There is a world of difference between announcing that you are considering an initial public offering, and actually getting the shares to the stage of first-day trading.

We've seen it many times in UAE markets. "XYZ plans share listing," scream the headlines, usually based on the anonymous word of two or three bankers "aware of the plan".

Everybody in the financial community gets very excited. The markets, starved of new listings since the financial crisis, are dying to get one to get the IPO ball rolling again.

The financial professionals rub their hands at the thought of those lucrative IPO and underwriting fees; the PRs also get all worked up at the thought of some new business; even the financial journalists raise a glimmer of interest at the prospect of writing about something other than debt and restructuring issues.

But for the past few years, especially in Dubai, that's as far as it has got. Several "planned IPOs" have been pulled at various stages along the process. Axiom in 2010 was probably the most advanced, aborted just a few days before trading was due to begin. Al Habtoor created quite a stir for a while last year before being called off for "moral" reasons.

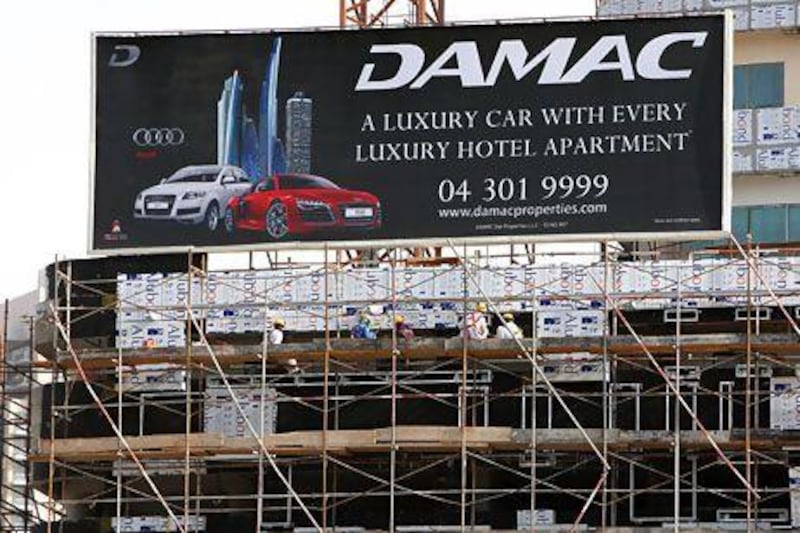

So while it's encouraging to see that Damac, one of the best known names in Dubai property, is considering a listing, maybe we shouldn't get too excited just yet. Experience shows there are plenty of things that can go wrong on the IPO journey.

Damac Properties was launched in Dubai in 2002 by Hussain Sajwani, the current chairman, and expanded rapidly in the high-end residential and commercial development market. Inevitably, the property crash of 2009 slowed its progress, but it has come back since with a number of eye-catching developments, usually in association with a big-name luxury brand such as Versace, Fendi and (most recently in Dubai) Paramount Hotels. Foreign expansion followed, in Egypt, Saudi Arabia, Lebanon and other places across the region.

Mr Sajwani is described by one confidant as a "real entrepreneur" who sees and exploits market opportunities enthusiastically. Damac's catering business is held as an example: he built a good business from the basic idea of feeding workers in the oil services sector.

So, you might think, all the ingredients are there for a successful IPO, especially against the backdrop of the recovery in the Dubai property market. But it is still very early days. In the words of one senior banker involved in the plans, "it's super-premature".

There is not much in the public domain about the condition of Damac finances, so speculation about values and market capitalisations is even vaguer than usual. Some experts talk about a total market value of $1 billion (Dh3.67bn), but it's really at the stage of informed guesswork.

There are also some legal issues to be resolved. Mr Sajwani found himself at the wrong end of an Egyptian court decision recently that alleged he was tied in with the Mubarak regime.

Talks continue about a resolution of these problems, but it would be good to have them out of the way before the lawyers and bankers got round to drafting an IPO prospectus.

Then there is the thorny question of where to list the shares. With the origins of the business in Dubai, you might have thought a listing on one of the emirate's markets was a foregone conclusion, but it isn't necessarily so. The listing of NMC Health on the London Stock Exchange last year showed that some in the UAE believe there is better value to be had elsewhere.

There has been some talk that Damac might go for London as a market that understands property and where potential investors are located; even that Hong Kong, as a market that understands the luxury sector, might be more appropriate.

Of course, if the company got far enough down the IPO road and decided on a Dubai listing, it would still have to make the choice between the Dubai Financial Market and Nasdaq Dubai. Some market executives believe it might be possible to construct some form of dual listing on the two markets, as was considered for Al Habtoor, but this would require the approval of Dubai policymakers.

There is a lot of work still to do before we can get too excited about a Damac IPO.

[ fkane@thenational.ae ]