MUMBAI // The decision last week by the Indian government to overhaul its existing telecommunications policy could usher in a new era of transparency and help it jump to the next level of the mobile boom, industry experts say.

The National Telecom Policy 2011 (NTP 11) is expected to be rolled out in the next three months, Kapil Sibal, India's telecoms minister, said on Saturday.

The decision to implement the new policy comes as Indian authorities investigate the role of Mr Sibal's predecessor, Andimuthu Raja, who was forced to resign in November amid allegations that he sold licences for second-generation mobile frequencies (2G) at throwaway prices in 2008, resulting in a revenue loss of up to US$40 billion (Dh146.92bn).

He denies the allegations, which have tarnished the image of telecoms ministry. Mr Sibal insists he plans to evolve a "clear and transparent" policy and create a "level playing field" for mobile phone operators. But he did not divulge whether he planned to alter government policy at the heart of the 2G telecoms controversy: the allocation of frequency licences.

The current policy mandates the allocation on a "first-come first-serve" principle, but experts are demanding that the criteria be made more competitive.

Since Mr Sibal took over the ministry in November, he has collected penalties of more than 730 million rupees (Dh60m) from mobile phone companies on charges including forgery of documents; suppression of information and failure to roll out 2G services on time.

Last month, the telecoms ministry recovered $2.2m from Etisalat DB Telecom, a joint venture between Etisalat and Swan, for missing the rollout of 2G services in four circles. It levied similar penalties on Aircel, Uninor and Dishnet.

The existing telecoms policy was formulated in 1999 when the sector was monopolised by state-run enterprises.

But in recent years, there has been rapid growth in telecoms, which has emerged as the most dynamic sector of the Indian economy.

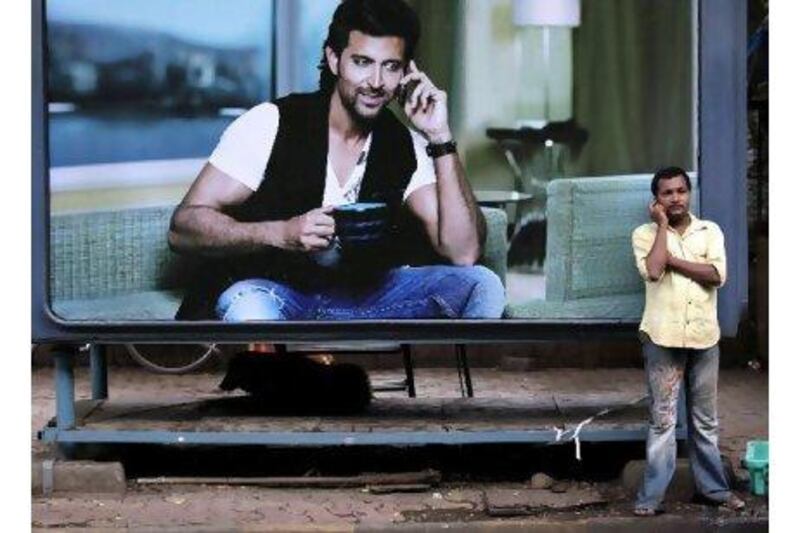

With 700 million-plus mobile phone subscribers - and 17 million new ones being added every month - India is the world's fastest-growing mobile phone market after China. A policy change is badly warranted to accommodate this rapacious pace of expansion, experts say. "A new NTP is long overdue," said Rajat Kathuria, a professor of economics at the International Management Institute in New Delhi and a former consultant with the Telecom Regulatory Authority of India. "Many changes have taken place since NTP 99 [in 1999]. The context of growth for the Indian market has altered significantly."

The focus of the new policy, Mr Sibal said, would be on three fronts: reasonable increased government revenue; affordable services to users; and brisk growth of the sector. Telecoms would benefit from "infrastructure sector status", leading to tax breaks for cellular operators and the domestic telecoms equipment manufacturing industry.

"We need to encourage the growth of this very important segment in new ways since our attempts in the past haven't yielded desired results," Mr Sibal said.

More than making telecoms dealings more transparent, the role of the new policy "should be to enhance data connectivity and aim to maximise the social and economic impacts of pervasive telecoms infrastructure", said professor Kathuria.

To further growth of the sector, Mr Sibal said the ministry planned to allocate more spectrum bandwidth to telecoms operators. "The real problem is that in India we have the lowest volume of spectrum available to the public and the civil community, so we need to increase the amount of spectrum," he said in November.

Last May, seven private telecoms operators - among them Bharti Airtel, Vodafone and RCom - won bids for the 3G spectrum in a government auction. The winning bids totalled 1.06 trillion rupees, far exceeding most expectations of revenue inflow.

With the advent of this new technology, India's mobile subscriber base is expected to cross the 1 billion mark by 2014, according to PricewaterhouseCoopers.