Watch out, Ferrari. Porsche plans to take on the legendary brand in the ultra luxury segment.

Matthias Müller, appointed the chief executive of Porsche last October, wants to step up a gear to reach the market for super rich clients who can afford to buy models at prices starting at €250,000 (Dh1.2 million). The market has been left to Italy's Ferrari for too long, he says.

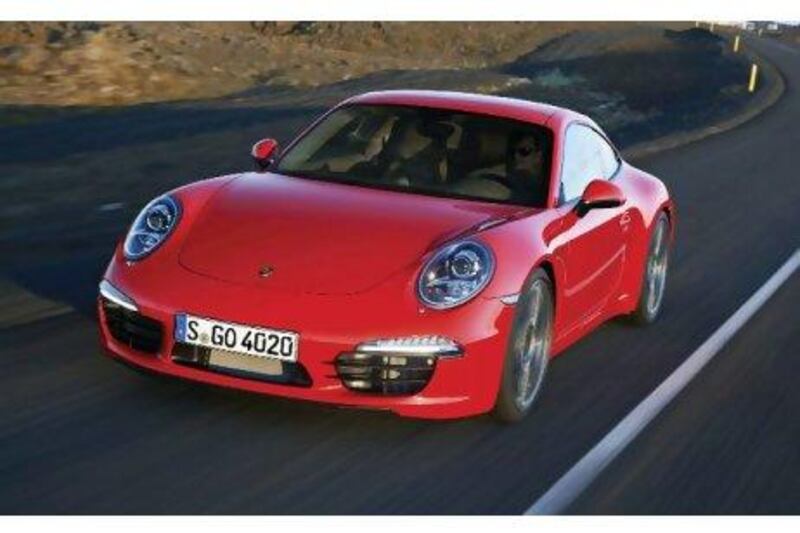

Porsche's flagship 911 model, which has altered little in appearance in almost half a century, costs about €250,000.

The latest version of the 911 will be unveiled at the Frankfurt International Motor Show, which starts on Thursday. It is an icon of German engineering, no doubt, and to Porsche fans epitomises speed and quality, but it still lacks the exclusivity and head-turning allure of some of Ferrari's top models.

The Porsche 918 Spyder, a limited-edition hybrid supercar expecrted to be launched in 2013 and boasting a 3.4-litre, 500-horsepower V8 engine, will retail at €750,000. But the price range between the 911 and 918 is dominated by Ferrari, with cars such as the 599 and FF.

"It has always irritated me that the 911 stops somewhere around €250,000 and doesn't start again until the 918 for €750,000," Mr Müller told the German newspaperSüddeutsche Zeitung in August. "In between sits Ferrari, relatively comfortably and without competition. We've got to get in there."

Mr Müller said Porsche might develop a larger sports car than the 911, one similar to the Porsche 959, which was built in the late 1980s and was the world's fastest street-legal series production car at the time of its launch, with a top speed in excess of 320kph.

"I could imagine such a model in a price range of €250,000 to €400,000," said Mr Müller.

His aim is to protect Porsche's core brand, which is about to undergo more dilution in the coming years in an ambitious dash for growth. He plans to double vehicle sales to 200,000 by 2018 with cheaper, smaller models that have little in common with the company's legendary sports car image beyond the Porsche badge on the bonnet.

A new SUV, the Cajun, is being developed, which will be junior to the Cayenne. There will also be a smaller luxury sedan, the Pajun, a junior version of the Panamera. Porsche is also considering an entry-level roadster available for under €50,000 - a price your average Ferrari owner would sniff at.

The surge in production is being enabled by Porsche's increasingly close production ties with VW, Europe's largest car group, which owns 49.9 per cent of Porsche. More than a third of the components that make up the Porsche Cayenne SUV are identical to VW's Touareg model.

Porsche's operating profit jumped by almost 60 per cent to nearly €1.1 billion in the first half of this year and the company is heading for record sales of more than 100,000 vehicles this year, in part because of strong demand from China, especially for the Cayenne. But Porsche's deepening cooperation with the mass car maker VW poses long-term risks for the exclusivity and strength of the Porsche brand.

Porsche has little choice in the matter, though. Mr Müller, a close confidant of the chief executive of VW, Martin Winterkorn, was dispatched last October to take over the management of Porsche, which ran into financial trouble in a failed attempt to seize control of VW in 2008. The two companies have both been dogged for years by power struggles among the Porsche and Piech families that control them.

Mr Müller's appointment triggered fears among Porsche workers that their proud firm would eventually turn into little more than a VW assembly plant. But at the moment it is Porsche shareholders that have more reason to be worried.

VW had planned to merge with Porsche by the end of this year but announced last week it was shelving the tie-up because Porsche faces continuing, and unquantifiable, legal risks and compensation claims from when it tried to acquire VW.

The Porsche holding company, Porsche SE, remains haunted by lawsuits brought by investors and a criminal investigation into alleged breach of trust and market manipulation linked to the complex web of derivatives Porsche spun in its takeover bid for the much bigger VW.

Porsche shares sank more than 10 per cent after VW effectively called off the merger last week. Qatar owns 10 per cent of Porsche SE as well as 17 per cent of VW.

VW now looks set to buy the remaining Porsche shares outright in a €3.9bn deal using call options. VW has said it is looking at "other potential courses of action" for creating an "integrated automotive group with Porsche". But that is likely to be a strategy to prevent further losses in Porsche's share price.

The ownership problems risk spoiling the party for Porsche this week when it unveils its new 911. It will need to fight to preserve the autonomy of its brand within the VW group in the coming years. If it doesn't, Ferrari will become an unreachable rival - a red dot, far ahead on the autobahn.