A majority of UAE and Saudi consumers are optimistic that their countries’ economies will rebound within two to three months despite the crippling effects of the Covid-19 outbreak, a new survey from global consultancy McKinsey found.

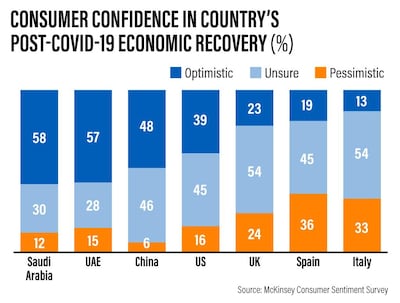

Fifty-seven per cent of UAE consumers and 58 per cent of Saudi consumers are optimistic that the economy will grow to become "just as strong or stronger” than before the outbreak, according to the survey that measured Middle East consumer sentiment during the coronavirus crisis.

The results from the poll, which was conducted between March 23 and 26, were released on Thursday and follow similar surveys in China, Italy, Spain, the UK and the US. About 1,000 consumers each in the UAE and Saudi Arabia were surveyed.

"The survey was done when the UAE, KSA and wider GCC region were still in the early stages of the Covid-19 country contagion curve," Abdellah Iftahy, partner and leader of the consumer and retail practice at McKinsey Middle East, told The National. "As such, consumers are still optimistic about a speedy recovery of the economy."

In China, where the virus originated and new cases have since significantly decreased, 48 per cent of survey respondents are optimistic about the country’s economic recovery.

However, consumers were largely either unsure or pessimistic about the lasting economic impact of Covid-19 in countries where the outbreak has accelerated at an alarming rate.

In the US, which now has the highest number of cases globally, 39 per cent were optimistic about an economic recovery. In the UK, only 23 per cent were confident, in Spain 19 per cent and France 18 per cent. In Italy, which has the highest death toll from the virus and second-highest number of confirmed cases, that figure stood at only 13 per cent.

Worldwide there are over 930,000 cases of Covid-19 with more than 47,000 deaths as of Thursday, according to Johns Hopkins. Around 194,000 have recovered.

The US has over 216,000 cases and Italy more than 110,000. Saudi Arabia has 1,720 cases with 16 deaths and 264 recoveries. The UAE has 814 cases with eight deaths and 61 recoveries.

Measures to contain the virus, including widespread business and school closures, travel restrictions, event cancellations and stay-at-home directives, have brought some sectors to a complete halt and had drastic ramifications for the global economy.

McKinsey’s Middle East survey found that 28 per cent of UAE consumers and 30 per cent of Saudi consumers are unsure about the country’s economic recovery, meaning they think it will be affected for six to 12 months and will “stagnate or show slow growth thereafter”.

Fifteen per cent of UAE consumers and 12 per cent of Saudi consumers are pessimistic, meaning they think Covid-19 will have a long-lasting impact on the economy and either "show regression or fall into a lengthy recession".

The survey also looked into consumer behaviours, shopping trends, and changes in both household income and spending during this time.

In the UAE, 52 per cent of consumers said they are worried about Covid-19’s impact on their overall finances and 54 per cent said they are cutting back on spending.

In terms of household income, 52 per cent of UAE consumers said it has either reduced slightly or reduced a lot. About a third said it remained the same and 17 per cent said it increased slightly. As for household spending, 52 per cent said it has remained the same and a quarter said it has increased.

In Saudi Arabia, half are worried about the impact of the virus outbreak on their finances. Forty-four percent said household income has reduced and 48 per cent said household spending has remained the same.

Consumers in both the UAE and the kingdom are focusing on the essentials, with about a third in each country increasing spend on food and drink categories, but more than half decreasing spending in beauty and cosmetics.

Government curfews and stay-at-home directives have accelerated the shift to online shopping. Fifty-five per cent of respondents in each country expected to spend more money on online entertainment over the next two weeks. Thirty per cent of UAE consumers and 24 per cent of Saudi consumers expected to buy their groceries online over the same time period.

“The circumstances have required consumers to change their behaviours rapidly, both in terms of consumptions and channels, accelerating the penetration of online industries, such as e-grocery,” Mr Iftahy said.

The intent to spend on groceries online has “skyrocketed” to up to five times the baseline penetration rate before Covid-19 and home consumption is increasing, he added.

Although the trends are tied to the current situation, “most consumers are likely to retain the behaviour changes going forward”, Mr Iftahy said.