“They separated their money for all those years and I never knew.”

These are the words of a woman in her 40’s who had just found out how her parents managed their money. It wasn’t so much a family secret, than a way of living that they had not shared. She believes that knowing this when she was growing up would have saved her a lot of heart-ache, and financial fallout as an adult.

She would have been comfortable defining what was hers, his, and ‘theirs’ in her own marriage, and would not have handed her life’s savings to her husband, money that he squandered, because she felt guilty about earning much more than him.

At least that’s what she believes would’ve happened.

Her parents had always separated their money. She found this out by chance and believes she would have handled her own money differently if she had known. Instead, she handed her husband her life’s savings, and he lost it.

Growing up, she assumed that her parents had thrown all their savings and earnings into a family pot and had no individual claim over it, which is why discovering the ‘his and hers’ accounts has left her feeling betrayed.

Especially as she had been lambasted for seeking to find out what her husband did with the substantial sum she’d given him, with the aim of recovering at least some of it. The standard mantra coming from her parents was that it was ‘only money’ and that saving her marriage was more important. If that was true for them, why did they separate their finances?

The money narratives of our childhood colour our financial behaviour as adults. As with other issues in life, we either repeat what we were exposed to, or we reject it.

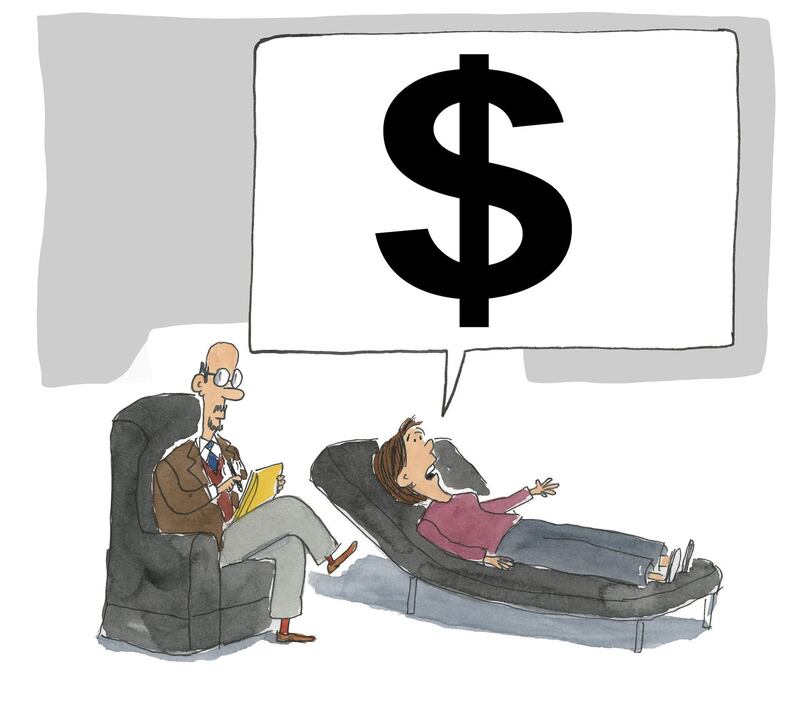

To know where you’re at, let us branch into a key area of therapy to deal with this - the family money story.

We each have one; it lays down the code of our current conduct with money. It comes about through experiences with money including what was said about it and the general sentiment around money and money-issues, even when nothing was said. Very importantly, it also comes from how you interpreted all of those thing throughout your life, and how you interpret them now.

_________

Read more:

The real cost of divorce is far worse than the financial outlay

Students must master personal finance before flying off to university

Monopoly may be a game but it comes with serious life lessons

Digitise your IOUs to make lending a pleasure not a pain

_________

To know your family money story, you need to dig into the past. Was yours a household of abundance or scarcity. Do you still scrimp and save even though you need for nothing? I know someone whose life was dominated by scarcity – a war meant she could no longer live in her childhood home. Decades on, she continues to bargain, and look for the cheapest option of whatever she’s buying, even though she has more money than she will ever need and that doing so costs hours of life.

Childhood experiences run very deep. To figure out your money story, answer two simple questions:

• Is money good, bad, or neither?

• How would you describe your relationship with money? (Someone I know describes it as ‘fleeting’ - she spends it as it hits her account)

Ask yourself what you have learned from your parents when it comes to money. What it is you’ve taken on, and what you’ve shunned. Uncovering these deep-set beliefs will help rationalise your own money decisions to date.

Of course you might not know the reality of what your parents did with their money – and it’s not about blaming them for any of your decisions, but knowing the path you’re on, and whether you want to stay on it.

Brene Brown, a research professor at the University of Houston who is perhaps best known for her work on shame and vulnerability, once said, “When we deny the story it defines us. When we own the story, we can write a brave new ending.”

Remember, you are not your parents. Be curious about your own money story, and make your ideas about money your own.

Nima Abu Wardeh is a broadcast journalist, columnist and blogger. Share her journey on finding-nima.com