Rich Chinese tourists paying US$40,000 (Dh146,920) to hunt elk in the United States or booking the entire first-class cabin for a family flight to France show China's economic slowdown has yet to thin the wallets or dull the appetites of its deep-pocketed elite.

China's "Golden Week" holiday, a popular time for overseas travel, starts today. This year, it coincides with the Mid-Autumn Festival to create a rare eight-day break and visitors to Europe will not be there to get a taste of austere living.

Helen Shen, a travel planner in Shanghai, says a private business owner booked the whole first-class section of a Lufthansa jet to fly his family of four to Paris this month.

Ms Shen is one of many luxury travel organisers who still see the money rolling in from executives and members of the fu er dai - the second generation of wealthy families - despite China's economic uncertainty.

"If you look at your affluent Chinese overseas, they are your tourist, your shopper, your investor all in one," says Christine Lu, the co-founder of Affinity China, a Shanghai-based luxury travel firm.

"Even though there is all the talk of a slowdown in China, the luxury sector we are dealing with is a segment that can still afford to travel."

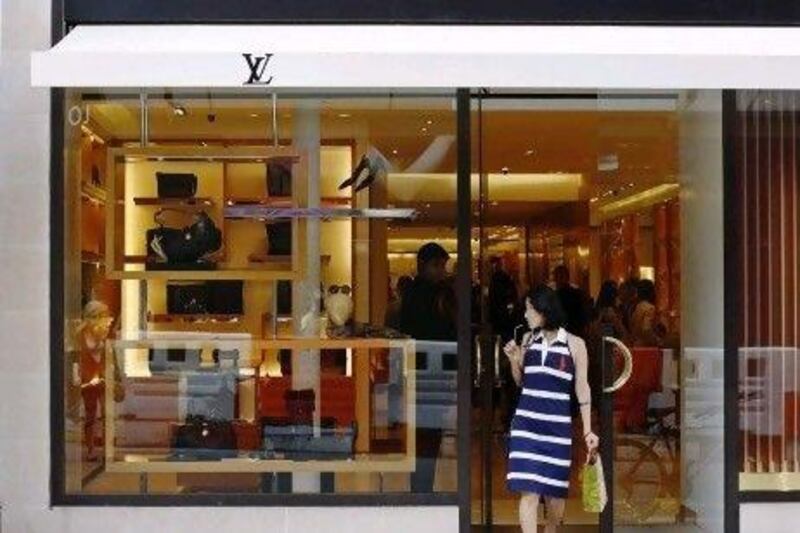

This is good news for luxury brands facing the prospect of weaker demand within China as Beijing cracks down on conspicuous consumption at home.

In the rest of the world, rich Chinese tourists are famed for their lavish spending. To avoid steep sales taxes at home, many of them unleash the cash on deluxe goods and premium cosmetics with every stamp of their passports.

"Most of the people who are going abroad already have quite a bit of wealth and buying things overseas is still much cheaper than buying things in China," says Renee Hartmann, a luxury retail consultant based in Los Angeles.

Global Blue, a tax-free shopping firm, said in July that Chinese travellers were the biggest spenders in duty-free shops, racking up €2.1 billion (Dh9.9bn) in sales last year, up 68 per cent from 2010.

"The [weakness] of the euro and the pound, plus the post-Olympic effect, is increasing the draw of Europe as a tourist destination and enticing wealthy Chinese to shop in Europe," says You Jinzhang, the chief executive of HHtravel, a luxury travel brand under China's top online travel firm Ctrip.com International.

The firms that sell coveted brands do not see their Chinese customers suddenly discovering asceticism.

The Italian fashion designer Brunello Cucinelli, whose eponymous firm sells cashmere jumpers for almost €2,000, has shrugged off concerns about a slowdown, saying Chinese demand for old-world luxury remains strong.

Some of Beijing's better-heeled are not content with adorning their wardrobes with fine cashmere. Mr Cucinelli tells a story of a group of Chinese investors who once visited his company in its hilltop home of Solomeo, in central Italy, and were so smitten by the place that they asked how much it would cost to buy the whole village. "The Chinese love what we do, what we wear. They want to be like us. This is the Chinese century," he says.

For this year's holiday, most boutique-bingeing tourists from China will still travel to Europe and the United States as those trips were planned months in advance, but the pure shopping jaunts in Asia may take a hit.

"[Overall] sales [for the Golden Week] can come down by 10 to 15 per cent both in Hong Kong and China," says Lam Tung-hing, a general manager in the retail operation of Oriental Watch Holdings. He cites economic concerns, but also the preference of many shoppers for London, Paris and New York over Hong Kong and Macau.

It isn't just ringing tills in retail outlets that show the upper echelons of Chinese society are immune to the slowdown.

Top-end tourists lap up exclusive experiences such as meeting the family of Patek Philippe, the Swiss watchmaker, or having their genes analysed in Munich.

52Safari, a hunting club that caters to wealthy Chinese, is also having a good year. Scott Lupien, the club's American founder, will run three hunting tour groups this holiday.

One couple, heading to the US state of Utah for an elk-hunting trip, is paying Mr Lupien $40,000.

"This is going to be our best October in four years of business, we have more demand than ever," Mr Lupien says.

* Reuters