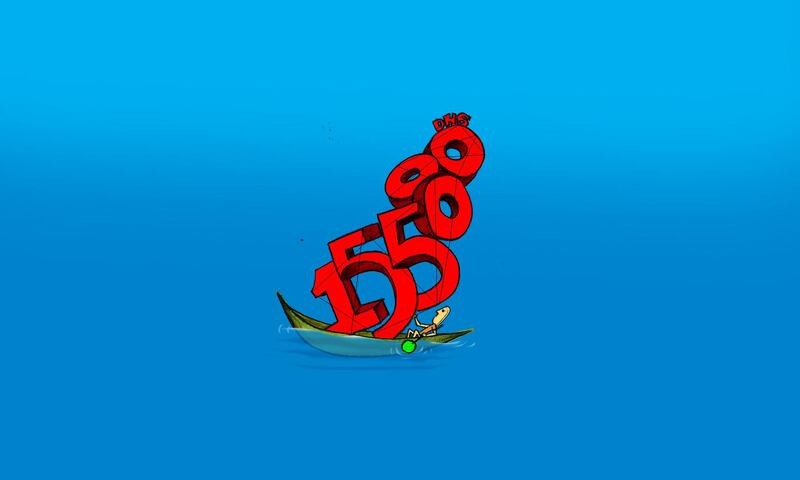

I earn Dh8,000 a month as a senior service technician in Abu Dhabi and owe Dh155,000 on four credit cards from different banks as well as a loan. I applied for buyout loans but was rejected because my debt burden ratio (DBR) is 110 per cent. I have never missed payments before, but I have encountered some unforeseen expenses and won’t be able to repay half my cards from this month.

My debts are: amount owed / minimum payment

Personal loan: Dh16,473 (Dh969)

Credit card 1: Dh37,729 (Dh2,300)

Credit card 2: Dh22,533 (Dh1,000)

Credit card 3: Dh37,061 (Dh1,400)

Credit card 4: Dh42,060 (Dh2,850)

Total: Dh155,856 (Dh8,519)

The debts started piling up in 2013 when I signed up for a mortgage in India to buy a family home there. Then my company did some cost cutting, removing allowances that helped me pay the bills. The company has also not paid us a bonus for several years.

In 2016, my mother became unwell and I took a salary advance. She has a heart condition that needs continued maintenance. The loan was deducted from my monthly salary, which made it difficult to pay the credit cards off in full. That’s when I started only paying the minimum amount due.

My wife also had an emergency C-section in 2017, so I took out cash advances on my credit cards. It was a series of events that led to this predicament. As well as only paying the minimum on the cards, I have been taking cash out on one card to pay for the next.

My wife lives in the Philippines, where she is from, and is a stay-at-home mum. My monthly expenses including remittances to support her are about Dh2,500. What is my best course of action now? IF, Abu Dhabi

Debt panellist 1: Ambareen Musa, founder and chief executive of Souqalmal.com

Relying too much on credit card debt is risky, as things quickly get out of control if you're unable to repay your credit card dues on time. Not only will interest keep on piling due to the high interest rates, but hefty late payment charges and penalties will also end up inflating your debt. You must be proactive in dealing with credit card debt and make it a priority above all else.

Buyout loans and conventional debt consolation may be out of the question, given your high DBR. The only solution that would be financially better for you in the long run would be to negotiate a reduced settlement amount in favour of a lump-sum repayment. This is only feasible if you have some savings or investments back home that can be sold to gather the funds to repay the card providers. Alternatively, ask the card providers to restructure your debt. This would involve converting your outstanding credit card balance into a fixed-interest loan, a reduction in interest rates or a waiver of late payment fees.

You mentioned your wife is a stay-at-home mum living in the Philippines. Would she be open to finding a job in the Philippines or perhaps, here in the UAE? An additional source of income can drastically reduce your financial burden and allow you to repay the debts much faster. If this is an option, you could redirect the funds you are currently remitting to your family towards debt repayment. Even if one of you can find freelance or part-time work, the additional earnings will ease your situation.

Another important aspect to consider is an emergency savings fund. Not being financially prepared to deal with unforeseen circumstances such as your mother's illness and wife's emergency C-section made you nosedive into a financial crunch. And, with no emergency savings to fall back on, you found yourself caught in a never-ending debt spiral. To prevent this from happening again, you must set aside at least six months' worth of your expenses in an emergency fund.

Debt panellist 2: Shaker Zainal, head of retail banking at CBI

Credit cards are intended for expenditures and short-term financing needs. Due to their relatively high interest rates, relying on credit cards for longer term financing needs tends to have a snowball effect.

If your DBR was not beyond the maximum levels permitted by the Central Bank of the UAE regulations, you could have immediately attempted to consolidate your existing loans into a long-term personal loan. This would have reduced your interest rate burden, as well as your monthly loan payments. However, because of your high DBR, this is not an option.

To reduce your DBR, you need to inject some cash. Consider selling your property in India and use the cash proceeds to bring down your total debt exposure. Alternatively, if there are other liquid assets readily available, consider liquidating them. Another option is interest-free borrowing from friends or relatives, to allow you to reduce your debts and avoid a further snowballing effect.

Also, talk to your banks to extend the tenor of your current loan and transform your cards into long-term, low-interest personal loans, thereby reducing your monthly payments and debt burden ratio. There are debt consolidation agencies in the UAE, who provide advice and support on such matters and you may wish to consult with one of them.

One last option is of course to look for a higher earning job; in which case you can also use your end-of-service benefits to reduce your debt exposure as well.

Debt panellist 3: Rasheda Khatun Khan, founder of Design Your Life

Learning to assess your true affordability before taking on financial commitments is an absolute must. The question is simple: "can I/we afford this?" If the repayments together with all your other fixed and variable expenses, is more than your income, the answer is "no, you cannot afford it."

The most common errors are made in the calculations:

1) Borrowers don't consider all the costs, especially ad hoc expenses such as travel, car maintenance or groceries. As they add up over the month or year, they find themselves stuck again.

2) No provisions are made for emergencies when unforeseen circumstances are inevitable. This is a leading cause of credit card debt. If your emergencies include helping others, ensure that you build up a cash reserve for that purpose.

3) People allocate variable income, like bonuses and commissions, for fixed expenses. Then, when the bonus or commission is no longer there, they run short.

Learning to say "no" or "not now" will save you from falling into a cycle of unmanageable expenses and debt. This then allows you to manage your expenses comfortably and anticipate an affordable time line for the things you need / want.

Try applying the snowball effect on your credit cards. Start with the credit card with the lowest balance and only pay towards that for a few months. In two months you can reduce your credit card from Dh22,533 to Dh10,000 and in four you will have paid it off. Once you have cleared that card, target the card with the next lowest balance. In the meantime, keep making requests to the bank for a restructure, seek financial support from family and friends, consider selling your assets and explore ways to generate more income.

The Debt Panel is a weekly column to help readers tackle their debts more effectively. If you have a question for the panel, write to pf@thenational.ae