A man whose bad-news predictions are most often on the money, Marc Faber's comments draw the attention of smart financial analysts. During a recent appearance in Abu Dhabi, the pony-tailed guru enthralled investors with his advice on how to survive the volatile world. Brad Reagan reports In the white marble lobby outside the Al Jaheli theatre at the Armed Forces Officers Club and Hotel in Abu Dhabi, famed investor Marc Faber sits smoking quietly by himself. The 60 or so financial analysts who are here for Mr Faber's talk mill about the room, trading business cards and noshing on pastries, either unaware that the man sitting on a love seat in the middle of the room is the main attraction, or are too intimidated to approach him.

Mr Faber is accustomed to feeling like the skunk at the garden party, having spent a career telling investors what they often do not want to hear. A die-hard contrarian, Mr Faber specialises in spotting storm clouds where others see only blue skies. Not for nothing, his monthly newsletter is called The Gloom, Boom and Doom Report. At his Abu Dhabi appearance, Mr Faber cut a striking figure in black trousers, navy shirt and lavender tie, with the majority of his remaining hairs pulled back into a short ponytail. His words were similarly stark.

"Believe me, you will not find anyone who is more bearish about everything in the world than I am," he says, elaborating over the next 90 minutes about why he sees a future filled with wars, sovereign defaults and other economic catastrophes. Now 63, Mr Faber says he first came to the Middle East in the mid-1970s, when he advised a close friend to get out of the soaring Kuwait stock market, which for a time was valued more than Germany's. The market crashed completely in 1982.

That was among the first of Mr Faber's bold calls, which reportedly included advising his clients to pull out of the US stock market a week before the 1987 crash. In 2007, he wrote in Time magazine that "I believe we are in the midst of the greatest asset bubble ever", a prognostication that also appears to be on the mark. In good times, Mr Faber is often a lone voice in the wilderness, but in turbulent periods such as the one we are in now, his always-provocative views get a closer listen.

Mr Faber, who grew up in Geneva, Switzerland, and still speaks with a pronounced accent, moved to Hong Kong in 1973 and now lives in Thailand. He is disdainful at times about what he calls "the divine people of the West", but saves his greatest scorn for those in charge of US monetary policy. He says the US policy in recent years "has been a disaster for the US, but it has had a very positive impact on emerging economies". (It is worth noting that he does not hold out much faith that US President Barack Obama can right the ship. A typical Faber-ism: "Obama doesn't know anything about anything.")

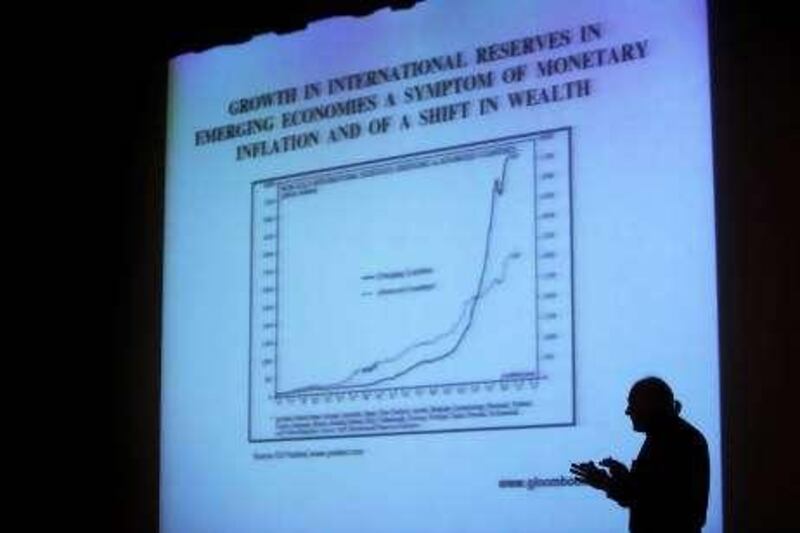

Mr Faber's belief that the West is in the middle of a steep economic decline - and how investors should play it - is the theme for the night. "We are in the midst of an enormous economic shift from the Western economies to the emerging economies," he says. "[But] don't be overly dogmatic and think the whole world is deflating or the whole world is inflating. You have to look at sectors." To Mr Faber's eye, China is not in a much better position than the US. "I think it could crash," he says. Australia also has what appears to be a property bubble, while he thinks budding superpowers China and India could find themselves clashing over water as well as oil.

The key in such a volatile world, he says, is to diversify. Whereas a typical pre-crisis portfolio would be split about 50-50 between the US and international stocks, with about 20 per cent devoted to emerging markets, Mr Faber says investors should keep at least 50 per cent of their portfolio in emerging markets. He adds that investors should not only diversify the types of assets they hold, but also the locations where they are held, a symptom of his belief in the precariousness of global banks and currencies.

"In absence of knowing what the world will look like, you have to be well diversified," he says. Given his dire world view, it is not surprising that he is a fan of precious metals. "If I could only choose one [asset class], I think I would choose gold," he says. At one point, he also recommends everyone buy at least one house in the country as he anticipates future wars will target urban areas almost exclusively.

But unlike other über-bears, many of whom advise finding financial safety in government bonds and cash, Mr Faber sees equities as a smarter play for wealth protection because of the inflationary policies he expects from the US Federal Reserve. Throughout the presentation, Mr Faber is not merely content to provide his opinions, but ticks off a remarkable flood of statistics - everything from the number of cars sold in China last year to the value of the Mexican peso in 1977 - that provides historical context for his findings.

As macroeconomic theory goes, it is hardly boring, notwithstanding the one man who snores loudly about halfway through his talk. The audience barrages Mr Faber wth questions when he finishes. In one of the last questions of the night, Mr Faber is asked which other investment gurus he reads. "I follow every opinion because when you go shopping, you better visit every shop in the bazaar," he says. Mr Faber slips on his jacket and as he walks up the stairs, he fields a few questions about his take on the UAE.

He says he is generally bullish on the Emirates, in part because of the "cushion" provided by its large migrant labour population. Unlike countries such as the US, which are struggling with mass unemployment, the UAE is able to pare the number of workers here without directly impacting Emiratis. But Mr Faber faults the UAE for not doing a better job of creating a local professional class through education, as Singapore has done, and says that leaves the country overly dependent on oil.

"If [oil] goes down to $40 [Dh146.9], the whole Middle East is in deep" trouble, he says. But he does not think that will happen. "In general, I think oil prices could be much higher than they are now. Compared to a can of Coca-Cola, oil is still pretty cheap." Mr Faber lights another cigarette and reclines on the same love seat where he sat alone earlier, only this time he is surrounded by analysts who want to hear more. breagan@thenational.ae

Date of birth February 28, 1946 Nationality Swiss Lives Thailand Education Studied economics at the University of Zurich and, at the age of 24, obtained a PhD in economics magna cum laude 1970-1978 Worked for White Weld & Company in New York, Zurich and Hong Kong 1978-1990 Managing director of Drexel Burnham Lambert (HK) Ltd. 1990-current Set up his own business, Marc Faber Limited, which acts as an investment adviser and fund manager Other highlights Author of several books, including Tomorrow's Gold - Asia's Age of Discovery, published in 2002, as well as the publisher of the Gloom, Boom and DoomReport