Is Careem really worth a billion dollars?

It’s a question some market watchers are asking after news broke on Sunday that Saudi Telecom Company (STC) has invested US$100 million in exchange for a 10-per-cent stake in the Dubai-based ride-hailing company.

The investment was part of a larger $350m deal led by the Japanese internet company Rakuten.

The infusion makes Careem the Middle East’s latest “unicorn” – or a company with a billion-dollar valuation.

STC’s board certainly thinks Careem is worth that much, but it’s a head scratcher when the broader market is considered – and doubly so given other recent Saudi government-backed moves.

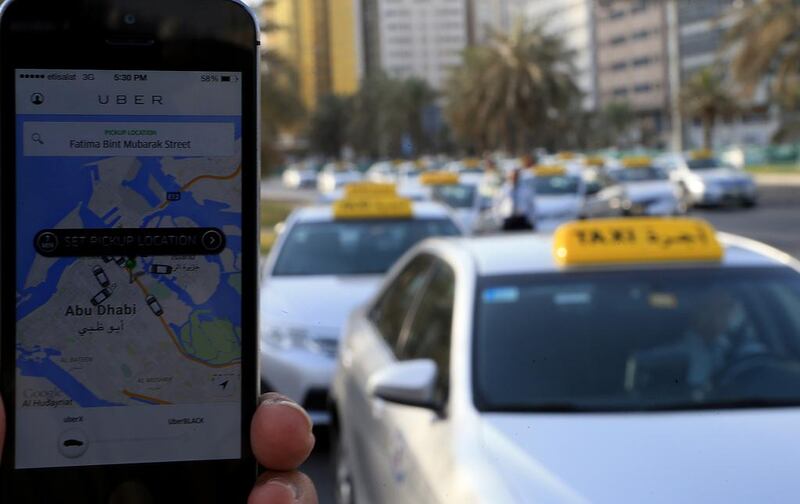

The government’s Public Investment Fund (PIF) obviously prefers Careem’s main competitor, Uber. The fund announced a whopping $3.5 billion investment in the San Francisco-based company in June, thereby valuing the company as a whole at an astronomical $62.5bn. That’s more than several major established car makers are worth, including Ford and General Motors.

The Saudi investment fund also holds a 70 per cent stake in STC, which makes the Careem move a curious development. Are Saudi investors hedging their bets when it comes to ride-hailing companies?

Originally started four years ago as a corporate car reservation service, Careem has smartly filled the niches where its rival either doesn’t operate, or refuses to. The company, for example, offers child seating and allows users to schedule pick-ups.

That differentiation has allowed it to grow into a full-fledged regional rival to Uber, with six million registered users in 47 cities across the Middle East, Asia and Africa.

Still, Careem is a veritable minnow compared to the American behemoth – and an easily swallowed one at that, since its minor service differentiations can be easily overcome.

Indeed, Uber is already replicating Careem’s main draw by offering scheduled pickups in 45 cities, mostly in North America, but increasingly in Asia as well.

Uber, with its incredibly deep pockets, is bent on dominating the ride-hailing business. It wants to be as synonymous with the market as Google is with search or Netflix is with streaming video and it’s prepared to outspend all comers to get there.

The company has been knocking out competitors everywhere as a result. Uber used aggressive pricing to force London-based Hailo to pull back from North America in 2014.

The same strategy appears to be working in the United States against fellow San Francisco-company Lyft, which is having trouble growing.

Brazil-based EasyTaxi, meanwhile, has hit roadblocks in the Middle East thanks to Uber’s massive recruitment drives.

In Cairo alone, Uber has been signing up 3,000 drivers a month, according to data company 7Park, leaving its competitors scrambling.

According to financial details leaked earlier this year, Uber is ploughing huge funds into advertising. Sales and marketing, Uber’s largest expense category, was $295m for the first half of 2015, a huge jump from $246m for all of 2014.

The company is also girding for the near-term future with investments in autonomous vehicles.

Uber has already rolled out self-driving taxis in Pittsburgh and San Francisco, despite not yet having permission to do so in the latter city.

Put all of this together and it’s no surprise that Uber is burning through money. The company’s expected whopping loss of $3bn this year would be triple Careem’s value in just a single 12-month period.

These are all luxuries that a company worth $62.5bn can afford, at least for the short term as it works to establish itself and dominate the market in the process. Does anyone – even a billion-dollar unicorn such as Careem – stand a chance against that sort of heft?

In the pre-internet analogue taxi world, there was room in most cities for multiple competing service providers. But in the internet-enabled and smartphone-driven paradigm of the future economy, new markets are inevitably dominated by a single player, with a few fringe rivals perhaps picking up the scraps.

Against that backdrop, Careem – as well as Lyft, EasyTaxi and others – is facing the same struggles for long-term success as a new search company might against Google or a fledgling social network would against Facebook.

Investors in Uber’s rivals are thus betting against a certain inevitability. It’s nice that they’re trying but the road ahead is all uphill.

Peter Nowak is a veteran technology writer and the author of Humans 3.0: The Upgrading of the Species.

business@thenational.ae

Follow The National's Business section on Twitter