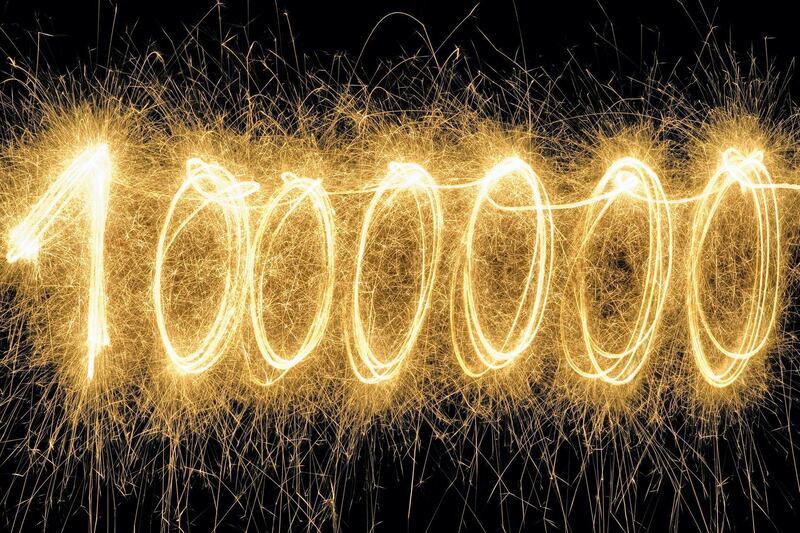

Who wants to be a millionaire? It's not an easy goal to achieve and only the select few will be able to generate an income of $1 million (Dh3.67m) a year.

But when it comes to your investment portfolio, building a fund worth $1m in total is within many ordinary people's reach, provided they have plenty of time, get down to the task and stick with it. Here's a guide to how to make it happen.

Start as early as possible

In simple terms, if you invested $500 a month from the age of 25, and your money grew at an average rate of 7 per cent a year after charges, you would have $1.28m by the age of 65.

Save as much as you can

Due to inflation, $500 a month may not be enough to retire on by the time you turn 65, so you might need to save more than that, depending on your age.

If you are older, you will need to save more. So at 35, you will need to set aside $1,000 a month to build a similar-sized pot, that’s twice as much, and at 45, around $2,250 a month. So the first rule is that there is no time to waste.

Don't waste money on things you do not need

Stuart Ritchie, director of wealth advice at Dubai-based AES International, says building a large investment portfolio is possible for anybody on a reasonable income. What you need is discipline and a plan of action. You also have to commit yourself to the project.

“Life isn’t a rehearsal," he says. "You don't get a second chance at this, so do not waste time.”

His key tip is to spend less than you earn. “There’s a general rule of thumb called the 50/30/20 rule to building your wealth," Mr Ritchie explains. "It says that 50 per cent of your salary should go towards things like accommodation, food and bills, 30 per cent towards entertainment, eating out and shopping, and the remaining 20 per cent should be saved.”

Increase your monthly contributions by 3% every year

Mr Ritchie's second key tip is to not ignore inflation. “For millennials, with around 40 years until retirement, $1m will have the same spending power as around $300,000 today, and it will continue to shrink throughout your retirement," he explains.

Mr Ritchie says you should work on the assumption that your money will shrink by 3 per cent a year on average: “Every year, you should invest at least 3 per cent more, just to keep up."

The good news is that salaries and bonuses typically rise every year. “Invest your spare capital, but do not speculate, take undue risks or fall for get-rich schemes,” he adds.

Mr Ritchie also recommends investing in some self-education, because financial literacy is a core life skill. "Andrew Hallam's Millionaire Teacher is truly inspiring and shows how the author managed to build up a $1m portfolio on a modest salary," he says.

Invest directly after receiving your monthly salary

Work out how much you need to save each month and make it a habit, says Demos Kyprianou, a board member of SimplyFI, a non-profit community of personal finance and investing enthusiasts in Dubai. “As soon as you get your salary, invest regularly in passive, low-cost exchange traded funds (ETFs), either monthly or quarterly, and live on what you need with as few luxuries as possible."

Keep it simple

Some people make portfolio planning complicated, but Mr Kyprianou says you can keep it simple with just two global ETFs: Vanguard FTSE All-World ETF (VWRD) invests in a spread of global equities, while you can get some exposure to lower-risk bonds with the iShares Global Govt Bond UCITS ETF (IGLO).

Do not time the market - buy and hold for the long term

Offshore investment guru Andrew Hallam, author of Millionaire Expat: How to Build Wealth Overseas, says to build a $1m portfolio, you also need to stay the course during periods of stock market underperformance.

Investors have done well over the last decade, which has seen the longest bull market run in history, but it won’t always be like that.

Mr Hallam says when markets fall, some people sell their holdings or cancel their regular monthly payments, especially if they stay low for some years. “It's easy to say, ‘yes, I can handle a market crash’, but one year is a long time to wait for most people to see a gain, three years feels like an eternity, and after that people begin to question their strategy.”

Investors in the S&P 500 made little in the first decade of the millennium, but the index took off after the financial crisis in 2009, climbing 380 per cent from 677 to around 3,280 at time of writing, according to Refinitiv data.

Choose low-cost globally diversified ETFs

Mr Hallam also believes in achieving your goal by investing in a portfolio of passive ETFs, mostly those investing in stocks and shares, but with some exposure to bonds, which are less risky and deliver a lower return over the longer run.

This may seem odd, given that over an investment lifetime, a portfolio that is 100 per cent in stocks would beat a portfolio that is 70 per cent in stocks and 30 per cent in bonds, Mr Hallam says. “The problem is that stocks are more volatile, but if you hold bonds as well, your portfolio will not fall as far in a correction.”

Look beyond short-term stock market volatility

A balanced portfolio means it should still grow even when markets are struggling, helping you maintain your resolve. “Diversified investors stand a higher chance of succeeding,” Mr Hallam says.

When filling your portfolio, the fewer "moving parts" the better; as a result, Mr Hallam favours all-in-one portfolio funds.

US nationals can invest in low-cost ETF provider Vanguard's Target Retirement Funds. “They are also available to Canadians and Australians, in the form of all-in-one portfolio ETFs,” Mr Hallam says.

UAE residents can purchase these from a discount brokerage such as Interactive Brokers, Internaxx or Saxo Capital Markets. “These are diversified portfolios of indexes wrapped up into single funds. Best of all, they rebalance automatically so you don’t have to do it yourself," he says.

UK residents can buy all-in-one funds directly from Vanguard UK, where they are called Life Strategy Funds. “British expats in the UAE can buy the same products, but at this point, only from Swissquote," adds Mr Hallam.

Stick at it

So what stops everyone from doing the same as Mr Hallam? All too often, people are their own worst enemy, Mr Ritchie explains. “Like dieting and exercise, it is easy to find an excuse not to do it," he says. "The right financial plan, budget and spending habits can get you there but only if you have the discipline.”

Enjoy life along the way

Mr Kyprianou says if you need to up your motivation levels to hit your $1m goal, imagine how your life would look if you had that amount stashed in the bank. "Be specific, imagine where you would like to be, and what you would could be doing,” he says.

While saving the maximum makes sense, do not overdo it. “Spend some money to enjoy life today, whether travelling or other activities," Mr Kyprianou says. "Saving like crazy only to end up being miserable will not help anybody.”

He suggests reading research on the connection between money and happiness. "The best book I've read on this subject is Kim Stephenson's Taming the Pound, which tells you how to make money your servant, not your master," he says

Mr Kyprianou recommends monitoring your spending for a month and cutting out anything that is either not essential, or does not make you happy. "If retail therapy isn't working for you, it’s time to cut back.”

That millionaire portfolio could be yours, so what are you waiting for? The sooner you get started, the better your chances of making it.