Women have traditionally had a different set of money challenges to men, from earning a lower salary to retiring on less. Yet they also living longer and are often forced to work part-time or leave the workforce due to their roles as carers for children or parents.

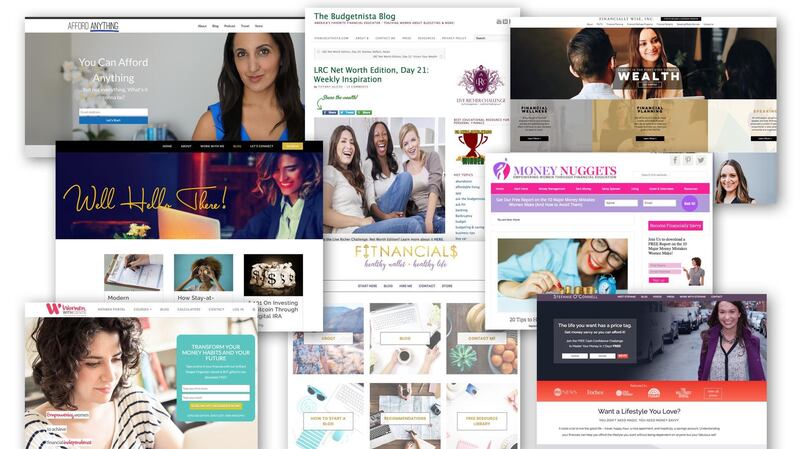

Therefore, it is no surprise that a raft of blogs has sprung up around the world to cater specifically to women’s monetary needs, often written by women who have gone through the financial mill themselves or spend their lives advising others on their finances. These eight bloggers hope to lend a helping hand.

The Budgetnista (US)

[ https://thebudgetnistablog.com ]

Tiffany Aliche, aka The Budgetnista, is a personal financial educator for brands including Prudential and Nasdaq and author of two finance books. There aren’t many sites that “financially speak” just to women, she says. Coming from a family of five girls, her chief financial officer father held weekly meetings to go over the family budget and she wants to pass on those lessons. Five years on, she has a community of 200,000 taking a series of daily ‘Live Richer’ challenges, such as automating payments for debt and savings, as well as a beginner investment course.

Blog highlight: Watch Ms Aliche's tell her own story about losing her home, her job and her savings at one fell swoop in a video diary on her About page.

Twitter followers: 36,100

Money Nuggets (UK)

This career and personal finance blog was founded by project manager Esther Mukoro to empower women through financial literacy. She says she was left feeling vulnerable by financial terminology as a novice taking “baby steps” in the world of financial matters – and set up the site because no one was “nailing it” to “demystify” money for women like her. There are posts on the themes of income, spending, debt and saving – but also on mindset, the crucial first step.

Blog highlight: '15 Money Habits Of Financially Savvy Women': ask for what you're worth, automate savings, respect money and make it work hard.

Twitter followers: 8,000

_________

Read more:

The best blogs to help millennials manage their money

10 blogs to help you achieve financial independence

The must-read personal finance books

Finance blogger Andrew Hallam’s new guide for expats wanting to become wealthy

_________

Afford Anything (US)

[ https://affordanything.com ]

“You can afford anything, but not everything,” says Paula Pant of Afford Anything. At 34, she is the owner of eight homes, which raked in an income of $125,000 last year. In Afford Anything she explains how she did it and how to overcome your financial fears. The key, she claims, is index funds that just mirror the market, rather than beating it, and a property portfolio. “I’m not trying to become the next Forbes billionaire; I’m satisfied with having enough money that employment is optional,” she writes.

Blog highlight: Start with the fantastic 'Feeling Overwhelmed? Here's Why Simplifying Is The Smarter Choice', which advises you to earn more to save more, rather than try to save pennies. With hand-drawn 'money maps', this post comes from the heart.

Twitter followers: 14,600

Stefanie O’Connell (US)

[ https://stefanieoconnell.com/ ]

Ms O’Connell - an actress who started a side hustle in freelance writing - has got “serious” about her blog, originally called The Broke And Beautiful Life, after turning that into the title of her first book. A slick blog (tagline: “the life you want has a price tag”), Ms O’Connell talks specifically to a millennial audience about issues that resonate with them, such as how to save for retirement in a gig economy. Her mission, she says, is for all women to have “confidence and control” with their money.

Blog highlight: 'The Myth Of The 10% Savings Rate' - why saving 10 per cent "just isn't going to cut it" when it comes to your life goals.

Twitter followers: 11,300

Fitnancials (US)

[ https://www.fitnancials.com ]

This blog started out as a testament to Alexis Schroeder’s 27 kilogram weight loss, but she has broadened her horizons to blog about having a healthy wallet as well as a healthy life. She blogs about “how to save lots of money without sacrificing your happiness” - and makes $10,000 a month in the process from her blog. Much of that comes from affiliate links and sponsored posts and they are liberally scattered throughout the blog. If you want tips on monetising your own blog, there’s plenty of that but the blog’s quite low on practicable personal finance advice.

Blog highlight: 'How I Went From $1k Per Month To $10k Per Month On My Blog In 1 Year' - Ms Schroeder demystifies making money from blogging.

Twitter followers: 4,200

_________

Read more:

'Happiest Teacher' blogs about saving money in Dubai

Dubai blogger behind 'I Retired Young' on how he achieved financial independence

Ladies: don't fall into the investment gap as well as the gender pay gap

The importance of financial literacy for female investors

_________

Financially Wise Women (US)

[ https://www.financiallywisewomen.com/ ]

It takes a village and this site provides you with a “dream team” to “serve you on your financial journey”, says Brittney Castro, a certified financial planner and founder of boutique, fee-based financial advice company Financially Wise Women. She vlogs weekly, with videos on subjects such as when to buy a house and why it’s worth taking a luxury holiday. The site focuses on key financial stages in a woman’s life: getting married, starting a family, buying a home and investing for retirement.

Blog highlight: '3 Ways To Successfully Merge Money With Your Honey' - Ms Castro discusses joint or own bank accounts and planning together for retirement, investing and emergencies.

Twitter followers: 10,400

Women With Cents (Australia)

womenwithcents.com.au/blog

Founded by accountant, financial planner, Serbian refugee and mother of two Natasha Janssens, Women With Cents combines a community forum with a well-written blog, albeit Australia-focused in terms of taxes. Initially the site was intended for young Australians looking to buy their first home, but the focus shifted when Ms Janssens got pregnant and saw how many mothers were online looking for help. Women, she says, have to contend with the gender pay gap, retiring with a 45 per cent lower pension and coming out of divorce financially worse than men. A fresh voice in the blogging world, with a series of calculators and a subscription membership portal.

Blog highlight: 'The Little Black Dress Every Woman Needs.' That LBD is actually an index fund: "a key starting point and a must-have for every wardrobe."

Twitter followers: n/a (7,800 Facebook)

Girls Just Wanna Have Funds (US)

[ girlsjustwannahavefunds.com ]

Psychotherapist Ginger Dean started this blog 15 years ago for women to have a conversation about money without any “lipstick lingo”, with a focus on how to make passive income. Having been in what she classes a ‘financially abusive’ relationship, as well as being an “emotional spender” who had to clear $30,000 of debt, the blog shows Ms Dean’s desire to pass on her lessons on being mindful about spending and debt.

Blog highlight: 'Mission Possible: Making Ends Meet On An Inconsistent Income (6 Steps!)' – from figuring out your fixed expenses to estimating income and covering gaps in income with savings and short-term money, these are wise words for the freelancer or small business owner.

Twitter followers: 6,800