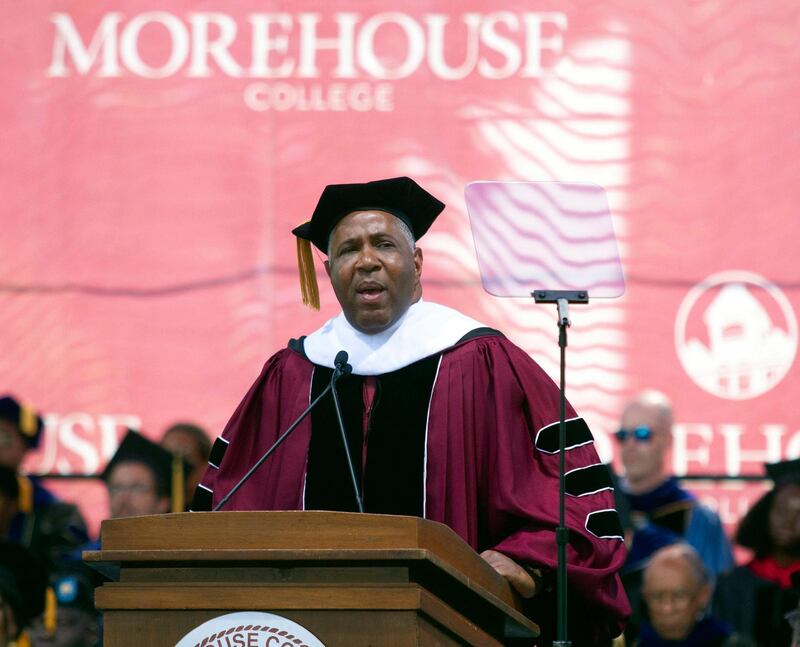

Robert F Smith

American private equity boss Robert F Smith stunned students at Morehouse College when he vowed to pay off the student loans of every member of the class of 2019.

“On behalf of the eight generations of my family that have been in this country, we’re gonna put a little fuel in your bus,” Mr Smith, 56, founder of Vista Equity Partners, said during his commencement speech to the Atlanta college’s graduating class. “My family is going to create a grant to eliminate your student loans,” Mr Smith added, according to a Twitter post by Morehouse.

Almost three-fourths of students use federal loans at the historically black college, which has about 2,100 male undergrads, according to US Education Department data. The typical debt for the Morehouse undergraduates who take out federal loans and complete college is $26,000, according to government data. That doesn’t include private lending or federal loans made to their parents. The school told the Atlanta Journal-Constitution it will cost an estimated $40 million to retire the debt of the graduating class, which totals about 400 students.

Mr Smith is the richest black person in the US with a net worth of $4.5 billion on the Bloomberg Billionaires Index, surpassing Oprah last year. The philanthropist had already announced a $1.5m gift to Morehouse. Students cheered at the news that he was also relieving the class of 2019’s college debts. He hasn’t yet clarified how the gift will be structured or the mechanics of how it will be used to pay off the students’ debt.

Mr Smith is the founder and chief executive officer of Vista Equity Partners, a private equity firm with $56 billion under management. A graduate of Cornell University and Columbia Business School, he was a tech investment banker at Goldman Sachs before leaving to start Vista in 2000.

Mr Smith signed the Giving Pledge in 2017, promising to invest half his net worth during his lifetime toward protecting the environment and supporting equality.

Lee Shau Kee

Hong Kong’s second-richest man, Lee Shau Kee, is stepping down as chairman of Henderson Land Development, joining the ranks of the city’s aging tycoons handing the reins to the next generation.

The 91-year-old billionaire announced his retirement from the top post before the developer’s annual meeting last week. While he remains as an executive director at the firm he founded 46 years ago, his sons Peter Lee Ka Kit and Martin Lee Ka Shing will take over as co-chairmen and oversee its mainland and Hong Kong businesses respectively.

“I will still participate and offer my opinion in major matters,” Mr Lee said in an interview with Bloomberg. “Aside from work, I hope I will have more time to enjoy family life, play with my grand kids and continue with my charity work.”

Mr Lee’s imminent retirement, which he flagged in March because of his advanced age, comes as other tycoons hand the baton to the younger generation. The city’s richest man Li Ka-shing, 90, put his son Victor in charge of the family businesses last year. Hong Kong gambling tycoon Stanley Ho, known as the "godfather" of Macau casinos, also stepped down last year aged 96 as his daughter Daisy took over his flagship SJM Holdings. David Li of the Bank of East Asia last week stepped down after a 38-year tenure as chief executive, the longest for a major Hong Kong-listed company.

Hong Kong boasts 87 billionaires in total, only second in the world to New York’s 105, according to Wealth-X's 2019 Billionaire Census. Mr Lee is worth an estimated $25bn, according to the Bloomberg Billionaires Index.

Mr Lee told Bloomberg he was positive about the outlook for the property market in Hong Kong.

“The current market still enjoys substantial housing demand, mainly because interest rates are quite low, and also because Chinese people like to have their own properties,” he said.

Ryan Graves

Uber’s first employee, Ryan Graves, has informed the company that he is resigning from the board of directors, according to a US Securities and Exchange Commission filing.

The filing stated the reason for Graves’ resignation, effective as of May 27, “was not the result of any disagreement” between him and the company or its board of directors.

Mr Graves, the founder and chief executive of investment company Saltwater, became the first official employee of Uber after responding to a tweet in 2010 from Uber co-founder Travis Kalanick, who was looking for potential employees for a start-up company. At the time Mr Graves was working at General Electric.

The 35-year-old became Uber’s chief executive, then senior of vice president of global operations before resigning in 2017.

Ron Sugar, the independent chairperson of the board of directors, called Mr Graves “one of the key people who helped shape Uber into the company that it is today”. Mr Sugar said the board accepted Graves’ resignation and thanked him for his “contributions to Uber’s success”.

Mr Graves owns 31.9 million shares in Uber and is worth an estimated $1.4bn, according to Forbes.

Amancio Ortega

Spain’s richest person is betting billions on prime US real estate. Amancio Ortega, the founder of Zara owner Inditex fashion group, completed a $72.5m deal for a downtown Chicago hotel last month. That followed purchases within the past six months of a building in Washington’s central business district and two Seattle offices leased by Amazon for a combined $1.1bn.

Mr Ortega’s US spending spree increases the value of his global property empire beyond $13bn, according to the Bloomberg Billionaires Index, giving him the biggest real estate portfolio among Europe’s super-rich. Diversifying his fashion fortune to preserve his sizable wealth, Mr Ortega has invested more than $3bn in US real estate over the past six years, acquiring landmark properties like Manhattan’s historic Haughwout Building and Miami’s tallest office tower.

“If I’m a billionaire investor trying to preserve my wealth for the long term, I’m looking at key buildings in major cities,” said Alex James, a London-based associate partner at real estate broker Knight Frank’s private client team.

US property makes up the largest share of the real estate owned outside Spain by Ortega’s main investment vehicle Pontegadea Inversiones, regulatory filings show. In March, the firm paid $740m for the Amazon-leased properties, the Seattle Times reported.

Beyond the US, Pontegadea has invested in property around the UK, Canada and Spain, focusing on major cities including Madrid and Toronto.

Mr Ortega, 83, has a net worth of $63.6bn, according to the Bloomberg index, making him the world’s sixth-richest person. Most of his fortune derives from his majority stake in Inditex, the world’s largest fast-fashion clothing chain operator.

Steve Cohen

Hedge fund billionaire Steve Cohen was unmasked by Artnet as the mystery buyer of a Jeff Koons rabbit sculpture last month in New York for $91m, a record for a living artist at auction.

Mr Cohen, 62, had denied purchasing the work at Christie’s post-war and contemporary art evening auction.

The winning bid came from art dealer Bob Mnuchin - the father of US Treasury Secretary Steven Mnuchin - who was in the sales room and said he made the purchase on behalf of a client.

The stainless steel, 3-foot-tall inflatable bunny was part of a group of works consigned by the family of late media mogul Si Newhouse.

Art collectors and investors shelled out more than $2bn over five days of auctions in New York. Mr Cohen, the founder of Point72 Asset Management, is one of the world’s top collectors, having amassed works from Pablo Picasso, Roy Lichtenstein and Jasper Johns. He’s worth $10.2bn, according to the Bloomberg Billionaires Index.