third quarter was boosted by an increase in hotel and operating revenues, larger dividend income, and income and gains on investments, as well as increase in other gains, the company said. Revenue increased 76 per cent to 550m riyals.

Kingdom Holding’s stock has declined 30 per cent so far this year and shed 19 per cent in the past 52 weeks, according to Bloomberg data.