The nation faces a bleak economic forecast, but there are reasons why international investors should not lump Italy alongside its Mediterranean neighbours. Its globally famous brands are one reason why.

Despite the economic woes driving southern Europe into its worst economic crisis since the Second World War, Italy offers unique investment opportunities.

With Italy just having auctioned billions of debt and the country's banks imposing a lending clampdown, its economy is seen to be struggling alongside those of Greece, which remains hanging onto the euro zone by its fingernails, and Spain with its far-reaching financial problems.

But there are strong reasons why international investors should not lump Italy alongside its two impoverished Mediterranean neighbours. Unlike Greece and Spain, Italy has big gold reserves and, more importantly, numerous internationally successful companies.

While global consumers might be hard put to name many successful Greek or Spanish brands, most could probably list about a dozen Italian brand names. Italy has held its reputation from design and cutting-edge technology since the Italian Renaissance in the late 13th century. Today, the country's factories produce top-brand goods, from sunglasses to sports cars. Italian manufacturers are also now seeing escalating demand for their goods as mushrooming new consumer markets in developing countries like China develop an insatiable thirst for Italian design.

There is a marked lack of up-to-date information on Italian investment opportunities from international financial institutions, who remain firmly focused on Italy's economic difficulties. But there are already some dissenting voices who believe that Italy's economic cloud my have a silver lining.

According to the multi-millionaire US-based investor Vince Stanzione, now is the best time to buy into top Italian brands. Mr Stanzione has amassed his fortune by investing against the tide of Wall Street opinion. He says Italy's problems are being exaggerated by the big financial institutions and points to the ability of the country's new technocrat prime minister, former European Commissioner Mario Monti, and to Italy's 2,451 tonnes of gold reserve that can be used for short-term financing requirements. Mr Stanzione has already begun to make strategic investment in Italian companies.

"We have already had a 5 per cent rally this week [ending June 15] and I am already showing a profit," says Mr Stanzione.

Mr Stanzione believes that whatever bad news the Italian economy has in store has already been accounted for and that the share price of successful Italian corporations has nowhere to go but up.

"The facts are that - yes - the European and Italian situation is bad, but markets look ahead; they have already discounted a lot of bad news, hence Italian stocks are back to 2009 levels," he says.

If Italian stocks are about to rebound as investors such as Mr Stanzione predict, then international investors should take a closer look at some high-performing Italian stocks.

"All it takes now is for news to be a little less bad and you will see a rally of 30 per cent plus," Mr Stanzione says. "History has proven that markets overreact and sell off and then snap back to return to a normal reading."

Mr Stanzione, like some other investors, employs a classic counter-cyclical investment strategy that pays little credence to mainstream investor sentiment.

"My own sentiment studies and client gauge shows that investors both professional and private are very negative on Europe, that is normally a good contra indicator," he says.

He adds that many Italian designer brands also pay good dividends to their investors.

One example he quotes is Luxottica, the eye ware company, which owns brands including Ray-Ban. Luxottica had net sales of about €1.8 billion (Dh8.3bn) in the first quarter of this year, an increase on roughly €1.6bn for same period last year.

Typically for Italy's top brands, this year's first-quarter figures, the best in the company's history, are the result of strong performance in emerging markets. Luxottica reports that developing world markets have grown by more than 36 per cent, with peak sales growth of about 40 per cent in Brazil, India and East Asia.

"Emerging markets ... represent incredible opportunities for our future," says Andrea Guerra, the chief executive of Luxottica.

"Many of the markets in which we operate are in good shape, despite the difficult environment in the Mediterranean area of Europe where we see a degree of nervousness and fluctuations in trends, although Luxottica's performance in this area remained positive in the quarter."

Italian car maker Fiat is another example of a company that is reporting bullish sales despite the country's economic crisis. Although it is estimated that the euro-zone crisis could slash car sales by more than three million to under 10 million, Fiat is sticking to its existing targets for 2012.

The Italian car giant, which also controls US carmaker Chrysler, is forecasting a net profit of more than €1.2bn for the full year. According to Fiat's chief executive, Sergio Marchionne, US growth is offsetting Europe's grim economic conditions.

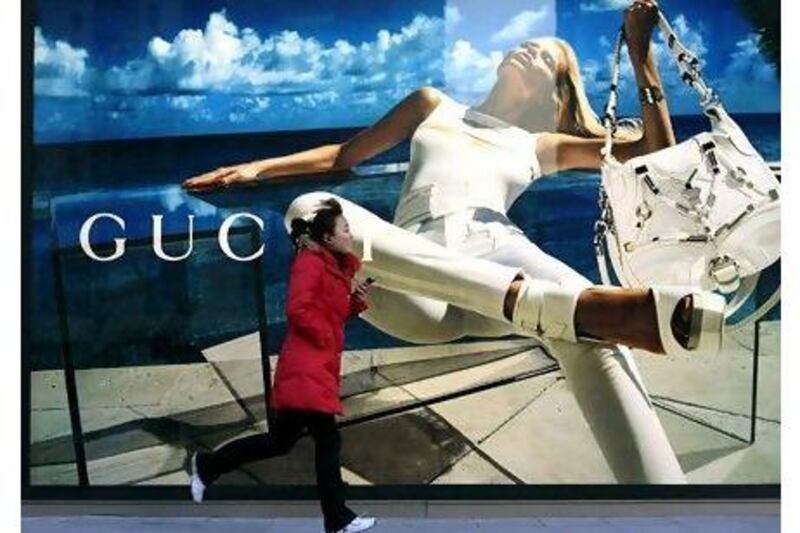

For many international consumers, the word Gucci is synonymous with style. The Gucci Group, which primarily handles the Gucci, Yves Saint Laurent and Bottega Veneta labels, is investing in new infrastructure even as investors cold shoulder Mediterranean stocks. The Italian fashion power house is building a new logistics centre in Switzerland in Sant'Antonino, in the Ticino commune. Gucci will have a 320,000-square-metre warehouse as its global distribution hub.

Gucci is now also seeing a growing global demand for its high-priced luggage and clothing. Chinese shoppers, in particular, are drawn to the brand's exclusivity. While it is possible to buy copies of designer goods in China that are indistinguishable from the real thing at a fraction of the price, China's new status-seeking wealthy classes want the real thing.

But it's not only Chinese consumers who are going shopping for Italian brands.

The Chinese group, Hotyork Investment, for instance, is understood to be in the process of acquiring 80 per cent of Italian sports car manufacturer De Tomaso for about €60 million.

De tomaso is one of those European companies with an illustrious past and not much of a future. The company has made Formula One cars and between 1979 and 1993 owned the legendary Italian sports car manufacturer Maserati. However, the company fared badly in the new century and went into liquidation in 2004, prior to being acquired by the Italian businessman, Gian Mario Rossignolo.

But Chinese investors firmly believe in the insatiable appetite their countrymen have for Italian design and technology and Hotyork is understood to have earmarked a further €400m to boost production and to market the cars abroad.

There is also evidence that some leading international financial institutions may also be starting to change their view on Italy's long-term future.

The Goldman Sachs Group, for example, has more than doubled its commitment to short-term Italian government debt in the first three months of this year while drastically reducing its exposure to Italian banks. Goldman's exposure to short-term Italian government debt more than doubled to US$8.22bn (Dh30.1bn) as of March 31, from $3.05 billion at the end of 2011.

But, as the big institutions start to turn their guns around, there could be a brief window for smaller and nimbler investors to cherry pick the top Italian brands.