By comparing quotes when buying car insurance, drivers can find a policy that not only matches their exact needs but also saves them money. Some industry experts claim residents can save as much as 50 per cent when assessing the market. With a multitude of insurance providers and policies available in the UAE market, shortlisting the best policies can be challenging. Here are a list key factors to keep in mind while assessing the options:

Your existing provider might not offer the best cover

Car insurance companies continuously update their car insurance rates and policies, which is why your existing provider may no longer have the most suitable or affordable options. Just because you found the best price with a particular insurer last year does not guarantee the best deal this year, so compare the market and switch to the right provider. Here are some factors to consider:

* Make sure your policy includes agency repair if your car is under warranty

* People with families should get a policy that also covers passengers

* Some car insurance policies also cover your personal belongings

* If you drive to work, consider a policy that comes with a car replacement option

* A significant discount can be secured by presenting a no-claims certificate while renewing your insurance. Show it to the insurance provider to prove you are a safe driver and have not made any claims during the previous year.

_____

Read more:

Insurance year in review: life regulations now expected early 2018

UAE car insurance market overhauled

Sports car drivers risk under-insurance in the UAE

Patrol the best car for retaining value in the UAE

_____

Changes in insurance regulations have led to increased premiums

The UAE Insurance Authority introduced new rules governing car insurance at the start of 2017. While the changes improved benefit and coverage, they also resulted in increased premiums, which is why it is both crucial and beneficial to search for the best deal before making a decision.

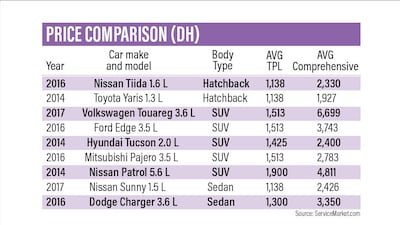

The average cost of insurance can vary by thousands depending on the vehicle’s make and model; other factors that affect what you pay include the engine power as well as the driver’s age and experience.

However, the cost of third party liability (TPL) insurance policies is usually the same for vehicles with the same engine power. For example, both the Ford Edge 3.5L and Mitsubishi Pajero 3.5L have an average TPL insurance premium of Dh1,513, whereas the cost of comprehensive insurance for these vehicles differs by almost a Dh1,000.

Don’t pay for cover you do not need

Before analysing the premiums quoted by different providers, make sure you are not signing up for more add-ons than you need. For example, you probably don’t require off-road or GCC coverage if you only drive to work and back each day.

Adding agency repair to your policy, which allows you to get your car repaired at the manufacturer’s authorised dealers, can also increase your premium by as much as Dh300. Getting protection against natural calamities costs Dh200, and for Dh1,000 you can extend your coverage to Oman.

Consider each option carefully before including it in your car insurance policy. Also take note: many waste money by overestimating the value of their car while filling in the declaration form. Once the requirements have been fine-tuned, drivers can reach out to multiple providers to compare the premiums.

Missed the renewal deadline? It might not be too late

Many drivers do not realise the transport authorities offer a one-month grace period to renew your annual car registration, which means that your car is insured for 13 months, not 12 months. Use this extra month to do your research and find the best option for you.

Obed Suhail is a senior writer at ServiceMarket.com