Investment apps swiped into the spotlight recently after retail investors drove up the shares of US video game retailer GameStop from less than $20 at the start of the year to more than $350 within a few weeks. While early investors made thousands of dollars, those who entered the game towards the end of the rally didn’t fare so well – particularly after apps imposed trading restrictions.

For anyone curious about investing, the episode certainly demonstrated that making investments online has become as easy as posting on social media – although the Reddit activist agenda behind the GameStop rally may not serve everyone.

The ease of access is a major draw for investors, Dubai-based corporate consultant Georges O, who asked that only his last initial be used, says. “What’s nice about these apps is the simplicity of starting your investment journey,” the French national says. The UAE resident, 24, uses StashAway, a digital wealth management app that has been licensed by the Dubai Financial Services Authority.

"The app gives me access to a wide range of asset classes through exchange-traded funds," he tells The National via email. "I think getting access to platforms like StashAway helps me manage my savings in a better way and think long term. This way, I am able to invest my savings into a low-cost solution, while benefiting from a sophisticated framework that the average person typically wouldn't have access to."

Time was when investors had to telephone their broker and write cheques to invest in any sort of financial markets. The development of online investment platforms and a subsequent new breed of mobile apps now makes it possible for anyone to trade directly from their phone and put their money into international financial asset classes that appeal to them, whether these are stocks and bonds in markets such as the UK and the US, currency pairs, commodities, derivative trading, cryptocurrencies, contracts for difference (CFDs) or even specific themes, such as halal investments.

Minimum investments can be as low as $100 (Dh367.5) and many apps require little more than a PayPal account and proof of identity and address to get started. Best of all, unlike the traditional managed funds marketed to expatriates in the UAE, most trading apps charge extremely low fees – usually fewer than 1 per cent and, in some cases, none at all.

Like all else digital, the pandemic appears to have been a tipping point for financial investment apps. Globally, overall investment app user sessions grew at 88 per cent in the first half of last year, according to a survey by app marketing platform Adjust and intelligence provider Apptopia. As the second-fastest growing vertical, trading apps beat out other categories such as casual and hyper-casual games, with much of the growth coming from emerging markets.

For UAE investors, investment apps offer an opportunity to see their savings grow across international markets. These apps have several benefits for UAE residents, Sharad Nair, managing director of Apex Advisors DMCC, an investment adviser to ultra-high-net-worth individuals across the region, says.

“Investment apps offer access to multiple global markets, which allows for more choice and better diversification, affording UAE residents access to foreign currency accounts and various global exchanges,” Mr Nair says.

“The other benefit is the quality of the user experience. International investment apps have developed and streamlined their platforms over many iterations in foreign markets. Therefore, the product we are receiving in the UAE has already had many updates based on user feedback.”

A wide variety of apps are available to UAE residents, serving as a sort of do-it-yourself route to trading and investment. Some focus on short-term trading gains by allowing users to add leverage to their outlay, thus maximising potential gains – but also potential losses. Others, such as those offered by banks or traditional brokers, recommend staying invested over the longer horizon.

Depending on the app and portfolio you choose, you can buy and sell assets at any time, or must wait to cash out after specific intervals, such as once a day or once a month. Most apps will typically ask investors about their trading experience with different asset classes before opening an account.

StashAway, a robo-advisory investment app that launched in Singapore in 2017 that came to the UAE last year, caters to a perceived gap in the market for local platforms that ease the investment process, while seeking to educate people about different asset classes and how to manage their money through courses and video material. Users create portfolios around different themes of asset classes and then set a risk index for each portfolio.

“Many people have long-term financial goals that they want to achieve such as retirement plans, purchasing a house or even have funds ready to send their child to higher education,” Ramzi Khleif, general manager of StashAway in the Middle East and North Africa, says. “Parking money into bank accounts is a way of saving, but people need to understand that they can grow their money rather than it staying stagnant.”

StashAway estimates that 45 per cent of total wealth in the Mena region is held in cash, which Mr Khleif says is an extremely high percentage compared with more mature markets. “This goes to show that there is huge amount of money sitting in bank accounts doing nothing and, more importantly, not generating any returns,” he says.

But while the experience of UAE residents who made money riding the GameStop wave are attractive, financial experts caution novice investors against using investment apps without a clear idea of what they're getting into.

Billionaire investor Warren Buffett criticised Robinhood, the zero-commission app at the centre of the GameStop share-trading mania in May, describing it as making it easier for younger investors to approach stock market investments as “gambling chips”.

“These apps do nothing to improve the expected life or investment returns of those who use them,” Sam Instone, chief executive of AES International, a financial services firm operating in the UAE, says.

“Ultimately, online investment and trading apps encourage active trading, speculation and risk taking. That is how they make money, from trading fees. This plays to our human biases and the evidence points to the fact that users of these apps get sub-optimal results,” he adds.

The best apps are the ones that help track spending, he says. “That way, you can spend less money than you make, save the difference, buy a low-cost portfolio and be patient. You don’t need an app to look at your low-cost portfolio because the evidence says the more you look at it, the more likely you are to fail to be patient and make a human error such as to try and time the market or react to market noise.”

Similarly, Steve Cronin, a financial coach and founder of DeadSimpleSaving.com, says he only finds three apps useful: the iPhone stocks app for tracking the movement of stocks and ETFs, the XE app for tracking currency movements, and the Interactive Brokers IBKR app for long-term investing in ETFs.

“Trading apps have led to a wave of trading that is mostly going to end in tears for all concerned. People won’t notice the risks while their tech stocks are doing well and they will think they are trading geniuses,” he says. “Apps make it very easy to invest at the click of a button. It’s great for the apps but it’s not great for you. For every Tesla, there is a Nikola that will wipe out your money.”

Taking a more nuanced view, Mr Khleif points out that while DIY trading apps require some level of knowledge and research on market trends and economic performance to constantly generate positive returns, they also offer measures to limit your risks, such as applying a stop loss when the stock is falling or an automatic “take profit” option to cash out at a pre-set goal.

Such options can help avoid potential losses or situations where platforms temporarily restrict trading. “It is prudent not to follow the hype and pursue the ‘hot stock’ of the moment, but rather stick to a consistent investment strategy and contribute into a diversified portfolio that optimises your returns for your specific situation,” Mr Khleif says.

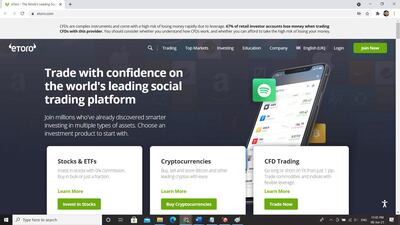

Experts caution investors to remember that it is easy to lose all their capital on an app, particularly when trading complex instruments such as CFDs. The social trading platform eToro features an alert on its home page that 67 per cent of retail investor accounts lose money when trading CFDs, and recommends considering whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

That said, it’s worth taking a look at the variety of investment and trading apps available in the UAE and considering what each one offers.

“I believe the first thing to emphasise to consumers when discussing or recommending investment platforms is the inherent risk. There are ways to build a portfolio that minimises risk, but low risk is not the same as no risk,” Mr Nair says.

He advises UAE residents to do their homework before they settle on an app – and suggests moving to another app if one doesn’t fit their needs.

“Always do your research. Once you've found a platform to suit your needs, you’re unlikely to move your portfolio from them. Therefore, do not feel like you need to rush into picking the first platform you come across. A little research can go a long way in most cases,” he adds.