Now here's a revelation: smarter people are more likely to own shares. Or at least that's what a recently published study has found.

Apparently, it's the first time that researchers have found a definitive link between a high intelligence quotient, or IQ, and stock market participation.

Unfortunately, the study doesn't say anything about the chances of these so-called smart people picking winning stocks. Just that they are more likely to own them. It also doesn't take into account a person's background, wealth or education, or if they parked their money in complicated investment vehicles, such as bonds.

I'm no Einstein (who, by the way, reportedly never did an IQ test), but I wonder about the results of the IQ and Stock Market Participation study, which was conducted by three academics - Juhani Linnainmaa, from the University of Chicago, Mark Grinblatt, from the University of California, and Matti Keloharju, from Aalto University in Helsinki, Finland - and published in the December issue of The Journal of Finance.

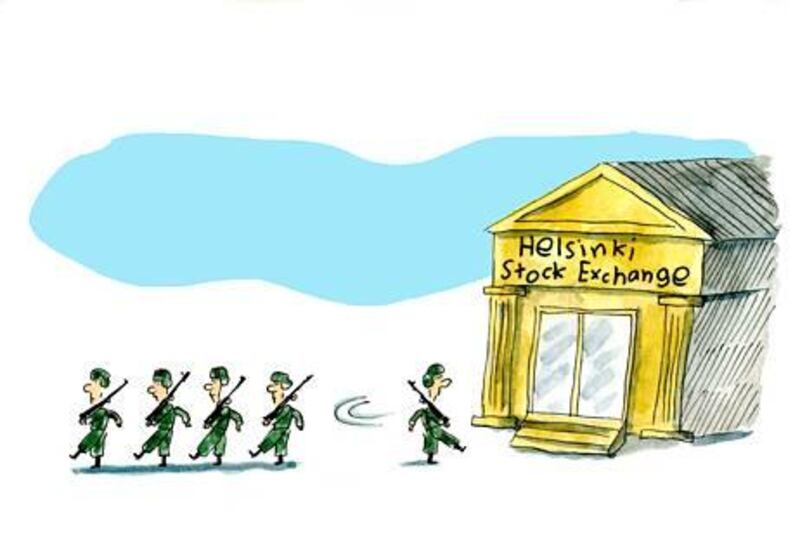

That's not to say that I'm questioning their qualifications. It's just that they bizarrely focused their efforts on 158,000 Finnish soldiers who served mandatory military service between January 1, 1982, and December 31, 2001. Many of them were about 19 or 20 years old at the time.

Perhaps the Warren Buffetts of this world were busy and couldn't participate, but I'm guessing they tapped into the nous of Finland's finest because they have to sit "a battery of psychological tests to assess which conscripts are most suited for officer training".

"One portion consists of 120 questions that score cognitive functioning in three areas: mathematical, verbal and logical skill," the researchers wrote in their report. "The [Finnish Armed Forces] aggregates these sub-scores to form a composite intelligence score, which we use and refer to as IQ."

Messrs Linnainmaa, Grinblatt and Keloharju then took these IQ scores and compared the results to investments the conscripts made after they'd served their duty.

And that's how they found the correlation between intelligence and share ownership.

To be honest, I thought all the smart people had divested themselves of shares a while ago. There's nothing like a bit of market volatility to bring out the bears, not to mention a drawn-out financial crisis. Too many people have been burnt. And if there's one thing I know, smart people learn from their lessons and don't repeat them. Well, not all of them, but some do, right?

That said, millions of smart - and not so smart - people have lost millions of dollars by playing the market, including the so-called experts: investment bankers, fund managers; you name it, pretty much everybody lost something. The proof? According to Bloomberg, US$37 trillion (Dh135.9tn) was wiped from global share values at the height of the financial crisis alone.

Brian Jacobsen, a chief portfolio strategist at Wells Fargo Advantage Funds in the US, was interviewed by Bloomberg this week about the study. He sums it up perfectly.

"When I saw this paper, I was really, really saddened that it would actually get published," Mr Jacobsen told Bloomberg.

"What they basically do is look at a very specific subset of the world's population and try to infer how this group of 19- and 20-year-old Finnish males did on a particular standardised test. To me, it really fails in the truth-in-advertising arena."

Not to mention the fact that women weren't included in the survey, which Mr Jacobsen also pointed out. Which brings me to my age-old argument that women make better investors than men because of their patience and aversion to volatility and risk. And no, before you get your heckles up, I'm not saying we are smarter investors; we are just more likely to get better returns on our investments because we are in it for the long term. Men, it is universally known (at least by women), chop and change their investments like there's no tomorrow. And there's studies that prove that.

But when you think about the world's most successful investors, the majority of them are men. According to rediff.com, this elite group is headed by Warren "The Sage of Omaha" Buffet (no surprise there). Coming in at number two is John Vogle, the retired chief executive of The Vanguard Group, and at three is Peter Lynch, who has been dubbed the "best stock-picker" in the world. Now that's one title I'd like to have.

But nowhere does it connect their IQ to their success.

Stock market success is a talent you've either got or not. Like being a professional athlete, a concert pianist or a best-selling author. We all have our talents, but unfortunately, the fickle hand of fate dictates that many of us will always find it difficult to pick a stock winner. Then again, I suspect even the experts are finding it just as hard these days.