The UAE Central Bank encourages bank customers to use online and digital services “as a measure to protect the health and safety of UAE residents” amid the coronavirus outbreak, the regulator said on Thursday.

“We continue to monitor the situation and will take necessary measures as needed,” Governor Mubarak Al Mansoori said. “We and the financial institutions stand strong to serve the community through multiple digital channels and contact centres.” Lenders continue to operate normally with some effectively implementing remote working, he said.

UAE Banks Federation chairman Abdulaziz Al Ghurair said: “Although the UAE banking sector has not seen any significant pressure at this stage, to maximise efficiencies and reduce the spread of the virus we encourage all customers to use digital channels to conduct their banking.”

Covid-19 has infected close to 220,000 people with nearly 9,000 deaths. More than 84,000 have recovered. As countries worldwide take increasingly restrictive measures to contain the spread, the UAE, which has 113 cases, has closed schools and many public gathering places, cancelled events and imposed travel restrictions. On Thursday, the UAE suspended entry for all residents overseas.

On March 14 the central bank rolled out a Dh100 billion economic stimulus package to offset the impact of the coronavirus outbreak by helping ease debt concerns for borrowers, boosting the property sector and providing support to small and medium businesses.

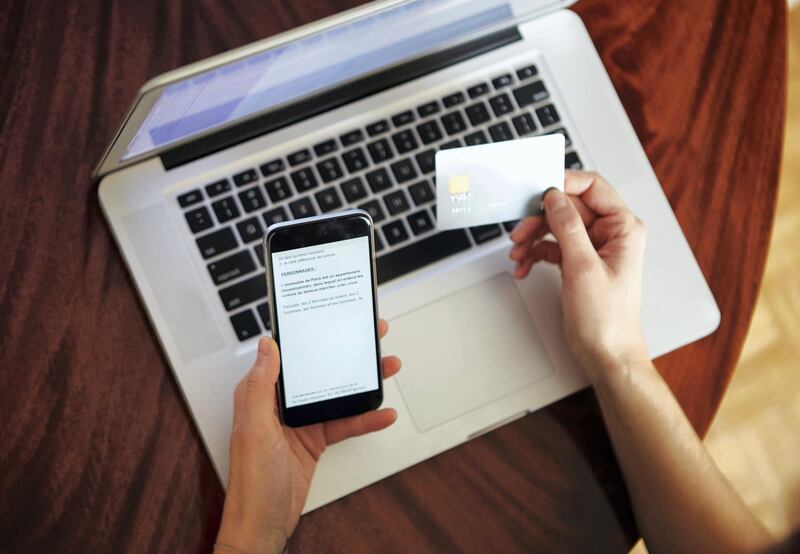

The latest central bank circular suggests important tips for customers to follow to take advantage of digital banking. These include: signing up to online banking and the mobile app; knowing log-on details; and using contactless or mobile payments to avoid touching a payment terminal or exchanging cash at shops.

The regulator also cautioned consumers to “stay alert” as fraudsters may try to take advantage of the current situation. “Make sure you’re on the lookout for anything suspicious, including messages about coronavirus claiming to be from your bank,” the circular said.

It said customers should talk to their banks directly and remember that lenders will never ask for their PIN or password, or ask to move money from their accounts. Consumers can file any complaints through the central bank website at https://www.centralbank.ae/en/form/complaints.