Mubadala Investment Company is bullish on the technology sector and is investing millions of dollars in various companies in the United States and across the globe, a top executive told The National.

“Mubadala has taken a view that technology is going to become core to a lot of industries around us and based on that view, it wants to become one of the largest global investors in technology,” said Abdulla Al Banna, director of Mubadala Ventures, the venture capital arm of the strategic investment company, based in San Francisco.

Mubadala Ventures is investing in the US and around the world, using capital from its three existing funds including a $400 million (Dh1.4 billion) direct fund and a $200m "fund of funds" programme. It has also committed $15bn to SoftBank's first iteration of its Vision Fund.

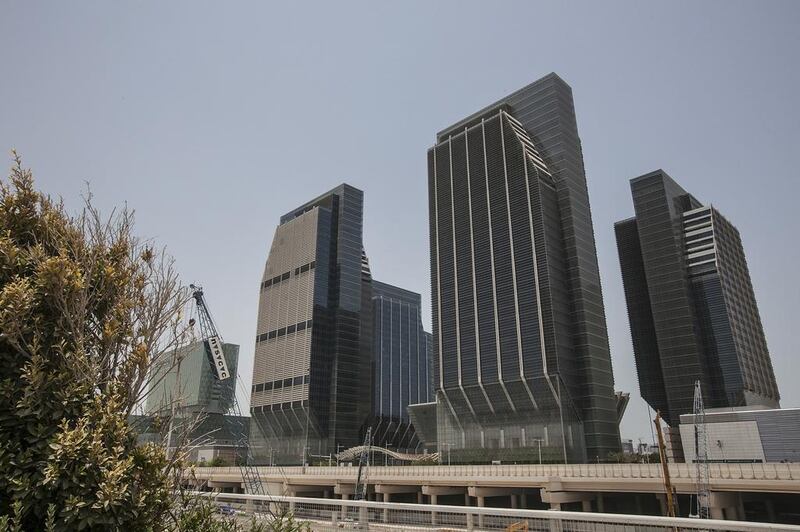

Last year, the company launched a $400m fund to target investment in European tech companies and started Hub71 in Abu Dhabi Global Market, the emirate's international financial centre, to encourage early stage start-ups to set up shop in Abu Dhabi.

In 2017, Mubadala, which has more than $200bn in assets under management, announced the launch of a venture capital unit to oversee its $15bn commitment to SoftBank's Vision Fund, as well as two other funds.

Mubadala joined Saudi Arabia’s sovereign wealth fund, the Public Investment Fund, in co-investing in the $100bn SoftBank fund, along with Apple, Foxconn and other global companies.

Mr Al Banna did not disclose how much money has been invested from these funds but said Mubadala has been investing in various tech start-ups spanning life sciences, health care, mobility and logistics, financial technology and artificial intelligence.

“There are few areas where we believe Mubadala can play a key role as technology transforms,” Mr Al Banna said. "Technology is going to transform a lot of traditional industries, every industry is becoming a technology industry."

One of the areas is health care, which focuses on how entrepreneurs are using data to transform delivery of care, drug discovery, how healthcare is accessed, consumed and used around the world, he said.

How technology is providing a level of mobility and action into the logistics supply chain is also of interest.

"Automation is changing how people move, and how things move. That is the big area of focus,” Mr Al Banna said

FinTech which is disrupting traditional ways of doing business, is another area that Mubadala Ventures is active in.

"We used to go to [the] bank to get different things done; iPhone kind of brought a strong wave of change and how software solutions and how financial services are accessed and how people access credit and different areas,” Mr Al Banna said.

Some of the tech companies, in which Mubadala has invested in the past two years in the US, include Recursion Pharmaceuticals, Color Genomics and a logistics company Turvo, among others.

Recursion is a biotechnology start-up based out of Saltlake City, Utah, and Color Genomics, sells genetic tests to assess cancer and other risks. Turvo is a logistics software start-up.

Mubadala Ventures is also taking ownership of some of the companies it is investing in.

Last month, Mubadala said it invested Dh70bn in 2018 across various sectors, predominantly in technology.

“Technological disruption is creating the potential for value across all sectors, which is an opportunity for us to deepen our position as a major global investor. We are also activating our investments and relationships to establish Abu Dhabi as the technology hub for the Mena region,” said group chief executive and managing director, Khaldoon Al Mubarak.