My daughters are desperate. Actually, they have been desperate for a long time. It's all over two magic letters: DS. At first I feigned ignorance. I warded off their attempts to coax me into buying them a Nintendo DS by telling them I did not know what they were talking about. Which was even true. Bewildered by their mother's ignorance, their desire for the electronic gadget was funnelled into creativity. They started collecting breakfast food and shoe boxes and built oversized DSs out of cartons. But the brightly painted buttons remained silent and motionless. So all hope shifted to Christmas. But I simply said no. Before I knew it, they had calculated how many months of pocket money the DS would cost them. I helped them do the sums. The nine-year-old with a weekly allowance of Dh16 (US$4.35) would have to save for 31 weeks, the seven-year-old twice as long. They were outraged at how little their pocket money bought. Still, they clung to their dream machine. Matters got worse after sharing a taxi with a businessman returning from the Gitex trade fair. He pulled the latest DS - pink - out of his pocket. "I am giving this to my niece," he said. That day I knew I had to change my tactic. I could not let them save for something that, in the end, I would not let them buy. The onus was on me. I would use the DS debate as a starting point to teach my children about investing and saving wisely while spending some of their money playfully and spontaneously. "It is important that they learn about all three things: to go out and spend, even if it means buying chewing gum, to save toward a bigger purchase and to invest, by which I mean taking it to the bank," says Roghayeh McCarthy, a psychologist at Dubai's Counselling and Development Clinic. She also says that Dh16 is too little to achieve the goal of learning to spend, save and invest. She recommends at least Dh20. "You cannot underestimate the importance of learning to invest and budget for big items," she says. "I see so many grown-ups who are like children. They spend all of their money, but are afraid of buying big things." My first important mission was to find out what the DS really meant to my kids. "Marian has one," said my eldest daughter. Her sister followed up with a list of her own friends who have the gadget. I asked when they would play with it, and the answer came: "When I am alone and bored, on a plane or in the car." So I proposed stocking the car's book box with some fun, new titles and looking for books on CD. She would think about it, elder daughter said. Devika Singh, a Dubai-based psychologist who conducts regular "Money Matters" workshops for children, disagrees with my tactic of talking my daughter out of the DS. She argues that buying such gadgets teaches children an important lesson. "The child wants something that goes on in their culture, at school" she says. "They do this several times until they notice that the object's perceived value and playing with it are very different. Soon they realise that it isn't so great after all." Ms Singh is convinced that children will give the next purchase more thought. Several months later, adding up the dirhams and euros in her piggy bank, my older daughter realised she had enough to buy the DS. But she would not have anything left. She was outraged. "So much money for such a little machine." Mrs Singh would have been happy with this, I thought. She says money plays a crucial role in children learning about their needs and wants. "Call it financial literacy," she says. "Children must learn how to keep money in the piggy bank but still go out and buy things they want. It is about making budgets and adding up costs." So I suggested to my daughter that she put some of her money into a savings account. Enthusiastically she asked how much the bank would pay her every day. I swore under my breath. The global economic crisis and its low interest rates were about to undermine my efforts to teach my children the virtues of saving. If I wanted to score on the bank front, it had to sound like a good deal. She would get about Dh5 for every Dh100 she put in the bank, I said. "But what if nobody borrows my Dh100?" she worried. I assured her that the bank would pay interest regardless. "Banks are cool," she concluded. She decided to put some money in the bank and buy a Kipling school bag with the rest. "Lots of kids have them." My seven-year old still wants the DS, but she was also determined to invite the family to a restaurant at Dubai's Atlantis resort. I had to disappoint her once again. The Atlantis, I said, is for rich people. "I am not rich," she said, and decided to invite all of us to the local fruit-juice stall instead. Now the girls are waiting for my husband to return early from work one of these days. They want him to take them to the bank. That gives me more time to ponder the issue of the DS, and cherish my four-year-old son's simple desires. Most of the time he spends his weekly dirham on a box of orange Tic-Tacs.

Saving is not child's play

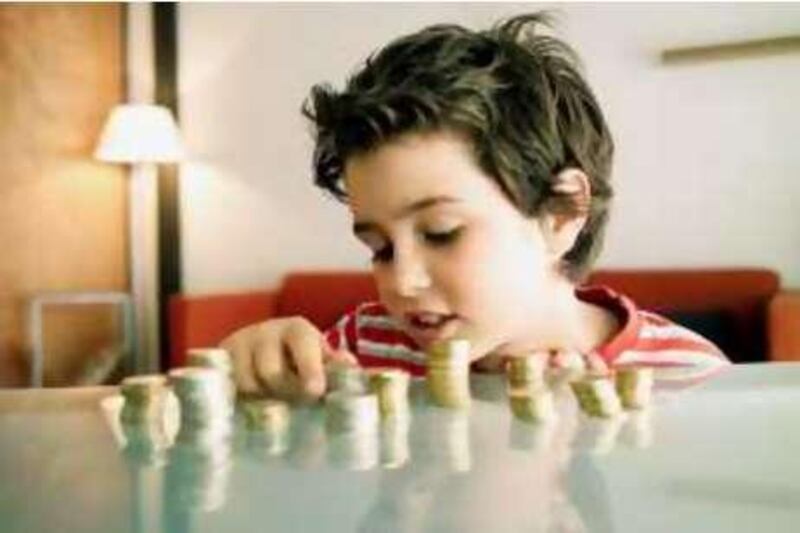

How do you teach children the value of money? With so many tempting toys and gimmicks, instilling responsibility can be difficult.

Editor's Picks

More from the national