Bitcoin is back, with the price bursting through $10,000 again, although in truth it has never gone away.

Those who kept the faith after the world's best-known cryptocurrency crashed from an all-time high of nearly $20,000 (Dh73,459) in December 2017 are feeling vindicated, as its price breaks through five figures to hit $10,017 at the time of writing.

However, the sceptics remain unconvinced, arguing that Bitcoin and other cryptos such as Ethereum, Litecoin and Ripple still have few practical uses and are primarily a play on their own volatility.

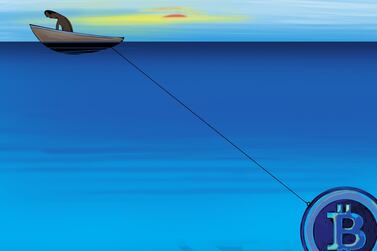

So how should you approach Bitcoin? Does it have a practical role in your portfolio, or is it still a speculative bubble to avoid?

The first thing is not to get carried away by the current price surge, because there is no guarantee it will last.

Last year, the price nearly quadrupled from around $3,250 to $12,000, only to end 2019 back around the $7,000 mark. It is still astonishingly volatile, and if you invest at the wrong time, it could cost you dearly.

There are plenty of Bitcoin bulls out there, though. Clem Chambers, chief executive of stocks and shares website ADVFN, names it as his number one investment in the world right now.

Mr Chambers is not averse to making risky calls. Two years ago he tipped Tesla as his number one stock, when Elon Musk’s fortunes were at their lowest, and his bold call has since been vindicated.

He insists Bitcoin does have a practical use, as a safe haven for people's money in times of political uncertainty. "In an emergency, it's better than gold. You can walk through any airport with $1 million of Bitcoin, and nobody is going to stop you,” says Mr Chambers.

If your country is in meltdown, Bitcoin is a good place to stash your wealth. “Global fear of the coronavirus is also creating demand, and is one of the factors driving the price right now,” he adds.

Mr Chambers expects demand to grow, especially after the so-called “halvening”, in May, which will cut the reward for mining Bitcoin from 12.5 BTC, the common abbreviation for the cryptocurrency, to 6.25 BTC, shrinking supply and driving up the price.

Matt Weller, global head of market research at Gain Capital, suggests traders who wrote off Bitcoin after its sharp drop may tune back in again. “The cryptocurrency has quietly risen from the ashes of despair,” says Mr Weller.

The keyword is "quietly", he adds, with relatively few aware of the latest rally, preventing a repeat of earlier mania.

However, Mr Weller advises caution as the current rally may be due a breather. "Indicators show signs of stalling out in overbought territory,” he says.

Others advise shunning cryptocurrencies altogether. Paul Donovan, chief economist at UBS Global Wealth Management, notes that despite the price surge, interest in Bitcoin has actually gone into sharp decline.

Google Trends showed a spike in online searches around December 2017, when the world watched fascinated as the price neared $20,000, with some hotheads calling $100,000 or even $1m, for a single virtual coin.

Mr Donovan says the initial excitement has passed. “Our own clients used to ask about it, but this interest has all but disappeared over the last 18 months,” he says.

So does it have a place in a balanced portfolio? Mr Donovan’s view is as certain Mr Chambers, but negative: “Of course not.”

He argues that a balanced portfolio is supposed to be made up of assets. “These generate a future income by acting as a claim on future productive capacity, or by having an intrinsic value.”

This can include fiat currencies, which can be used to purchase goods and services and meet tax liabilities. “Crypto does neither of those things. It is not an asset, it is not a currency, and cannot be used to pay taxes," says Mr Donovan.

He adds that cryptos have a value purely because someone else is willing to buy them: "They are a computer code in search of a justification for their existence, designed by people who understand mathematics, but not economics or currencies.”

The upside of this is that investors shouldn’t get caught up in another bubble. “When Bitcoin approached $20,000 there was a real concern that badly informed private investors were buying crypto in unregulated markets, and their life savings were being lost to bubble sellers. This is what made myself and so many other economists so angry," says Mr Donovan.

A repeat is unlikely, given dwindling interest, he adds, saying: “If people want to gamble on the price moving, and accept they could lose everything, that is less of a concern.”

Others argue that cryptos do have a practical use, as so-called digital gold.

"It is somewhere to store and protect your wealth, outside of traditional markets, and in an asset with largely uncorrelated returns," says Richard Galvin, chief executive of Digital Asset Capital Management, whose DAF Liquid Venture fund has just been declared the top-performing crypto fund in 2019, by data provider Crypto Fund Research.

This can smooth out volatility in a balanced portfolio, working as a "risk-off" asset in times of uncertainty, Mr Galvin says.

The underlying blockchain technology is starting to demonstrate its practical uses, too. "Growth has been incredible in the decentralised finance sector, which is largely built on Ethereum, with more than $1 billion in collateral loaned through various platforms," says Mr Galvin.

With a number of central bank digital currencies coming to the market, Mr Galvin sees a once-in-a-generation opportunity in a “rapidly moving, early-stage technology trading in a highly volatile market”. He advises taking a measured, portfolio approach, to minimise risk.

Victor Argonov, an analyst at online trading platform Exante, says Bitcoin may be a superior safe haven to gold. “Physical gold is extremely difficult to buy, sell or trade across national borders, and nearly impossible to use as legal tender. Cryptocurrencies can be freely traded across borders, and their use as legal tender is increasingly common,” he explains.

Bitcoin proved itself as a defensive asset in 2018, when Turkey, Argentina, and Venezuela experienced drastic devaluation. “While previously citizens of these countries bought dollars in similar situations, this time many turned to cryptocurrencies,” says Mr Argonov.

Be warned, Bitcoin is highly volatile for a supposed store of value. “Crashes are commonplace, and there is no guarantee your capital is not going to half in a month," he says.

Mr Argonov suggests current volatility may be a sign that cryptocurrencies are still in their infancy, and they could stabilise over time.

The only thing that can seriously undermine their rise is a complete ban by leading countries. “However, this seems unlikely. With every year, more and more influential financial communities join the cryptocurrency market, and they would not want to leave it,” he adds.

So should you invest? Fabian Chui, global head of front office at ADSS in Abu Dhabi, says cryptos do offer an opportunity, for the right investor: "It is an emerging asset class that divides opinion, and this creates a degree of speculation and volatility, which translates into trading opportunities.”

Bitcoin's price is consolidating, as investors turn to it as a store of value and diversification. “It is certainly an exciting space, whether one is a believer or not,” Mr Chui adds.

Having a little exposure to Bitcoin is tempting, but most ordinary investors should approach with caution.

Resist buying when the price is riding high, as it is now, as it is more vulnerable to the next crash.

On the other hand, it takes courage to buy after it has fallen and been forgotten, which means most people will buy at the wrong time.

Remember, only invest money you can afford to lose.