Schools teach us how to add and subtract, but lessons on personal finance rarely stretch to the intricacies of compound interest, managing debt and investing.

As a result, financial literacy presents a major knowledge gap for many, with only one in three people in the UAE feeling in control of their finances, according to a December 2018 YouGov survey. A similar number routinely worry about their finances, and more than one in three respondents have debt of some kind.

Yet, almost half of UAE expatriate employees have no adequate retirement plan except to work for as long as possible, a separate study from Mercer found last month.

Thankfully, there are plenty of ways to improve your financial acumen. Whether it’s basic personal finance literacy or planning for the best years of your life, there’s a book you should be reading among the latest crop of releases.

The Money Revolution by Anne Boden

Like everything else, our attitudes to money are shaped by our parents’ approaches; recognising this allows us a financial reboot.

“Families who have little money, but a spendthrift attitude risk passing this on to their kids. Those who value wealth creation will generally impart their philosophies and strategies to the next generation,” says the book's author Anne Boden, who is also the founder and chief executive of the UK-based Starling Bank, a digital, mobile-only financial institution.

The wave of new finance, banking, savings and investment apps, makes understanding money and taking control of it easier than ever, she writes in The Money Revolution: Easy Ways to Manage Your Finances in a Digital World, published last June.

The book is an easy-to-understand guide to some of these digital products and services, perfect for both millennials and late-generation boomers.

“I passionately believe the advantages of FinTech should not be restricted to tech-savvy people in metropolitan areas. I wanted to spread the word beyond the FinTech bubble and show that they could and should be enjoyed by everyone,” says Boden. “Digital technology can help us improve our personal finances in all sorts of ways.”

£14.99 (Dh71.84) and available from KoganPage

Retirement 101 by Michele Cagan

Financial advisers will often draw up a plan demonstrating how you’ll need an eye-wateringly large amount of money before you can afford to retire, but Michele Cagan says how you prepare comes down to your own personal goals.

"People see headlines about needing to save $1 million (Dh3.67m) or more, and that makes a lot of people shut down and avoid it — that goal feels unachievable to many people," says the author of Retirement 101: From 401(k) Plans and Social Security Benefits to Asset Management and Medical Insurance, Your Complete Guide to Preparing for the Future You Want, published in December 2019. Instead, she advises people to "focus on what you can save rather than on your ultimate goal or what you don't have".

Think about retirement in the context of what you want to do when you leave your full-time job, explains Cagan, a certified public accountant. “Retirement is really about building up a nest egg and achieving financial security so you can have the freedom to choose whether, when, and where you want to work,” she says. But that freedom is only possible if you have enough cash to cover your expenses.

Published in December 2019, the book is written for American audiences, so there are a lot of US-specific terms — such as 401(k) or Roth IRA — but it goes a long way to illuminate the issues facing retirees, from shifts in cash flow to medical expenses. One key takeaway that resonates for expatriates is that you don’t need to retire to the country you were born in: other countries might offer better choices.

The book also stresses that it's never too late to start planning. “You'll never have more time on your side than you do now, so start saving something — anything — right away,” says Cagan. “Any amount you put away is better than nothing and your future self will need it. No matter how hard it is to put money away now, it will be much harder when you’re 75 or 80 years old.”

$15.99 and available from Simon and Schuster

Napkin Finance by Tina Hay

Collin King and Herb Kelleher outlined their big business idea on the back of a napkin in 1968. That drawing turned into Southwest Airlines, now the world's largest low-cost carrier. As countless parents know, a quick sketch can simplify complex subjects, a principle that entrepreneur Tina Hay deploys to excellent effect in her new book, Napkin Finance: Build Your Wealth in 30 Seconds or Less.

Published in December 2019, the book is an extension of her Napkin Finance learning platform. “The inspiration for Napkin Finance was my own struggles as an MBA student at Harvard Business School. I come from a liberal arts background and it was very difficult keeping up with the former bankers and consultants in finance classes,” says Hay, who describes herself as a visual thinker, someone who tends to think in images and visual patterns.

“I have always sketched images to help break down complex topics, especially money and finance. I started sketching different topics on napkins as a personal tool, but saw that they seemed to resonate with quite a few people.”

Hay skips the big words and complex terms for a quick set of handy infographics offering a fun, accessible crash course in finance. One covers the concept of an emergency fund, explaining what it does, what qualifies as an emergency and how to set up autosave accounts. Others offer guides to initial public offerings, bonds, entrepreneurship and philanthropy, each accompanied by a few pages of bullet-pointed text.

"We have seen that learning about finance can be intimidating and oftentimes overwhelming, but that through radical simplification of difficult financial topics — including through pictures and simple-but-accurate explanations — we can help empower our readers to thrive in the digital economy," she told The National.

$25.99 and available from Harper Collins

The Cryptocurrency Revolution by Rhian Lewis

Smart financial investments are often about getting in on the ground floor, so why should cryptocurrencies be any different? Even after the severe Crypto Winter of 2017/18, which saw the value of Bitcoin plummet from nearly $20,000 to around $3,500 before stabilising around the $10,000 mark, digital currencies shouldn’t be seen as a fad that will be here today and gone tomorrow, says author Rhian Lewis, a software engineer, altcoin specialist and blogger.

"Cryptocurrencies are the investments and the money of the future, and it is possible for everyone to gain an understanding of the fundamentals. With this in mind, I wanted to provide a simply written guide that explains, among other things, the difference between fully decentralised currencies such as Bitcoin and the new digital currencies being developed by governments, or by corporations such as Facebook," she told The National. Her book, The Cryptocurrency Revolution: Finance in the Age of Bitcoin, Blockchains and Tokens, will be published this August.

The UAE has signalled it wants to be a cryptocurrency-friendly jurisdiction, and with initiatives such as the official Dubai Blockchain Strategy, Lewis expects the region to attract more crypto-focused start-ups. This, she says, will offer ordinary investors a greater choice of assets

“The emergence of cryptocurrencies and cryptoassets is one of the most exciting technical and financial innovations we have seen for decades, which will affect people's lives in many different ways, from new investment opportunities to improved international payment rails," Lewis adds. "Above all, cryptocurrencies have the potential to allow individuals to take control of their own money in ways that simply were not possible before.”

£19.99 and available from KoganPage

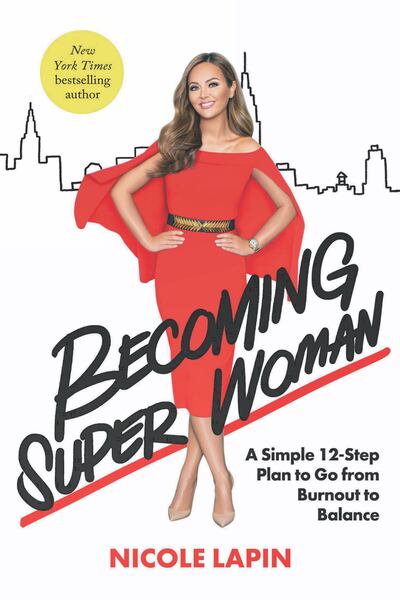

Becoming Super Woman by Nicole Lapin

While not strictly just a personal finance book, the value of American TV anchor Nicole Lapin's Becoming Super Woman lies in the way it puts money issues into the larger context of women's lives today. How does Superwoman save the world countless times in knee-high red boots while remaining perfectly coiffed at all times?

In the style of a chatty, sassy BFF (best friend forever) who’s got your back, Lapin writes that the answer lies in defining what success — or being “super” — means to each individual personally without the pressure and limitations of living up to other people’s ideals; something adding a space between the two words super and woman achieves.

So, what does that mean when it comes to money?

"Break everything overwhelming down into baby steps. You'll find that it's easier to tackle hard stuff like money management in small chunks," Lapin tells The National. "Figure out what your goals are and reverse engineer from there. A dream without a plan is that a wish and wishes are awesome but they don't pay the bills."

Successful money management can buy happiness, she adds.

Her overall message in this September 2019 book is that women need to value themselves. It can be framed into one nifty bit of advice for maximum financial impact: “Focus more on making more money, rather than skimping and saving so much. When you come from a place of aspiration instead of deprivation, your finances will follow,” Lapin adds.

$18.99 and available from BenBella Books