You know how I'm always banging on about the importance of budgeting and living within - or preferably below - your means?

Well, how about making this the year that it happens? I'm talking about nailing your spending habits and sticking to a budget. But instead of you discovering what it is you spend and then setting a budget for yourself, I'm asking you to just get on with it and allocate a budget - that you have to stick to no matter what.

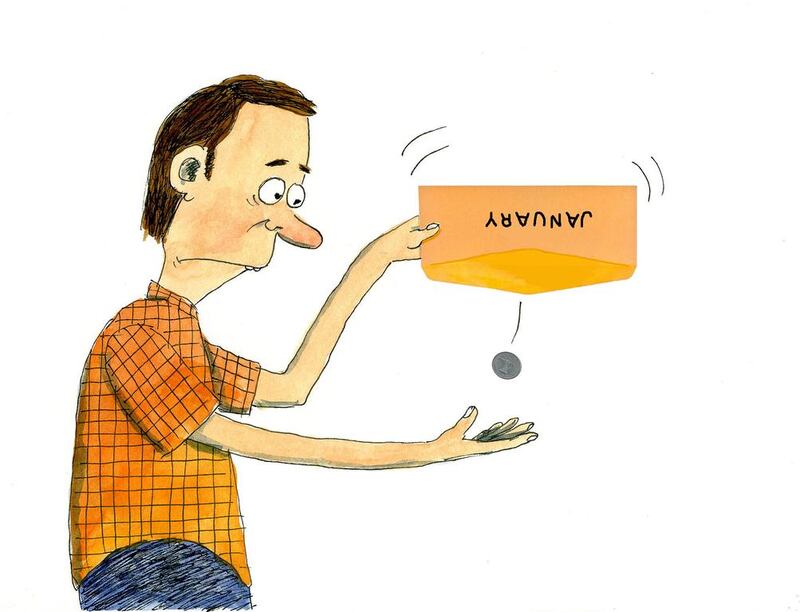

This is your challenge: you are only allowed to use a predetermined amount of cash for your monthly spending.

Let's call this a "cash diet" - yes, cash, not crash - although it's probably going to end up being both rolled into one - but instead of losing money (in place of calories), you'll end up doing the exact opposite and keeping money.

Notice that I say "a" budget. Why? Because I'm asking you to guess what you spend on various things. Why? Because I'm pretty sure that you haven't been tracking your daily spending and in fact don't know where your money goes - I mean every single thing - or how much the way you live is costing you.

You have two options: you can either decide on a lump sum (your guesstimate of the total amount you spend each month), or you can think this through a bit more and come up with various categories.

If you're nervous about commitment and divvying up your monthly spending, then I'd say go with option one as a start, and work your way to the multi-envelope option in a couple of months.

When/if you are on multi-envelope budgeting (where you divide what you're allowed to spend into different categories and corresponding envelopes), I suggest the obvious: money for groceries, petrol, entertainment, phone bill, utilities, TV package, home help, and anything else you can think of. To make things easy when you're starting off, perhaps you can whittle your categories down to a few broad ones like:

. Spending money - for things that are not important but make you feel good: going out, spending on yourself.

. Basics - could include groceries plus petrol or transport if you don't drive.

. Monthly bills - for utilities and phone expenses.

You're only allowed to spend what you've taken out, in cash, at the start of the month. If you spy something that you "must have" and "need", and don't have the money for it, you can't have it.

Whether you're using one envelope or many, you need to jot down what you're spending the money on as you go along - on the actual envelope. This will tell you where your money goes, and will show you where you can cut back in the months to come.

Why am I asking you do this?

Going on a cash diet means you find out practically, and perhaps painfully, how much your life costs you. I'm pretty sure you'll underestimate various things. Use the first couple of months to get to grips with your actual spending - and adjust your budget guesstimates accordingly.

Zero top-up is the rule. Once an envelope is empty, there's no more money for that expense until the next month. Let's hope you don't have too long to go .

No access to your credit card is essential.

The thing about having one envelope where you take out money as you go along is that you can keep going until every last penny is spent - it means you'll be spending petrol money to pay for a meal out. It's not ideal, but it's a start: to know that you are living within X dirhams per month. The aim, though, is to graduate to the multi-envelope approach, as well as keeping a record of your spending.

The big advantage of a multi-envelope approach is you very quickly get a feel for how much you spend. You might even break into a sweat as you see your notes dwindle in number. The upshot is that you'll start looking more closely at prices and get to know what you need versus what you want.

Once you've mastered your current monthly spending, and actually know what goes where, set yourself another challenge: cut down on that spending. Cut it back by 10 per cent across the board. Can you do it? I'm sure you can.

Challenge yourself to live on less. This will help immensely if you're in debt: use the extra money you have to get rid of it for good. If you're lucky enough not to have debt, then tune into and enjoy the financial peace that this way of living brings with it - and use the money that you're keeping in your life to generate more income by setting investment targets for yourself.

And there's a priceless thing that this will give you: it will instil key habits and behaviours that will help you live your best life. The ways you behave with money will definitely change if you stick to a cash diet.

Yes, this is about eliminating things but it's not about depriving yourself - there are many way to have fun, socialise and experience a full life without blowing your budget.

This means you'll cut back on spending, but far from cutting back on life, you'll be healthy, happy and financially fit for the long run - and, with time, the envy of people you know.

Nima Abu Wardeh is the founder of the personal finance website www.cashy.me. You can contact her at nima@cashy.me

Embark on a cash diet for a truly healthy figure

So are you up for the challenge of nailing your spending habits and sticking to a budget?

More from the national