It’s minus 4°C in Copenhagen, the capital of Denmark, with a wind chill of minus 10°C.

But that didn’t stop a group of international journalists gathering in Denmark’s capital city last week to witness Saxo Bank’s unveiling of its new social trading platform.

Saxo Bank is very much part of Denmark’s modern DNA. Having been created only in 1992, the Copenhagen-based online investment bank has now launched TradingFloor.com, which hopes to rival Facebook for investment professionals and amateurs alike. It’s a big commitment for the Danish institution with technology and trading as its beating heart, a commitment that has made it the first global financial organisation to throw its weight behind social-media investing.

“We were looking at Facebook and Amazon, people offering different products without a financial background,” says Kim Fournais, the chief executive and founder of Saxo Bank. “The concept of people sharing, the concept of crowdsourcing, engaging with each other, people you have never met and probably never will.”

Social trading allows users from across the globe to see and copy the trades of top-ranked traders. Traders can also follow their favourite traders, swap ideas and keep tabs on the market mood through the online network.

The idea is to make trading online as easy as buying a book online.

“Society and commerce only grows when people can share knowledge and help each other trade,” adds Mr Fournais. “When you see Blockbuster, the video store, being taken over by Netflix, it’s a surprise. But it is better for the client otherwise it would not be a success.

“This is similar, being able to trade any global market from your home screen. Having the ability to become an investment manager on the screen by doing good trades is unique. If you also think about the many people that have to take care of their own financial future, they buy Mutual Funds that cost maybe 300 basis points each year, that needs disruption [new thinking].”

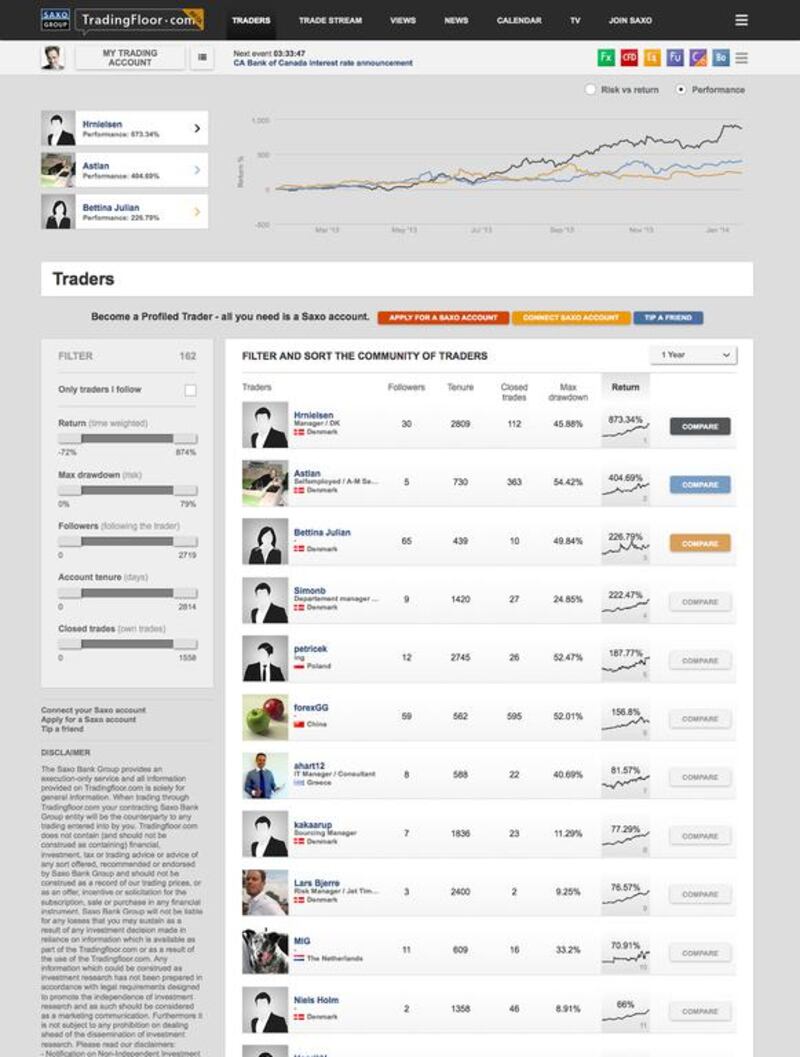

Social trading is one of the newest arenas for investment and speculation in foreign exchange markets. The phenomenon, mainly practised in the United States, has given novice traders the ability to copy experienced traders’ positions and gain a deeper knowledge of trading systems and strategies by transparently showing the history of traders’ investments and the returns. The Saxo Bank offering is a multi-asset platform allowing trading in foreign exchange, contracts for difference, options, futures, bonds and equities.

The bank has spent big, hiring broadcast and print professionals to deliver the message and make the learning and trading process a seamless one with videos, tutorials and research tools.

A visit to the website brings a list of Saxo Bank-sanctioned traders showing their investment strategy and their returns and a host of financial information, both televised and in text. The education concept is there to allow serious investors to trade with their own money without needing the services of a bank’s salesperson.

Instead users can choose to trade themselves or copy another trader’s position, automatically mimicking their investments.

The site’s social element also allows members to share and question investment decisions. The idea seems remarkably simple but the novice investor needs to understand the investment atmosphere.

“It is better to have a medium to long-term vision with this sort of trading,” says Adel Merheb, founder of the UAE-based investment website Tradeyourmarket.com. “It’s very common for people to switch the traders they are following, which means changing investment styles. From my experience, you may follow a guy because you see his track record and you see that he has been very successful. However, if they are down for a month or two it is easy to switch and then switch again. Sometimes a trader may have a great record but have a flagging performance for months in a row and few people are willing to stick to these guys, which is why it hasn’t proved to be super- successful.”

The investment from Saxo Bank proves its belief in the model with a 90-strong team employed to build and develop the site in a little under two years. The beta launch of the site currently has about 100,000 users, but the new approach to orthodox investment channels is considered a pure business driver.

“We wanted this to be a growth engine for Saxo first and foremost,” says Rune Bech, executive vice president and global head of digital media at Saxo Bank. “In the process we wanted to democratise the access to trading, to make it easy to trade. To enable the peer to peer power to come to its full bloom within the financial sector.

“The new media world has changed so many industries in the past, but not really the finance industry. We wanted to bring these disruptive changes that we have seen in so many other sectors. We wanted to make it a social experience, so that the world opens and the interaction with other traders lets everybody learn and the bar gets raised for everyone.”

The Wolf of Wall Street is currently wowing cinema audiences and the transparency offered by this social trading platform seems to balance the equation of investing in complicated financial instruments. But I possibly phrased this question wrongly to Saxo’s chief executive: so if this isn’t the Wolf of Wall Street, is it the sheep on the information superhighway … we get to follow the flock?

“We are definitely not sheep but we are definitely not the Wolf of Wall Street; we are the opposite of that type of selling,” says Mr Fournais. “Those who have similar interests will want to work and come together, this is all about win-win transactions.”

ascott@thenational.ae