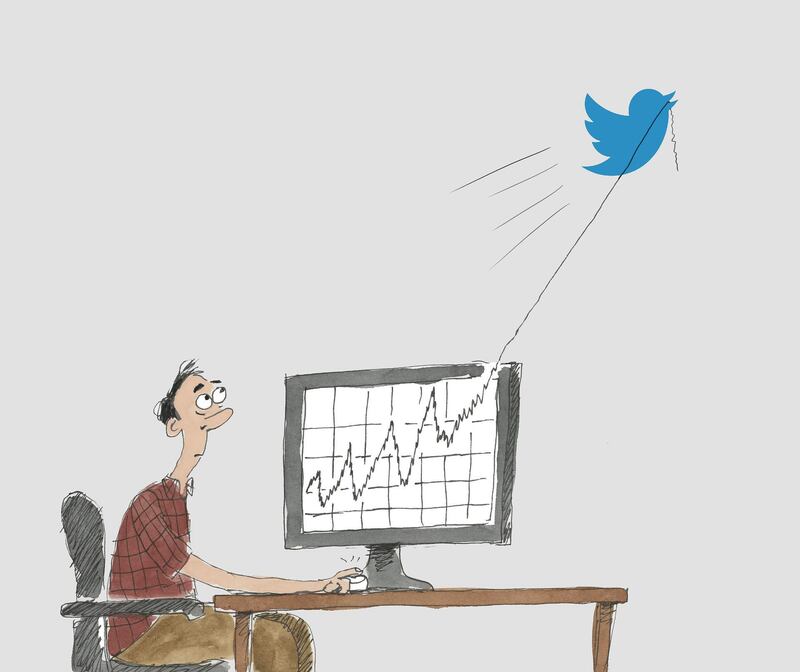

Can social media posts really affect someone's financial outlook and investor behaviour?

That’s precisely what a certain James Alan Craig was banking on when he used Twitter to launch a stock market scam a few years ago.

Mr Craig tweeted false statements about two tech firms in 2013, causing their shares to crash before he tried to buy the stock at deflated prices. The tweets cost shareholders around $1.6 million (Dh5.8m). It’s been a long-running case, with Mr Craig charged with securities fraud. Towards the end of May this year, a US court entered a final judgement against him and he got off lightly.

Twitter, Facebook and blogs can have the power to influence financial markets and change the fortunes of stock prices – and it happens very quickly.

I wonder if the algorithms traders use today are better at filtering bogus information compared to 2013.

Here are a few examples of what I mean: staying with 2013, a fake tweet on April 23 of that year from a hacked Associated Press account stated that explosions at the White House had injured Barack Obama. It resulted in more than $130 billion being wiped off the value of the S&P 500.

On August 13 2013, billionaire Carl Icahn, of Icahn Capital Management, announced his Apple position using his Twitter account. He also commented that it was significantly undervalued. Within seconds Apple stock spiked and within minutes gained $17bn in market cap.

Research into the economic crisis the same year, published in the Journal of Banking and Finance, suggests that financial markets are more influenced by negative press rumours than fundamentals. This finding is echoed in more recent research, carried out by the London School of Economics last September. This later report states that positive and negative micro-blogging sentiments have different effects on stock returns, with negative comments having more of an effect on share price than positive information.

The research found that a 1 per cent increase in negative sentiment leads to a three basis point (0.03 per cent) drop in stock returns. The study arrived at its findings after 18 million StockTwits messages – a social media platform designed for sharing ideas between investors, traders, and entrepreneurs – were analysed.

You don’t need to be a full-time trader or investor to be influenced. Let’s look at the social media reach of leading economists. Sticking with Twitter, the economist Paul Krugman runs an account with approximately 4.53 million followers.

Nouriel Roubini, commonly referred to as "Dr Doom" after he predicted the 2008 financial crisis, has 461,000 Twitter followers. This week he used the platform to announce a new tool he'd launched that, in his words, “uses an algorithm to signal when an asset class is overbought and the Bubble will lead to a down correction or when it is oversold and the Bust will lead to a recovery. Statistical analysis combined with a macro analysis overlay".

IMF chief Christine Lagarde has around 541,000 followers. Plus there are dedicated websites created by the like of the Financial Times and The Wall Street Journal that update in real time and discuss current hot issues. When these influencers say something, people pay attention – especially if they're mulling over an investment or financial decision.

The thing to note is that an increase in online search activity and online conversations influences what happens in the market. And it's not only stocks and shares that are affected. A 2012 paper co-authored by researchers from the Universities of Wyoming and Kansas titled Forecasting Residential Real Estate Price Changes from Online Search Activity found this: on average, cities associated with abnormally high real-estate search intensity consistently outperform cities with abnormally low real-estate search volume by as much as 8.5 per cent over a two-year period.

It appears to be a self-fulfilling prophecy if you think about it. Thinking X is a great place to live or stock to buy, means it’s researched, and the fact that it’s researched by the many feeds into public discourse and sentiment. In turn this means it’s ‘bought into’ as a great place to live or stock to own. If enough do this, you’re likely quids in.

Unfortunately for Mr Craig, his attempt to capitalise on the downward stock price movement he caused saw him profit by a meagre $97, because he allegedly waited too long to place each trade. And then he got caught and put on trial. I’ll leave you to work out the moral of that ending.

Nima Abu Wardeh is a broadcast journalist, columnist and blogger. Share her journey on finding-nima.com