Predicting the future is best left to economists and people who pick through chicken entrails, two professions that have a lot in common.

Still, with 2011 fading in the rear-view mirror, here are a few personal finance trends that will develop in the coming year.

Stealth wealth

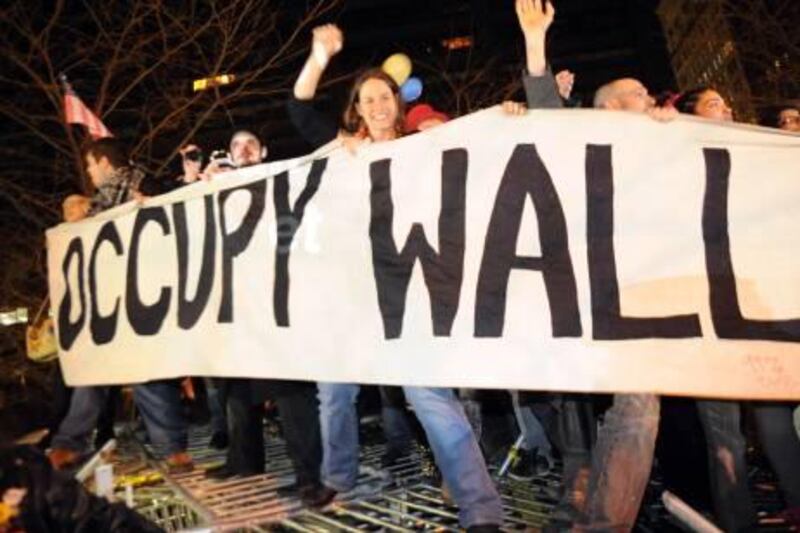

Unwashed young men and women camping along Wall Street have sent a clear message: it's no longer cool to be rich. Or at least, to be seen to be rich. Large houses, flashy cars and bling have been the way to tell the world that you've made it. Even if it's all paid for by your bank and the carats on your finger are really zirconium from China.

The term "stealthy wealthy" is now becoming so pervasive that it is turning up in the New York Times and Forbes. Unless you are so rich that you absolutely don't have to care, swap your Hummer for a Hyundai.

Gapless year

Here's a surprise. As the downturn bites, travel is up among the older generation. Back-packing, once the preserve of students, is now taking hold among garden-leavers and the early-retired. Banking group Santander says 1.2 million UK employees have taken time off work since the beginning of the recession. Many use the time for oversees volunteering and work opportunities.

This suggests people are now detaching themselves from their chosen career path. They are less likely to tough it out to retirement, and are resigning themselves to less wealth, and more life enjoyment.

Genteel poverty

Genteel poverty once described a couple of little old ladies who lived surrounded by cats, in a crumbling old house, their inherited fortunes whittled away by time. But today, it also fits the hordes stuck with underwater mortgages and a debt burden the size of the Greek economy.

This accounts for about half of all US home loans, a number unlikely to change soon.

When even the Joneses are driving a five-year-old Honda, and the tiles are falling off the wall in their McMansion, it's no longer a big deal to be broke. The middle classes will still live in their large houses, and carry an air of professionalism about their daily lives. With their mortgage swallowing every last penny, however, they will increasingly appear threadbare. Their oh-so-2009 Gucci sweaters will be trotted out again, this season.

Pawn stars

That ugly brooch that Granny left you? Hock it. The shame of selling off the family jewels is now in the past. The rise of eBay broke the ice with selling personal items, and as times get tougher, more people will see those heirlooms in terms of cold, hard cash. The proliferation of pawnshop reality TV shows indicates that the trend is now firmly established.

On the other side of the coin, it's also becoming more acceptable to deck out your house with other-people's stuff. From sofas to refrigerators, second-hand goods are no longer the seedy alternative for the poor and desperate.

DIY pensions

Shuffling around the golf course before a dose of prune juice and a nice nap are out. With 401ks being cashed in for today's survival, many hitting retirement age will have to keep on chugging along.

Even those with pensions are likely to need supplementary income. The most successful will be those who combine a skill with doing something they enjoy anyway. Arts and crafts, running a B&B, the options are endless.

At the very least, the professional environment is going to have a lot more grey heads around the office as the elderly dig in their heels and refuse to be shuffled out the door. Sociologists warn this could aggravate youth unemployment, but with little other choice, the older generation is likely to keep working for up to 10 years past retirement age.

Full nest

Divorce in Ireland has dropped almost 10 per cent in the past couple of years. The reason? Unless they are named Sinead O'Connor, they are too broke to split up. Across the western world, families are staying together longer. Children don't move out. Grandparents move in.

Moving into an apartment right after college is now a luxury for many graduates. It simply does not make sense for individual family units to struggle along alone, when they can pool resources. In a way, it's a return to a lifestyle not seen in the developed economies since WWII.

There is one new twist, however. Stay-at-home dads. Redundancies don't take into account family dynamics and many families will find themselves with a working mum and a caregiver in trousers.

Gavin du Venage is a business writer and entrepreneur based in South Africa.