Anil Ambani

India’s top court warned tycoon Anil Ambani he’ll be put behind bars unless his group pays its dues to Swedish supplier Ericsson, the latest twist in a dispute that helped push the billionaire’s mobile-phone carrier to file for bankruptcy.

Mr Ambani, 59, disobeyed an earlier Supreme Court order for his Reliance Communications to pay 5.5 billion rupees (Dh285 million) to Ericsson’s Indian unit, the court ruled last week. If payments aren’t made within four weeks, Mr Ambani will be jailed for three months, the court said.

The decision marks the latest setback for the tycoon, whose Reliance Communications filed for bankruptcy earlier this year after it struggled to repay about $6.3bn (Dh23.1bn) in debt. Mr Ambani saw his telecom fortunes crash after his elder brother, Asia’s richest man, stormed into the industry by offering free calls and triggering a price war.

The two-judge bench also ordered Reliance Communications and two affiliates — Reliance Infratel and Reliance Telecom — to pay 10 million rupees each as fines.

Ambani’s group said in a statement Wednesday that it will comply with the verdict.

Shares of Ambani-controlled companies plunged after the verdict. Reliance Communications plunged as much as 9.2 per cent during Mumbai trading, Reliance Capital slipped as much as 11 per cent and Reliance Infrastructure slumped 8.8 per cent. Reliance Power lost as much as 5.1 per cent.

The dispute with Ericsson began when the Swedish equipment maker sought to collect 16 billion rupees in dues from Reliance Communications. The Indian company then settled the dispute with Ericsson in May last year but failed to meet the payment deadlines.

Philip Green

British retailer Philip Green, the owner of Arcadia Group, is facing a formal bid to strip him of his knighthood after reports that he tried to silence former employees who alleged he sexually and racially harassed them.

George Freeman, a Tory member of Parliament, said on Wednesday that he will refer Green to the Honours Forfeiture Committee, a panel that examines whether public honours should be revoked. Mr Green has categorically denied all the claims against him.

If the panel rules against Mr Green, the committee would then pass its advice to Prime Minister Theresa May, who in turn would ask Queen Elizabeth II to revoke the honour. It was given in the monarch’s name and allows Mr Green to add "Sir" in front of his name.

The Arcadia boss has brought “the system of honours and business into disrepute by being found to have behaved disgracefully, letting down the vast majority of businesses who set the highest standards,” Mr Freeman told the House of Commons earlier on Wednesday. He later said by text that he will refer Mr Green to the committee.

Knighthoods are awarded for a "major contribution" to the nation at a ceremony at Buckingham Palace by the Queen, or one of her family acting in her name, in which the recipient is touched by a sword on both shoulders.

It’s not the first attempt by parliamentarians to strip Mr Green of his title. In 2016, 100 lawmakers tried to get his knighthood revoked but the attempt wasn’t legally binding on the government.

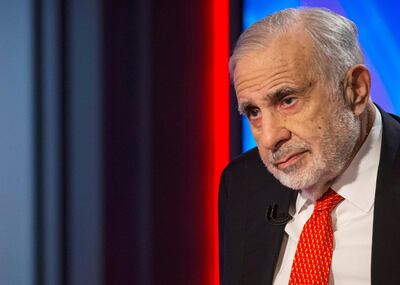

Carl Icahn

Investor Carl Icahn urged Caesars Entertainment to sell itself and disclosed he has taken a 10 per cent stake in the Las Vegas-based casino operator, according to a filing with the Securities and Exchange Commission.

The founder of Icahn Enterprises, a New York-based holding company, said in the filing that he wants representation on Caesars’ board and that the business should refrain from immediately appointing a new chief executive.

Caesars' stock is undervalued and the best way to boost it would be to sell the company, Mr Ichan’s filing states.

“We believe that our brand of activism is well suited to the situation at Caesars, which requires new thought, new leadership and new strategies,” the filing adds.

Mr Icahn intends to continue talks with Caesar's board of directors and management, and if necessary, he may nominate a slate of directors at the company's annual shareholders meeting, according to the filing. He also wants chief executive Mark Frissora out.

Mr Frissora, who joined Caesars in 2015 and guided it through bankruptcy reorganisation, was scheduled to leave his role February 8, but his departure was pushed back to the end of April. Mr Icahn does not want Mr Frissora's tenure to be extended again, according to the filing, and expects the company to not appoint a new leader until after he and the board have engaged "meaningfully”.

Caesars emerged from an $18bn bankruptcy in late 2017. Icahn’s move comes after the casino operator was approached by at least two companies.

Caesars in November confirmed that it had received a proposal from casino operator Golden Nugget, owned by Houston billionaire Tilman Fertitta. The proposal called for Caesars to “acquire substantially all of Golden Nugget's restaurant, hospitality, entertainment and gaming businesses in exchange for a significant minority of Caesars' common shares”.

Caesars at the time said its board rejected the proposal, but “continues to be open to reasonable alternatives to enhance long-term shareholder value”.

The Wall Street Journal reported an official with Eldorado Resorts also "made a preliminary approach" over the past several months.

Caesars did not immediately respond to a request for comment on the filing. Its stock ended up 47 cents to $9.62 on Tuesday and is up almost 42 per cent so far this year. But it's still down 27 per cent in past 12 months.

Mr Icahn last year sold his Tropicana Entertainment casino company for $1.85bn.

Prasert Prasarttong-osoth

Thai billionaire Prasert Prasarttong-osoth and two other major shareholders of Bangkok Airways have agreed to pay a fine totalling nearly 500m baht (Dh59m) for share price manipulation, the Securities and Exchange Commission (SEC) said last week.

The regulator announced the fine on Mr Prasert, who was also chief executive of Bangkok Dusit Medical Services, his daughter Poramaporn Prasarttong-osoth and another executive, Narumon Chainaknan, last month.

At the time the companies said all three accused would "prove their innocence in the matter".

By agreeing to pay the fine, they now avoid the issue going to court.

The regulator said last month that it had found the three people had traded shares in Bangkok Airways among themselves between November 2015 and January 2016, causing the share price and trading volume to be inconsistent with market conditions.

Mr Prasert resigned as chief executive of Bangkok Airways and Bangkok Dusit Medical Services, Thailand's largest private hospital network, last month after the regulator barred him from holding executive positions in listed Thai firms citing share manipulation.

Ms Poramaporn, who was chief operating officer of Bangkok Dusit, and Mr Narumon, who was executive secretary to the chief executive of Bangkok Airways, also resigned from their positions last month.

Bangkok Airways could not be immediately reached for comment.