Carrefour is the cheapest store for some basic household grocery staples and Al Maya the most expensive, a new survey of six supermarkets by Souqalmal.com has found.

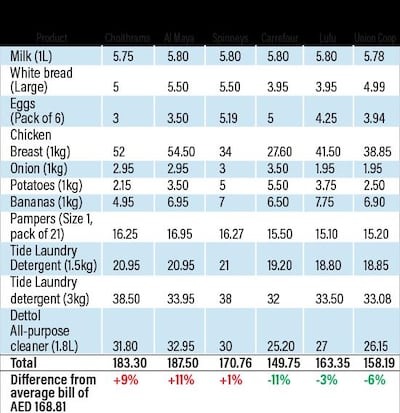

The survey, provided exclusively to The National, was conducted on 11 household items, from bread and milk to Dettol All-Purpose Cleaner and a 21 pack of size 1 Pampers diapers, creating an average bill of Dh168.81 across all six locations surveyed.

Carrefour was 11 per cent cheaper than the average, with a bill of Dh149.75, while Al Maya’s bill was 11 per cent more expensive, at Dh187.50. Choithrams trailed close behind at 9 per cent, or Dh183.30.

Ambareen Musa, founder and chief executive of Souqalmal.com, says the analysis aims to simplify bargain shopping for residents by offering more transparency on supermarket pricing while also highlighting where the best deals are.

"The fact that Carrefour emerged as the cheapest and Al Maya as the most expensive could come as a surprise to many shoppers," she says. "When it comes to choosing value-for-money supermarkets, UAE consumers often decide where to bargain shop based on past experience, recommendations or even hearsay. Rather than relying on the assumption that XYZ supermarket is always cheaper than others, shoppers can now see how prices at their favourite store stack up against those at others."

Miguel Povedano, chief operating officer and head of operational excellence of Carrefour UAE at Majid Al Futtaim Retail, says the supermarket chain was "extremely pleased to have an independent party like Souqalmal validate our efforts".

"A key factor as to why we’re so competitive is due to the strong relationships we’ve built with leading suppliers both local and international, allowing us to offer fresh, high-quality products for less."

The store locations surveyed were: Choithrams, Dubai Marina, Al Maya, Dubai Marina, Spinneys, Al Furjan, Carrefour, Discovery Pavilion, Lulu Hypermarket, Al Qusais and Union Co-op in Al Barsha.

Union Co-op and Lulu Hypermarket were the closest in pricing, taking the second and third spot, with Dh158.19 and Dh163.35, respectively, while Spinneys was fourth with Dh170.76.

While carrying out the survey Souqalmal.com’s staff shopped for the cheapest available items across categories such as chicken, milk, eggs and bread. One stark price difference came with 1 kilogram of chicken, which cost Dh54.50 in Al Maya compared to Dh27.60 in Carrefour.

Souqalmal says while comparing different groceries, it noticed a significant price difference between known brand names and the supermarket’s home-grown brands.

“By stocking home brands on their shelves, supermarkets are competing with premium name brands for a slice of the market share,” says Ms Musa. “Ultimately, this works in favour of consumers, who get more economical options to choose from.”

The analysis revealed that while there is a smaller difference in the price of name brand items between different supermarkets, the price of house brand items varies significantly.

The researchers concluded that it would only be fair to compare some products, such as eggs, chicken and bread, from the supermarket private label brands, to get a better idea of the actual retail chain pricing. They also conceded that the quality of private label meat, poultry and baked goods between supermarkets would vary.

Carrefour's Mr Povedano says: "Our private label is another reason for our high ranking. Manufactured according to stringent quality and safety standards, customers have the option of their favourite products at affordable prices."

V Nandakumar, chief communications officer for Lulu Group’s 147 hypermarkets across the region says Lulu’s bill, which was 3 per cent lower than the average, at Dh163.35, was not surprising as the chain is “obviously known for being the most affordable hypermarket in the region”.

However he disputes the methodology used in such surveys, as they often fail to compare “apples to apples” when concluding price disparities.

“When it comes to fresh produce or private labels or products that are not of the same companies or country of origin, basically you will never have uniformity in price,” he says. “Oranges can be procured from different countries, different variations, of different quality and obviously the price will not be the same. So the person doing the survey might just pick the price of an orange in a supermarket and pick an orange in another supermarket and it’s not a fair comparison.”

The other supermarkets did not comment on the analysis.

Rasheda Khatun Khan, a wealth planner and member of The National's debt panel, says despite the survey's findings, her overall perspective is that there is not that much difference in pricing at the stores surveyed. And while some items may be cheaper, others are not.

“It’s not like it’s cheaper overall,” she says. “It just depends on what you’re buying.”

For that reason, families like hers usually base their decision on where to shop on convenience and location, she says.

“We used to drive all the way to Union Co-op, which is maybe 10 or 15 minutes away, but it’s really busy, because the assumption is right, it’s just so much cheaper,” she says. “And really, it’s not actually that much cheaper. It’s not worth the driving time, it’s certainly not worth the parking time."

Unless she is in a mall and needs to pick something up, Mary Ann Carolino, a 46-year-old school bus supervisor from the Philippines, shops at the same place exclusively: the Lulu hypermarket at Al Falah Plaza in Abu Dhabi, which is two minutes from her home.

“I go almost every day or every other day,” she says. “It’s near our house, that’s why.”

______

Read more:

Cost of living decreases for expats in Dubai and Abu Dhabi - compared to other cities

Personal finance in the UAE: Residents track finances better but struggle with saving and debt

______

Melody Sylvain, a 27-year-old American teacher who lives with roommates in Abu Dhabi, says she shops about once a week. And she makes her decision on where to go “definitely based on price”.

“Unless I’m looking for something specific, I usually most of the time go to Lulu, Co-op or Carrefour,” she says. “Sometimes I go to Spinneys, but that’s only because it’s in my building.”

Although she is partial to the wide selection of organic items at Carrefour, Spinneys is where Ms Sylvain knows she can find the best produce, including ripe avocados, which is why she is willing to pay a little more.

She also likes the growing array of store-brand items, such as granola.

“It is expensive but I feel like their prices are going down,” she says. “I’ve noticed they’re starting to make more Spinneys brand things, like spices;, they are starting to package them in Spinneys packaging and they are cheaper than I’ve known Spinneys to be.”

Spinneys chief executive Matthew Frost says the company prides itself "on being an independently-owned retailer that listens to our customers".

"We review competitor activity on a weekly basis and have recognised a significant shift to price-driven promotions over the past few months," he says. "However, Spinneys remains focused on its commitment to providing fresh, quality food and exceptional value for money across its stores."

When it comes to saving money at the supermarket, Ms Khatun Khan says shoppers should limit their visits.

“When you just go for milk, you end up coming back with a basket of all sorts of things,” she says. “When you limit the number of times you are shopping, you are certainly saving money.”

Her advice is to do one big monthly shop at one of the country’s cheaper chains – Carrefour, Lulu and Union Co-op, supplemented with a weekly visit to the most convenient location for fresh items. That visit can even be to one of the upper tier stores, as long as the visits are infrequent and the items are essentials, she says.

“I think I would just confirm, for example, that Choitrams and Al Maya and perhaps Spinneys, are not going to be your monthly shop,” she says. “Maybe your weekly bits and pieces.”

______

Read more:

Geneva most expensive expatriate city in the world, new study says

The hotel loyalty programmes that help you save on your travels

The expensive bills you can now pay monthly in the UAE

Listen:

Business Extra Podcast: Cost of living in the UAE compared to the rest of the world

______

Does loyalty pay off?

While Souqalmal.com did not compare loyalty programmes in the survey, schemes such as loyalty cards, club cards and co-branded credit cards do play a role in where consumers choose to shop, Ms Musa of Souqalmal says.

“Loyalty programmes are big in the UAE," she says, adding that co-branded credit cards that offer loyalty rewards at supermarkets were the most popular credit card variant among UAE residents according to Souqalmal's research.

V Nandakumar, chief communications officer for Lulu Group’s 147 hypermarkets across the region, says the company’s co-branded card with Abu Dhabi Commercial Bank, which gives cash back for purchases, has done “phenomenally well”. However, the company has noticed that consumers in the GCC tend to be driven to spend much more by deals and pricing rather that loyalty programmes.

“We found in countries like the UAE, customers tend to have more inclinations toward promotions,” he says. “The consumers are more attracted to instant gratification, which includes price offers, buy one, get one, straightforward discounts, bundled offers – you buy two you get three – these kinds of offers make them rather more loyal to us.”

Mr Povedano says: "While it's true that shoppers are becoming increasingly price-sensitive, they're also demanding better service and more incentives to keep them from taking their business elsewhere.

"As a result we’re frequently unveiling offers on in-demand items and have in place MyClub, a loyalty programme that rewards consumers with points for every dirham they spend at our stores."

Mr Povedano says the retailer gives back the VAT on 365 basic everyday items in MyClub points and also refunds "any customer who has bought an identical item somewhere else for lower price with x20 the difference in MyClub points".

Loyalty programmes can be economical, says Ms Khatun Khan, but she says that the savings are "not groundbreaking" and often take too long to accrue.

Customers tend to scatter their loyalty between stores, which takes too long to reap rewards, she says, instead recommending that those that want to benefit should focus on one store to maximise savings.

“On the loyalty points, it just takes time,” she says. “But what it does mean is you have to use that place consistently instead of spreading them between supermarkets.”