Wealth managers must take action to capture growth opportunities in emerging markets such as the Middle East and Africa (MEA) while preparing their operating model for an eventual downturn, a new study from global consultancy Oliver Wyman and German investment bank Deutsche Bank found.

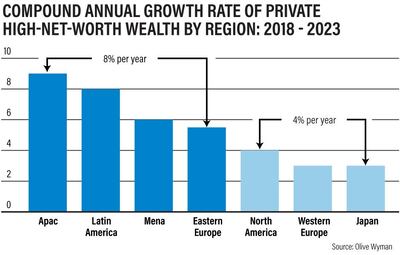

Growth of high net worth individuals (typically defined as those with in excess of $1 million in liquid assets to invest) in emerging markets will outpace developed markets until 2023 – at 8 per cent versus 4 per cent per year – with Asia Pacific, Latin America, MEA and Eastern Europe set to account for over half of global wealth growth over the next five years, compared to a third today, according to the fourth annual wealth management report Out of the pit stop – into the fast lane from the two companies.

“To realise above average growth, serving developed markets will not be sufficient. Emerging markets including the Middle East and Africa, are the engine for growth going forward as the industry continues to face fee margin and cost pressures in developed markets,” said Mathieu Vasseux, partner and head of financial services (MEA) at Oliver Wyman.

Global high net worth wealth growth grew to $70 trillion (Dh257tn) at a decelerated rate of 4 per cent in 2018 – far below levels seen in previous years – as challenging equity markets and fee compression led to declining business valuations in the industry. The strongest growth rates were observed in emerging markets at 7-8 per cent, while developed markets trailed behind at 2-3 per cent.

Investor hopes that the global economy was on track for a recovery this year was dented earlier this month after the US hiked tariffs on $200 billion of Chinese imports to 25 per cent on May 10, as talks between the two countries broke down without a resolution.

According to the Oliver Wyman and Deutsche Bank study, private high net worth wealth in the MEA region is expected to grow by 6 per cent annually until 2023, while Asia Pacific is expected to reach a high of 9 per cent over the same period and Latin America at 8 per cent, compared to rates of 4 per cent in North America and 3 per cent in Western Europe.

“These are the markets where wealth managers will have the greatest opportunities to expand their client base and significantly grow assets under management over the coming years,” the study said.

Wealth management business valuations decreased by more than 20 per cent in 2018, the report found, while valuations across banking also took a hit with the valuation gap between wealth management and other banking businesses continuing to narrow.

The revenue pressure experienced by wealth managers at the end of last year highlights the continued vulnerability of operating models to market stress, the study found. The market rebound in early 2019 brought short-term relief for some, but further pressure is inevitable as the end of the cycle approaches.

The report made a series of industry recommendations including advising wealth managers to rethink their positioning on emerging markets, particularly in Asia Pacific and Latin America.

“Be alert to developments in offshore hubs Hong Kong and Singapore while the challenge to build scale is growing – prepare for potential shifts in relevance between hubs,” it said.

The report also recommended wealth managers simplify their operating models, with the market rebound in the first quarter of 2019 offering "a last chance to improve efficiency of their operating model and adjust their cost base before an eventual downturn".

To increase efficiency in the front office to ensure wealth managers are free for revenue-generating activities rather than being caught up in paperwork, companies should automate and digitise processes, particularly in areas of client onboarding, know your customer and anti-money laundering and lending, the report added.