From an investment point of view, 2019 turned out far better than anybody expected.

Investors were rattled after a bumpy end to 2018, with markets plunging in the final quarter due to US President Donald Trump's trade war with China, fears over the affects of rising US interest rates on global growth, Italy's stand-off with the European Union and Brexit.

The MSCI World index ended 2018 more than 8 per cent lower, while emerging markets fell around 14 per cent, with Argentina, Turkey and Venezuela plunging into crisis.

Yet markets recovered strongly in 2019 and the post-financial crisis bull run has continued. So who were the winners and losers?

Equities climb

Global stock markets soared an impressive 24.6 per cent in the year to November 29, while the rampant US market did even better, up 27.9 per cent.

Europe climbed nearly 20 per cent, the UK more than 13 per cent and emerging markets a little more than 10 per cent, MSCI figures show.

Romain Boscher, global chief investment officer for equities at asset manager Fidelity International, says investor confidence grew as it became clear the US Federal Reserve was shifting tack on interest rate increases.

After four rate hikes in 2018, the Fed warned of another three increases this year, only to cut three times instead as growth slipped. Cheaper borrowing costs boosted markets by making consumers and businesses feel richer, while also reducing the attraction of leaving money in low-yielding cash or bonds.

Mr Boscher says company earnings also started to recover. “The continued resilience of the US consumer means we expect a soft landing for the global economy in 2020.”

Emerging markets have trailed this year, partly due to the impact on China of Mr Trump's continued trade war, but Kevin Anderson, head of investments in the Asia-Pacific region at State Street Global Advisers, says emerging market shares offer value over the longer term. "Investors may require a bit of patience, though," he says.

Bonds hold steady

The much feared bond market meltdown was averted once again, and the Fed can take much of the credit. Bonds pay a fixed rate of interest, which makes them more attractive when interest rates are falling, driving up bond prices.

David Kohl, head of currency research at private bank Julius Baer, says falling inflationary expectations, recession fears and ongoing trade tensions also supported bonds, a traditional safe haven. “They posted very good returns in 2019 with moderate volatility.”

However, they offer little in the way of income, with 10-year US Treasuries yielding just 1.8 per cent, while German and Japanese government bonds have negative yields.

Globally, around $17 billion (Dh62.4bn) of global bonds have negative yields, which means investors are actually paying for the privilege of holding them.

Cash slumps

It has been another rotten year for savers, with more than 30 central banks cutting interest rates around the world. “Returns on cash continued to crash in Europe, Switzerland and Japan, as well as the US,” Mr Kohl says.

Offshore savings rates are wafer thin, with HSBC's Easy Access Saver Account paying only 0.15 per cent in its US dollar version, 0.10 per cent on sterling, and nothing on euros, forcing many to take a risk on shares to get a better return.

Gold rises

The last year has been good for gold, the price up more than 17 per cent, according to Goldprice.org.

The precious metal is a traditional safe haven and demand typically rises in uncertain times. Gold does not pay any income, but that is less of a drawback given the current low or even negative yields on cash and bonds.

Fawad Razaqzada, technical analyst at currency traders Forex.com, says this has helped drive gold higher, along with uncertainty over whether the stock market bull run can last. “Gold is supported by historically-low interest rates, while bond yields aren’t going to rise materially any time soon. We remain bullish,” he says.

Bitcoin outperforms

The identity of this year’s best performing investment may surprise you. Cryptocurrency Bitcoin started the year trading at around $3,860, a fraction of its peak of almost $20,000 in December 2017, with some claiming it could fall to zero.

Yet by the summer, the price topped $12,000 and although it has since dropped to around $6,700 at time of writing, it is still up by around 75 per cent overall.

Maged Hassanain, a financial adviser living in Abu Dhabi, is sceptical about Bitcoin but says it may have a place as a speculative tool, provided traders understand the dangers. “Adoption is increasing, and many expect a new wave of buyers that could see it return above $12,000 in 2020.”

Property market mixed

The slowdown in the prime residential property market continued to gather pace in 2019, but prices didn't crash.

Kate Everett-Allen, partner at global real estate specialists Knight Frank, says luxury sales are at their weakest for years in many first-tier global cities. “Slower global economic growth, US/China trade relations, Hong Kong's political tensions, a US presidential election in 2020 and the Brexit conundrum are influencing buyer sentiment,” she says.

Moscow prices grew fastest, up 11.1 per cent in the year to September, followed by Frankfurt at 10.3 per cent and Taipei at 8.9 per cent.

European cities including Berlin, Paris, Geneva, Zurich and Madrid climbed between 4 and 6 per cent, while Sydney and Toronto crept up slightly.

In Dubai, property prices fell 3.7 per cent, while London fell 3.9 per cent and New York by 4.4 per cent. The worst performers were Vancouver and Seoul, which registered double-digit drops, after the authorities took steps to check rampant price growth.

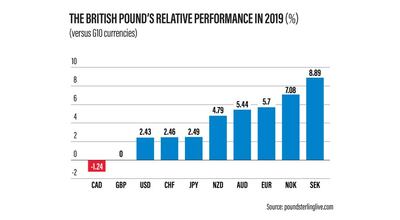

Sterling soars

There is one clear currency winner this year — the British pound, although with plenty of volatility along the way.

While sterling ends the year much higher against most major currencies, Mr Hassanain says it has had a wild ride, as it plunged in the summer over fears the UK would exit the EU without a deal.

“It only started to show signs of recovery after Prime Minister Boris Johnson struck a new withdrawal agreement with the EU,” he says.

The pound soared in the hours after Mr Johnson’s shock election landslide, which clears the path for the UK to finally exit the EU next year and put an end to all the uncertainty.

It then slammed into reverse after Mr Johnson ruled out extending the Brexit transition period, which means the UK will leave the EU on December 31, 2020, deal or no deal.

Andy Scott, associate director at global currency exchange service JCRA, says sterling slid more than 1 per cent versus both the US dollar and euro.

“Outlawing an extension leaves very little time to agree a comprehensive free trade agreement and means the clock is now ticking down to a cliff edge next December,” he says.

Sterling nonetheless remains 10 per cent up against the dollar compared to its September lows, but the uncertainty is likely to drag over the next year, Mr Scott says. “Markets have been reminded that Mr Johnson’s promise to leave the EU is something he intends to fulfil, possibly without negotiating an amicable future relationship."

US dollar still strong

Dr Nannette Hechler-Fayd’herbe, head of global economics and research at Credit Suisse, says the dollar continued to climb against every major currency, aside from sterling and the Canadian dollar.

“Within emerging markets, the Russian rouble outperformed the dollar, but the Argentinian and Chilean peso both suffered amid political instability. The Chinese yuan moderately depreciated, due to US-China trade uncertainties.”

Word of warning

Demos Kyprianou, a board member of SimplyFI, a non-profit community of personal finance and investing enthusiasts in Dubai, warns against buying investments based on strong recent performance. “This is likely to result in losses, as you risk buying when the trend is peaking, before the market crashes,” he says.