Last month a viral tweet showing the female anatomy made many of us aware of something so basic — so obvious — that it’s a shock to the system. Women’s muscular make-up doesn’t look the same as men’s. You know this instinctively, right?

Not acting on this knowledge is unforgivable. Unfortunately, the same thinking translates to other areas of life, like financial products and life’s trajectory.

In healthcare, this is a problem because men’s bodies and the way they process medicines and chemicals are the default. Women’s bodies are the ‘other’. In a 2014 report, researchers at the Brigham and Women’s Hospital in Boston found that the science that informs medicine “routinely fails to consider the crucial impact of sex and gender”.

When the default research and treatment protocols presume the male body as the gold standard, half the world ends up not being treated, looked after and dealt with in a way that is specific to them and their needs.

The end result is that women get substandard care, because we don’t know — definitively — how women process drugs, for example. (Shocking, right? Calculating dosage by weight is not a reasonable way to address this).

Guess what? The financial sector does the same, not considering the specific needs of women: longer lives, more health care as a result, lower pay, less full-time wages collected. And that’s just the tip of the iceberg.

I can see a time — not too distant in our future — when we will witness a huge social problem with a spike in aged women unable to live with dignity and pay for basic needs. Why? Because longevity brings with it significant challenges, such as paying bills for longer, money spent on changing needs and medical costs mounting.

I don’t see financial products catering to an average life-arc for women, who may dip in and out of earning, never earn to their full potential and have no way of making up for accumulated losses.

It will take time for things to change — so, really, the only thing you can do is learn from the mistakes or regrets of others, and mitigate risk for yourself, and your female family members.

A report titled Women and Financial Wellness by Age Wave and Merrill Lynch shares some of the fears and regrets women have about their financial decisions.

Sixty-one per cent of women would rather talk about their own death than money. Sadly, a woman in the UK in the news just a few days ago reportedly took her life because she could not bring herself to speak about having spent her life’s savings. A systems error meant that she had stopped receiving her pension, and she was too proud to let her family know she had nothing left.

Around 40 per cent of participants in the report state that their biggest financial regret is not investing more. The number one barrier to investing? Sixty per cent cited not having sufficient knowledge, followed by not having the confidence (34 per cent).

The worrying thing is that the confidence to invest declines by generation, with millennial women 14 per cent less confident in investing than the “silent generation” (those born 1925 to 1945).

Among the things that women wished they had done differently, according to the report: 35 per cent would have chosen a career with higher pay, 34 per cent would have not taken on as much credit card debt and 32 per cent would have lived beneath their means.

So what’s the answer? Well, in light of what’s on offer in the way of investment tools, and approach to life, the biggest game changer as I see it is women making, getting and keeping more money.

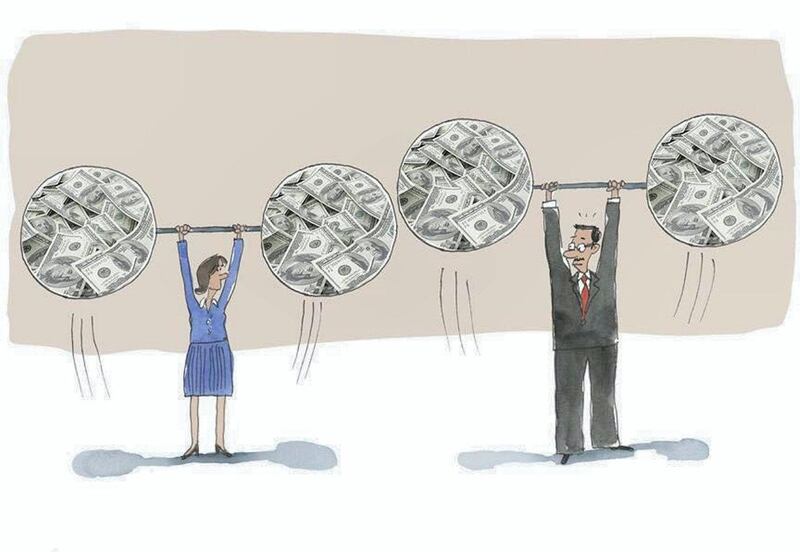

How? By understanding the lifelong ramifications of time off earning, and negotiating solid financial solutions, either with their employer or life partner. By leaning in to negotiating their needs and wants so they can rise at work and not get stuck. If they are happy with where they are, then by making sure they earn the equivalent of their male counterpart’s wage.

And, crucially, by making the money conversation part of everyday life. Muscle, like money, has the ability to contract and move (muscle is the only tissue in our body that has this ability FYI). Muscle, like money, can also grow. Make it work for you.

Life support takes on a very different meaning when the serious issue of women lacking finances to see them until death truly sinks in.

Nima Abu Wardeh is a broadcast journalist, columnist and blogger. Share her journey on finding-nima.com